As of 1 October 2025, the Eurosystem comprises the 20 national central banks (NCBs) of the euro area Member States plus the European Central Bank (ECB). The governors of these institutions meet regularly within the Governing Council to define monetary policy stance. Decisions taken apply to all jurisdictions and their implementation is delegated to the NCBs, which derive most of their interest income and expense from this. Therefore, net interest incomes of the various NCBs evolve firstly in a synchronized manner (see table below, block ). In a context of excess liquidity, they remained at high levels during the period of low interest rates between 2015 and 2022, before falling sharply following the rise in rates in 2023 and 2024. Since they are members of the Eurosystem, NCBs aim to ensure price stability in the euro area and may therefore alternate between periods of positive and negative income, depending on the measures taken to fulfil this mandate (Bénassy Quéré, 2024 and 2025).

Adding to this common trend, NCBs’ interest income also varies with national factors, such as the characteristics of the domestic banking system or liquidity flowing in and out of the jurisdiction. In turn, these national factors are themselves partly related to the monetary integration of thex euro area. This is why the Statute of the European System of Central Banks (ESCB) provides for cross jurisdictional reallocation rules, which aim to maintain a proportionate distribution of income generated from the common monetary policy (referred to as monetary income). These rules result in the net interest incomes shown in block of the table below and are described in the first part of this article.

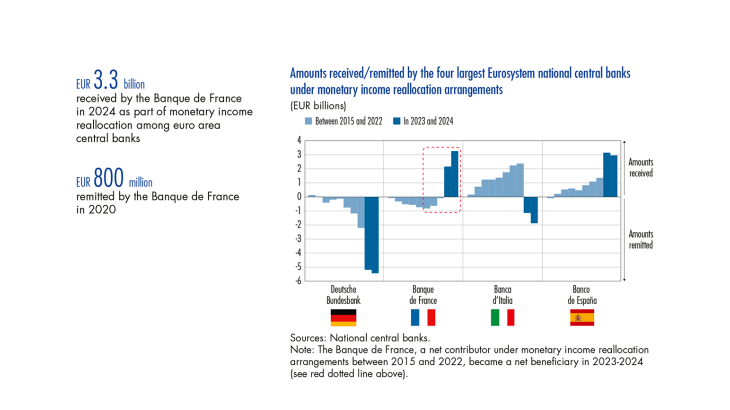

For an NCB, the net result of pooling monetary income (“net result of pooling” in the rest of this article) is the difference between income after and before reallocation (see block “ – ” in the table). Since 2023, the net result of pooling of some of the main NCBs has switched between positive and negative (see Chart 1 below), giving rise to questions (Baglioni, 2024; Cesaratto et al., 2025). These changes are analysed in the second part of this article.

1 The rules for the reallocation of monetary income

Interactions between a national central bank and commercial banks within its jurisdiction

Monetary policy implementation in the Eurosystem is decentralised. Each NCB interacts mostly with the commercial banks within its jurisdiction. It handles their deposit accounts and provides …