Post No. 433. Carry trades exploit interest rate differentials between currencies by borrowing at low interest rates in certain currencies and using the proceeds to invest in currencies offering higher interest rates. However, the gains from interest rate differentials can be wiped out by the associated currency volatility. Since the summer of 2024, with the unwinding of positions and weakness of the US dollar, it has been tricky to find the right currency pair to bet on.

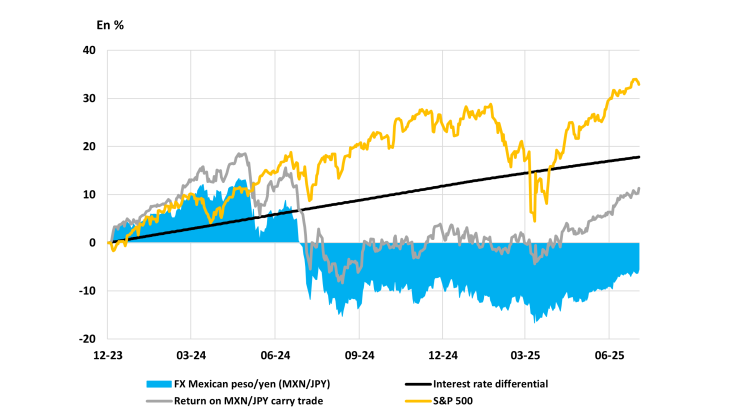

Chart 1: “Investment in Mexican peso, financing in Japanese yen” strategy compared with the S&P 500

Note: 1 January 2024 = 0. Return on the S&P 500 (without reinvestment of dividends). Return on the carry trade strategy, broken down into the portion from the interest rate differential (daily compound interest as of 1 January 2024) and the portion from exchange rate variations (variation relative to 1 January 2024).

Carry trades are bets on unhedged interest rate parity

A currency carry trade consists in borrowing in a currency with a low interest rate and investing the funds in a currency with a high interest rate. Without hedging, the investor is betting that the rate differential will not be offset over time by changes in the exchange rate between the two currencies: in theory, currencies offering higher interest rates will depreciate over time against those offering lower rates, and by a similar proportion to the interest rate differential, in line with the unhedged (FX) interest rate parity theory.

Although the theory holds true over the long term due to arbitrage opportunities, it rarely holds true over the short term, and many investors use carry trade strategies to exploit these market inefficiencies. The strategies can be highly profitable, with returns sometimes exceeding average equity market returns. However, they also carry significant risk.

In 2024, one popular carry trade strategy was to borrow in Japanese yen (short the currency) and invest the proceeds in Mexican pesos to take advantage of the 10-percentage-point differential between Mexican and Japanese 3-month yields (see Chart 1). However, the trade delivered contrasting performances over 2024. Until the end of May, it outperformed the US equity market. But at the start of June 2024, the results of the Mexican presidential election triggered a sharp drop in the peso, which then accelerated the following month when the Japanese central bank unexpectedly hiked interest rates. As a result, in the summer of 2024, the foreign exchange (FX) component turned the strategy into a loss-maker. FX volatility therefore had a major impact on the profitability of peso/yen carry positions. However, from mid-2025 onwards, the peso recovered against the yen, leading to a widening of the interest rate differential and making the strategy profitable again (Chart 1).

While interest rate differentials evolve slowly and fairly predictably, depending notably on monetary policies, exchange rates are often volatile and unpredictable. Hence, the potential return on a carry trade is not solely dependent on the interest rate differential; FX risk can completely modify the trade’s performance, wiping out or amplifying the expected gains.

FX volatility has a decisive impact on the performance of these strategies

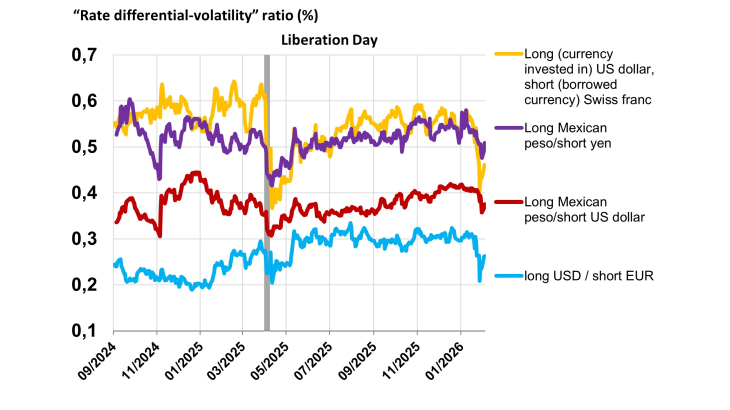

The expected return on carry trade strategies needs to be weighed against the volatility of the currency pair by calculating the normalised gain per unit of risk. Comparing carry-vol ratios – which measure the interest rate differential relative to FX volatility – makes it possible to identify more suitable investment strategies than using interest rate differentials alone. When FX volatility risk is taken into account, the most attractive carry trade strategies are not limited solely to investments in emerging currencies (which are often more volatile). They can also be found in G10 currency pairs: it can be worthwhile to bet on a narrower interest rate differential offering lower FX volatility (and hence a higher carry-vol ratio). For example, the so-called G10 strategy consists in selling or borrowing (shorting) three lower yield G10 currencies and selling or investing (going long) in three higher-yield G10 currencies.

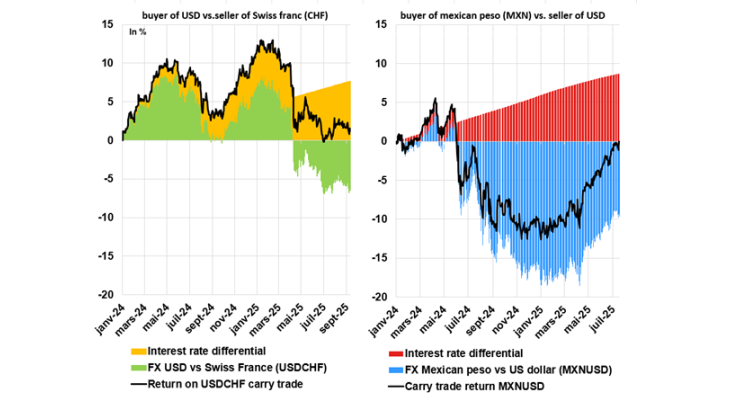

Since January 2024, based on carry-vol ratios, it has been more attractive to borrow in Swiss francs (CHF) and invest in US dollars (USD) than to borrow in USD and invest in the Mexican peso (MXN), even though the USD/MXN pair has a wider interest rate differential (Chart 2).

Chart 2: Breakdown of the return on two carry trade strategies since 2024

Note: 1 January 2024 = 0. Return on the carry trade strategy, broken down into the portion from the interest rate differential (daily compound interest as of 1 January 2024) and the portion from exchange rate variations (variation relative to 1 January 2024).

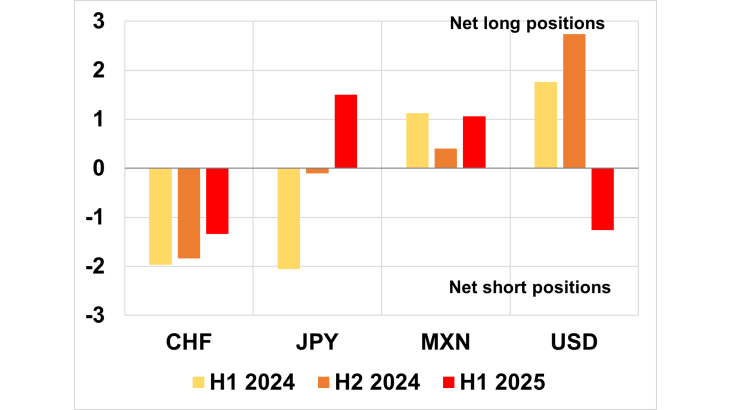

Market volatility is changing “traditional” positioning

The higher the number of these speculative positions in a market, the greater the risk of a massive unwinding and market destabilisation. If the unwinding leads to a rise in volatility, it can trigger a sell-off spiral. To estimate the extent of these speculative bets, we track speculative investors’ positions in derivatives known as “FX futures contracts”. The data reflect the overall position of these investors – i.e. whether they are aggregate buyers (long) or sellers (short) – as opposed to the hedging needs justified by trade flows (Chart 3).

The chart clearly shows the change in investors’ overall position: in the first half of 2025 they held a net long position in the Japanese yen (JPY), meaning they were expecting it to appreciate against the USD; at the same time, they held a net short position in the USD, meaning they were betting the greenback to depreciate. Their net position in the Swiss franc remained short, which seems logical as the CHF is frequently borrowed to buy other currencies, and the Swiss central bank lowered its key rate to 0% in June 2025 to limit the currency’s appreciation. The MXN continued to benefit from a net long position, thanks to its high interest rate differential with other currencies and the easing of fears of a major trade war with the United States.

Investors looking for the best risk/return ratios have therefore had to contend with strong FX volatility since 2024. While long-term investors, such as asset managers and pension funds, tend to be able to weather this volatility and so can ignore carry-vol ratios and opt for a pure carry approach, hedge funds are often more edgy and quick to react. Moreover, when long-term (institutional) investors reach their risk tolerance thresholds, they can also rush to unwind their carry trades, thereby amplifying the sell-off.

Chart 3: Net long/short positions in FX future contracts at the end of each half

Note: Number of call contracts/number of put contracts per currency, normalised by the average number of contracts since 2022. A net positive position indicates a long position in the futures market.

In the summer of 2024, the “invest in MXN/borrow in JPY” strategy turned out to be loss-making. Aside from the depreciation of the peso mentioned earlier, the unexpected hike in Japanese rates (which narrowed its interest rate differential vis-à-vis other currencies) triggered a massive unwinding of positions and led to a marked reduction in net short exposure to the JPY. Speculative investors completely unwound their carry trade positions in the first fortnight of August, and have held a net long position since the end of 2024 (Chart 4)

Chart 4: Change in the carry-vol ratio of four strategies and 2 April US tariff announcements

Note: Long: investment currency, short: borrowing currency. 3-month yield differential for each currency pair, divided by its implied 3-month volatility.

Another significant episode was Liberation Day at the start of April 2025, when the United States announced a broad package of import duties. The usual long positions in the USD became net short positions, reflecting (i) increased hedging demand among non-resident investors to protect USD-denominated assets against FX risk; and (ii) market expectations of a depreciation in the USD. As a result, the returns on the “invest in USD/borrow in CHF” strategy, which was common at the start of 2025, have still not returned to the levels seen at that time (Chart 2): the USD has shed 13% against the CHF, wiping out the gains on the interest rate differential for investments in USD financed in CHF, and remains more volatile than before the tariff announcements (Chart 4). Conversely, the returns on the MXN/JPY strategy have returned to their early 2025 levels thanks to a fall in FX volatility and a continuing wide interest rate differential (over 7 percentage points; Chart 1).

Download the full publication

Updated on the 20th of February 2026