This study on the use of retail means of payment in France in 2024 is based on different data sources:

- Statistical data collected by the Banque de France from payment service providers established in France and from card payment schemes operating in France. The data collected relate to all types of cashless payments made by their customers – both individuals and professionals – other than financial and monetary institutions.

- SPACE (study on the payment attitudes of consumers in the euro area) surveys carried out by the European Central Bank (ECB) on the payment attitudes of households only. These surveys, conducted on a sample basis, cover the use of both cash and cashless means of payment. The Banque de France also builds its own annual estimates based on the results.

By combining these data sources (see Box 1), this bulletin presents key findings on French citizens’ use of cashless means of payment for 2024 and puts them into perspective against the trends observed in the 2024 SPACE survey, taking into account the differences in scope and methodology between the two sources.

1 In 2024, innovations such as instant credit transfers and mobile payments became a feature of everyday payments

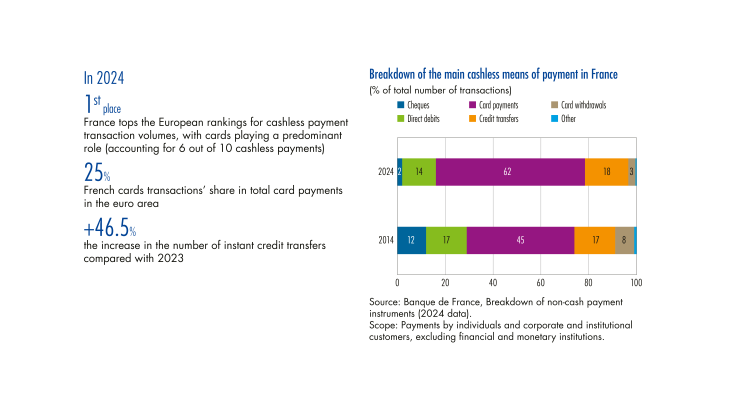

In 2024, cashless (i.e. non-cash) means of payment were used in 32.7 billion transactions across all economic agents (households, businesses, government administrations) in France, up 5.2% in volume compared with 2023. In terms of value, the amounts exchanged increased by 3.4% year-on-year to EUR 34,730 billion. This trend was also seen in payments made by households in shops, which rose by 3.2% year-on-year to EUR 803 billion in 2024 based on estimates from the SPACE survey (see Chart 1).

According to the latest statistical data, instant credit transfer use grew sharply in 2024, both in volume (600 million transactions, up 46.5%) and value (EUR 231 billion, up 30.6%). This increase is attributable to the broadening of uses for instant credit transfers for the public, as the average transfer amount fell from EUR 583 in 2020 to EUR 387 in 2024. The shift from standard credit transfers to instant transfers is one of the main factors, as annual growth in instant credit transfer flows has exceeded that of standard transfers, in absolute terms, since 2022 (see Chart 2). In 2024, instant credit transfers accounted for 10% of the total volume of credit transfers issued in France. …