- Home

- Deputy governors' speeches

- Climate change is already hurting our ec...

Climate change is already hurting our economies

Agnès Bénassy-Quéré, Second Deputy Governor of the Banque de France

Published on 14th of November 2025

Agnès Bénassy-Quéré, novembre 2025

To mark the 30th Conference of the Parties (COP30) in Belém (Brazil), the Network of Central Banks and Supervisors for Greening the Financial System (NGFS, 148 members) has issued a reminder that, although fighting global warming will have a cost, it will be much lower than the economic and financial damage caused by climate change.

The NGFS is known for its long-term (25 years) and short-term (5 years) macro-climate scenarios. But the costs of global warming are already an observable reality. Europe is warming faster than the world’s other regions, and, according to Météo-France, France is already 1.9°C warmer than in the pre-industrial era. Average temperatures are rising, and above all, extreme weather events are proliferating, affecting economic activity and destroying public, private and natural capital.

There are two aspects to the cost of extreme weather events: the direct cost associated with physical damage, such as the destruction of homes; and the indirect cost associated with lost revenues, which can be long-lasting – think, for example, of the loss of tourism when a forest is partially destroyed by a storm. The cost in terms of human lives lost, which is unfortunately already a reality, will not be considered here as its quantification raises a vast array of ethical concerns.

The direct cost of damages

France is primarily exposed to flooding and droughts, as well as cyclones in its overseas territories.

Historically, storms and floods are the main cause of direct economic losses linked to extreme weather events in France. Cyclone Xynthia in 2010, for example, cost insurers EUR 1.5 billion and, according to an information report submitted to the French Senate, caused an estimated EUR 2.5 billion of total direct damage; the equivalent of 0.13% of GDP in 2010.

The French Budget Directorate estimates that the compensation paid by the Caisse Centrale de Réassurance (CCR – the French public reinsurer) for flood-related damages has increased by 23% in France over the last ten years. The CCR also reports that the cost of claims related to clay shrinkage and swelling made by single-family homes rose from EUR 400 million per year over the 1989-2015 period to EUR 1 billion per year during 2016-20, and up to EUR 3.5 billion in 2022.

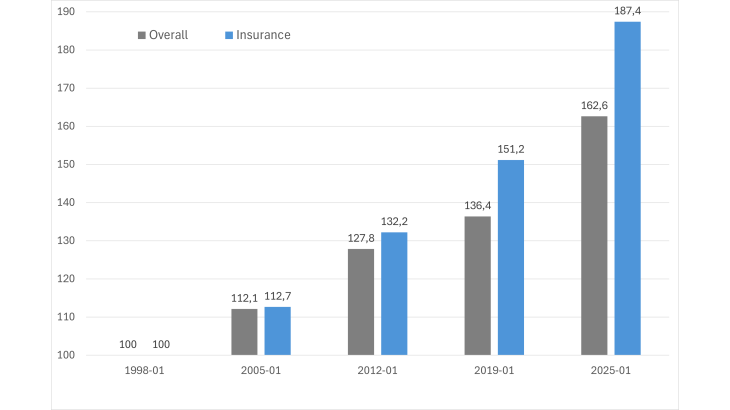

Now, this reinsurance is financed by mandatory additional premiums on property insurance policies. On 1 January 2025, the additional premium rate rose from 12% to 20% for home and business properties (Article A.125-2 of the French Insurance Code). Chart 1 shows that the consumer price index for insurance has been rising faster than the overall consumer price index since 2012, although obviously the gap between the two cannot be attributed entirely to climate change.

Chart 1: Harmonised Index of Consumer Prices in France overall index and insurance index (1998-01=100)

Businesses are also affected by increasing insurance costs. According to France Assureurs, professional property insurance premiums (excluding agriculture) amounted to EUR 9.4 billion in 2024, up 8.1% from 2023, itself higher by 10.9% compared to 2022. This includes approximately EUR 900 million in additional “natural catastrophe” premiums. The increase in additional premiums in 2025 is expected to directly raise rates by around 7%. Premiums for agricultural property insurance rose by 15.8% in 2023 to EUR 1.8 billion, driven by specific premiums for climate risks, which increased by 31.1% in 2023 to EUR 856 million.

Local authorities, too, are not spared, as a growing number face rate increases (see Association des Maires de France, 2024).

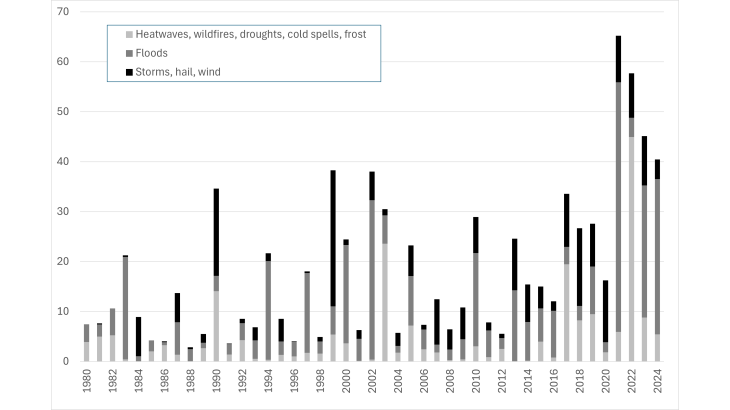

At the European level, the European Environment Agency added up the damages resulting from the various weather events and put the direct economic losses associated with climate catastrophes at EUR 40 billion in 2024 (around 0.2% of European Union GDP). The damage is trending upwards, and has accelerated over the last four years (see Chart 2).

Chart 2: Annual economic losses associated with extreme weather events in the European Union (EUR billions)

The economic cost of extreme events

In contrast to the cost of physical damages, the economic costs of extreme weather events cannot be measured directly. For example, France’s GDP grew by 0.3% in the second quarter of 2025 from the previous quarter, despite a heatwave in June. However, in no way does this imply that the effect of global warming is benign. Its effects may be delayed, to be felt later in the year, or even over decades if school days have been lost, for example, or ecosystems have been destroyed. We also need to consider how GDP would have evolved if there had not been a heatwave (see INSEE, September 2025).

Usman, Parker and Vallat (2025a) estimated the impact over the 1995-2022 period of heatwaves, droughts and floods on activity at the most detailed European regional level (1,160 NUTS level 3 regions, equivalent to France’s departments). They found marked recessionary effects, notably for droughts and floods. They then used this estimate to calculate the impact of the extreme weather events that occurred in Europe during the summer of 2025 (Usman et al., 2025b). They found declines of up to 1.4% in value added in the departments of the former Languedoc-Roussillon region. The scale of the figures is consistent with the findings of Costa and Hooley (2025) based on a dataset covering 1,600 regions in 31 OECD countries from 2000 to 2018, even though, in both cases, these are econometric estimates that are surrounded in considerable uncertainty.

This type of calculation does not take account of relocations of activity from one department to another, which may mitigate the impact of extreme weather at macroeconomic level, nor the attenuation effects of input supply from other departments. Hence, it cannot be extrapolated to the country level. Nonetheless, it provides a quantification of how climate change may affect companies at local level.

The effect of extreme weather events on prices initially appears ambiguous, as in the short-term natural catastrophes reduce both supply and demand. However, Kotz et al.(2024) find that global warming has an upward impact on inflation. Their calculations suggest that the drought of 2022 increased food inflation in Europe by 0.4 to 0.9 percentage point, and pushed up headline inflation by 0.2 to 0.4 percentage point.

A growing economic cost

According to the short-term climate scenarios of the Network for Greening the Financial System (NGFS), if Europe – under current economic and climatic conditions – were to experience a combination of low-probability but particularly severe weather events, France would suffer a loss of GDP of more than 7%, due in particular to physical damage and financial market reactions.

But without additional efforts to reduce greenhouse gas emissions, extreme events will actually increase significantly both in terms of frequency and intensity over the coming decades. Météo-France, using a trend-based scenario, projects a tenfold increase in heatwave frequency in 2100 over the 1976-2005 average, with temperatures in excess of 40°C every year and peaks of 50°C locally. Rainfall intensity would increase by 15%, increasing the risk of flooding.

Beyond extreme weather events, global warming is having a chronic negative effect on our economies and it is becoming increasingly pronounced. For example, staple crop yields have been stagnating in Europe since the 1990s, after increasing by an average of around 0.6% per year in the 1960s, 1970s and 1980s. According to Vidal (2023), one third of the decline in growth can be explained by global warming, with the other two thirds due in particular to decreases in soil organic content and crop diversity. Climate change is also contributing to forest dieback and is increasingly impacting manufacturing and energy production as water becomes scarcer.

Conclusion

Awareness of the damages associated with climate change is becoming increasingly entrenched not only among insurers, but also among business leaders and local government officials. While climate awareness may be declining in certain spheres of public opinion, it is frequently gaining ground in emerging economies. Within the scope of their respective mandates, central banks and prudential supervisory authorities are continuing their efforts to anticipate risks and help the financial system to shield itself against them. Far from dropping its guard, the Central Banks and Supervisors Network for Greening the Financial System (NGFS) is pressing on with its work. Because make no mistake: climate catastrophes will become more frequent, and their economic and financial costs will increase. Even the most ardent climate sceptic will eventually come to realise it.

Download the full publication

Updated on the 14th of November 2025