1 Insurers and pension funds increased the horizon of their fixed income investments in 2024

In 2024, insurers and pension funds’ investment holdings continued to grow after the recovery observed in 2023

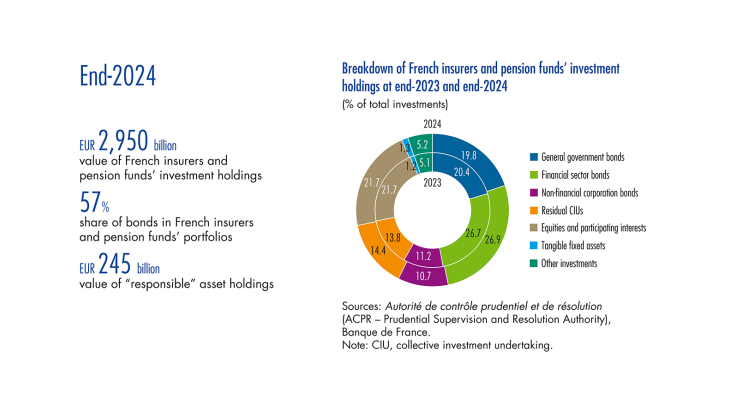

At the end of 2024, insurers and pension funds had EUR 2,950 billion of investment holdings, of which 76.8% was held by life insurers and 16.6% by non-life insurers. The remaining 6.6% was held by pension funds, up from 6.4% at the end of 2023.

Between the end of 2023 and end of 2024, total outstanding investments rose by 3.4% (or EUR 93.5 billion), driven by EUR 55.3 billion of net acquisitions (including EUR 18 billion stemming from the investment holdings of a new reporting entity) and a positive valuation effect of EUR 37.9 billion. The valuation of bond holdings increased moderately (by EUR 0.5 billion), reflecting the stability of yields on French 10-year government bonds (OATs) (despite cuts to key rates; see later). Nearly all capital gains were on non-money market CIU shares/units (EUR 34.0 billion), and notably on equity funds, which were boosted by strong stock market performances: rise of 24.7% in the US S&P500 index and rise of 11.9% in the Euro Stoxx 50.

French insurers and pension funds purchased significant assets over 2024 to readjust their portfolios, resulting in annual net acquisitions of EUR 55.3 billion. They notably purchased EUR 48.2 billion of debt securities to take advantage of attractive fixed income yields. Conversely, they sold a net EUR 7.0 billion of CIU shares/units, as purchases of non-money market CIUs (EUR 14.1 billion) were outstripped by EUR 21.1 billion of money market CIU sales. Holdings of equities and participating interests remained stable when measured at constant scope. The observed EUR 14.1 billion rise was almost exclusively caused by a scope effect, with the inclusion of a new reporting entity during the year.

Insurers and pension funds shifted away from money market instruments and towards longer-term debt securities (over one year)

The European Central Bank (ECB) continued to lower its key rates as inflation eased (100 basis-point cut to the deposit facility rate). The decline was passed through to short-term interest rates, prompting insurers and pension funds to rebalance their portfolios. They reduced their holdings of money market instruments and shifted instead towards the longer end of the yield curve. …