Assessing the Impact of Basel III: Evidence from Structural Macroeconomic Models

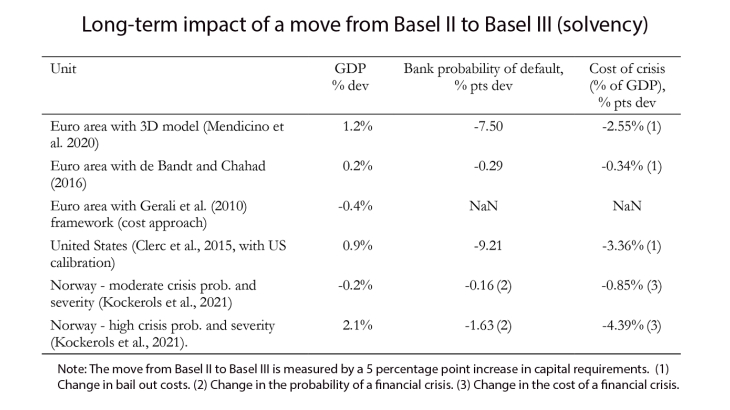

Working Paper Series no. 864. This paper reviews the different channels of transmission of prudential policy highlighted in the literature and provides a quantitative assessment of the impact of Basel III reforms using “off-the-shelf” DSGE models. It shows that the effects of regulation are positive on GDP whenever the costs and benefits of regulation are both introduced. However, this result may be associated with a temporary economic slowdown in the transition to Basel III, which can be accommodated by monetary policy. The assessment of liquidity requirements is still an area for research, as most models focus on costs, rather than on benefits, in particular in terms of lower contagion risk.