- Home

- Governor's speeches

- About our monetary policy: A good posit...

About our monetary policy: A good position but not a comfortable, nor a fixed one

François Villeroy de Galhau, Governor of the Banque de France

Published on 5th of December 2025

CEPR Paris Symposium 2025

Speech of François Villeroy de Galhau, Governor of the Banque de France,

Paris, 5 December 2025

Ladies and Gentlemen,

I am delighted to welcome you today to the Banque de France for the fourth edition of the annual CEPR symposium, a great opportunity for academics and policymakers to share knowledge. We’ve just heard Philippe Aghion, Nobel laureate 2025, challenge us with bold ideas on innovation and growth. Now, let me lay the necessary foundation which is trust and price stability: how does monetary policy navigate today’s uncertainties?

Three years after reaching its peak, inflation is currently at 2.2% in the euro area and has been very close to target since May 2025.i Thanks to the credibility and effective action of the European Central Bank, this disinflation was achieved without triggering a recession, an outcome many observers had considered unlikely. We are, as President Christine Lagarde has observed, “in a good place”. But a good position is not a comfortable one nor a fixed one, as I will discuss today.

I. Not a comfortable position: dealing with uncertainty

Claiming to be in a comfortable position in such an uncomfortable world would obviously be excessive. Uncertainty has eased but remains high: AI valuations, fiscal and political instability, trade shifts, geopolitical tensions, and doubts over the US dollar’s global role keep CEOs and policymakers awake. Many of these uncertainties are “Knightian”, for which there is no well-defined set of probabilities over different outcomes. As inflation and economic conditions become less predictable, there are diverging assessments on the state of the economy and risks across agents. And when investors hold diverging views, markets are less likely to stabilize. Consider recent developments in bond markets on the one hand and in equity markets, on the other hand. With rising market perceptions of fiscal risks, we see tensions at the very long end of yield curve. At the same time, the stock market has been outperforming, with high price-to-earnings ratio and compressed credit spreads. Overall, this suggests some optimism in the short-to-medium-term but concerns on the longer term.

A well-known tendency when faced by uncertainty is cautious action, invoking Brainard’ principle in monetary policy.ii Yet Banque de France research shows this can be counterproductive if agents expect systematic under-reaction to inflation shocks. In Bernanke’s words: “Brainard's attenuation principle may not always hold […] stronger action by the central bank may be warranted to prevent particularly costly outcomes.”iii

A risk-management approach to uncertainty: Agile pragmatism, forward-looking with scenario analysis.

Hence, our repeated commitment to a “data-dependent, meeting-by-meeting approach”: it’s more than a mantra; it’s my favourite notion of “agile pragmatism". Data-dependency means pragmatism: our reaction is state-contingent – where the state includes not only current economic conditions but also the outlook and the balance of risks.

And meeting-by-meeting means agility. But meeting-by-meeting doesn’t mean ignoring the future. Transmission lags make forward-looking analysis essential, which is why our projections play a crucial role in the decision-making process. But we also have to think about how robust our decisions are to plausible and policy-relevant future shocks that may occur during those lags. This is where scenario analysis becomes valuable.

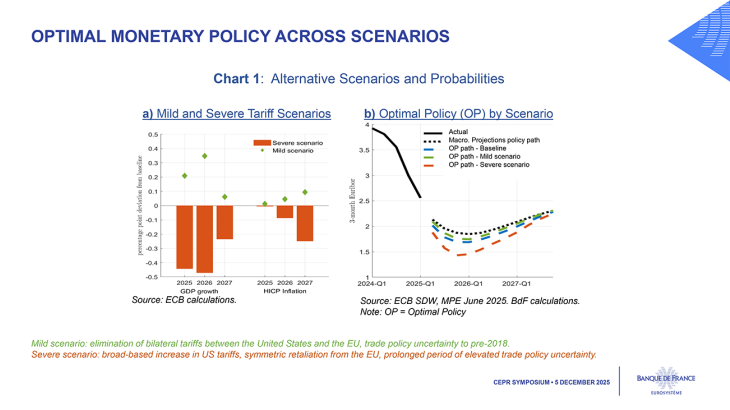

Banque de France staff researchiv is developing an example of monetary policy risk-management framework informed by a range of scenarios. Let me illustrate: last June, ECB staff provided two different risk scenarios around the baseline, shown in Chart 1.a.

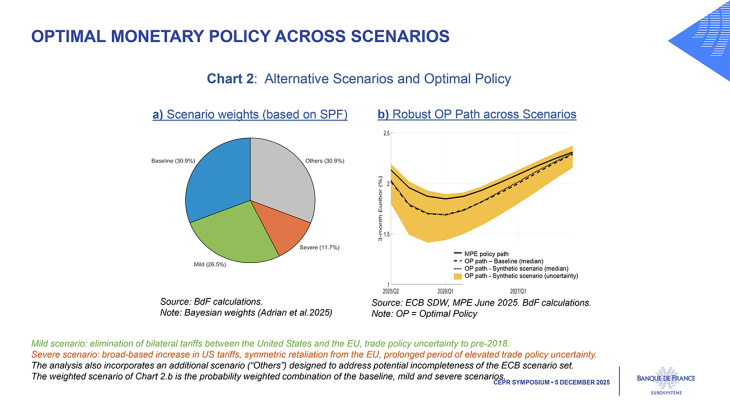

Each scenario implies a different optimal policy path, as shown in Chart 1.b. Our framework then allows assigning weights not only to alternative scenarios but also to the baseline, as reported in Chart 2.a.

These weights are assigned based on their relevance according to the Survey of Professional Forecasters (SPF). Accordingly, we can design a “synthetic” scenario as the weighted average of the baseline and the two alternative risk scenarios. Chart 2.b. shows the resulting synthesis. Despite different optimal paths under the scenarios, the synthetic path aligns very closely with the optimal path under the baseline. This is due to the low probability assigned to the more extreme scenario. In short, while an extreme tariff shock would justify looser policy, its low plausibility means little need for extra insurance now.

That said, many questions remain open on scenarios. Who selects and prepares them? And beyond that, how should we use them? Two main options exist to derive a single policy decision from a range of scenarios: one is to synthetise scenario results using techniques like Bayesian synthesis – as illustrated above – and model averaging; and the other is to select the policy path that avoids the worst outcome across scenarios following a robust control approach. Both have pros and cons. Broadly speaking, I would say that scenario synthesis should be the preferred option, while robust control remains valuable when facing extreme risks whose plausibility is difficult to gauge. In that case the policy maker might be more concerned with taking out insurance against the “bad state” of the world.

Such “what if?” exercises also help illustrate how the central bank might respond to shocks, allowing agents to learn about the policy rule from plausible – not just observed – decisions. Of course, such descriptions must remain indicative, and not committing.

In its November 2025 Monetary Policy Report, the Bank of England has interestingly integrated scenarios into monetary policy council discussions and communications. Minutes, reports, and press releases use scenarios to highlight risks around key policy judgments and to explain alternative policy paths assuming each scenario occurs. Board members use scenarios to explain their decision within the monetary council. v As you know, we in the Eurosystem prefer that decisions are communicated without attributing individual views to encourage completely open discussions and preserve collegiality. But we could use scenarios more.

Communication under uncertainty

The academic literature has found that monetary policy uncertainty heightens market interest rate sensitivity to macroeconomic surprisesvi. We cannot, of course, reduce the fundamental economic and geopolitical uncertainty. But central banks can reduce monetary uncertainty about their future decisions through efficient communication, by enhancing economic agents’ perceptions of the policy framework.

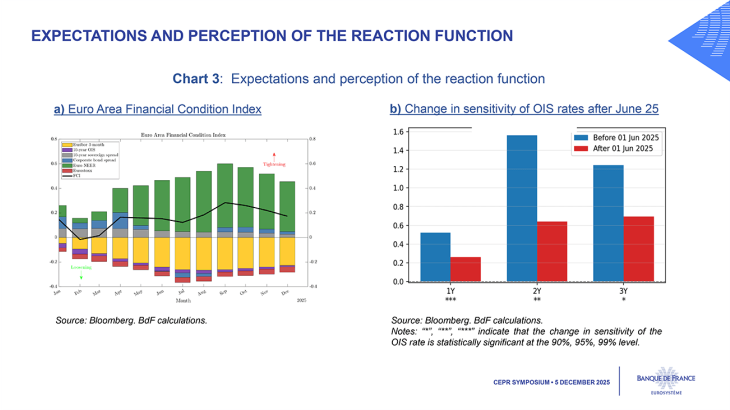

In a context of high uncertainty, we need to combine a hard commitment to the 2% symmetric inflation target and a soft guidance on the interest rate path. Soft guidance is not the kind of almost unconditional and “long horizon” forward guidance we have used at the ELB. Nor should soft guidance be interpreted as static. After our June and July meetings, markets had the wrong perception of the ECB having necessarily reached the terminal rate. This has contributed to a somewhat undesired tightening of FCI (Chart 3.a) and, since last June, the sensitivity of expected rates to expected inflation has diminished (Chart 3.b).

Soft signaling is our everyday life business, in which we influence market expectations of future near-term policy but keep optionality.

Furthermore, I am convinced that we must openly address all other sources of economic uncertainty with a broader and bolder communication beyond monetary policy vii. Today, uncertainty stems primarily from deteriorating public finances, and missed opportunities for structural reforms. If we don’t advocate a full implementation of the Draghi and Letta reports by the 1/1/28, including “a 28th regime for 2028”, who will? A remarkable move in this direction is Christine Lagarde’s recent speech in Frankfurt: “Another six years of inaction – and lost growth – would not just be disappointing. It would be irresponsible." viii

II. Nor a fixed position: navigating the road ahead

At the current juncture, our good position is not either a fixed one. Let me first dispel three main misconceptions I sometimes hear about our reaction function.

1. Three misconceptions about our reaction function

The ECB would have gone back to “below but close to 2%”

The first misconception is about an alleged asymmetry of our reaction function. Some believe we would tolerate inflation to go below but close to 2% for a prolonged period of time. In our strategy review since 2021, as reaffirmed in 2025, we strongly stated that our inflation target is fully symmetric. Positive and negative deviations from 2%, if lasting, are equally undesirable. Let me be clear: we are not “keeping our powder dry” to create a buffer with the effective lower bound.

The bar for changing rates would have increased

Second, some might think that we should react only to large deviations from the target and ignore small ones. But as I already stressed ix, what matters is not the size of the deviation, it is whether it is temporary or persistent. Even small but lasting deviations can affect the anchoring of inflation expectations. This is why we need to analyse thoroughly the effect of each shock, to decide whether to look through or act pre-emptively. Agility is not excessive policy activism, but it is not stickiness either.

The ECB could not decouple from the Fed

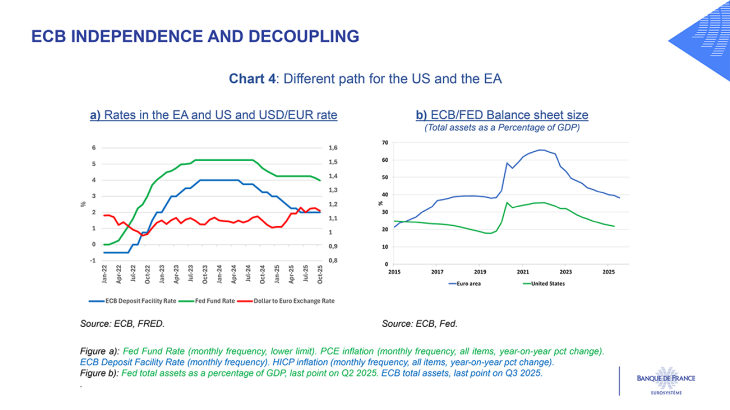

Finally, considering the Fed’s recent easing, and with an opposite mistaken view, some recommend that the ECB follow suit, but wrongly so. Remember Spring 2024, there was a symmetric debate about whether the ECB could truly cut its policy rates before the Fed. And the ECB did it (Chart 4.a).

Despite this decoupling, the exchange rate market absorbed this without turbulence, as it happened on several other occasions over the past decade.

Moreover, let me remind the obvious: we are already significantly more accommodative than the US. Our deposit facility rate is at 2%, close to estimates of the natural rate, our balance sheet size is 38% of GDP [Q3 2025], whereas it is 22% of GDP in the US [Q2 2025] (Chart 4.b). The 10-year OIS stands at about 2.5% in the euro area, compared to about 3.5% in the US.

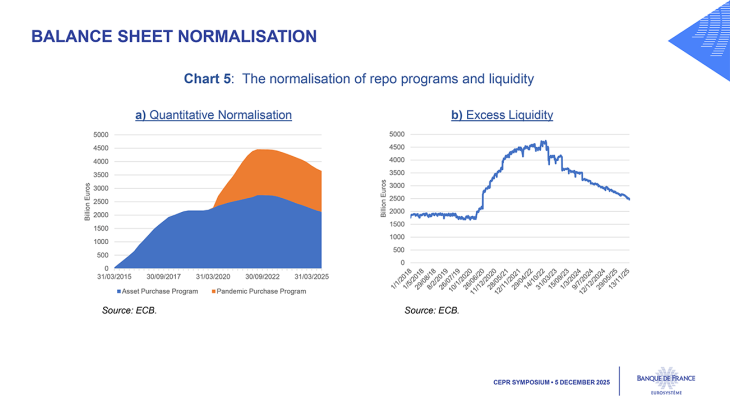

2. Some thoughts on Quantitative Normalisation

There have also been mistaken suggestions that because the Fed has concluded the reduction of its aggregate securities holdings, we should do the same. Nevertheless, this raises a more serious question about the right size of our balance sheet. I agree with my colleague Isabel Schnabel that the word “Quantitative tightening” is misleading about the present process: we should speak of “Quantitative normalisation” (QN)x . But until when and to what size? We will discuss next year about the implementation of our operational framework introduced in September 2024, but let me share two considerations:

- We should maintain ample liquidity in the European banking system. At present, it is still abundant, with our excess liquidity of about EUR 2,500 bn. It is to be compared with the necessary level of liquidity to have money market rates anchored to the floor policy rates, namely FREL (Floor Required Excess Liquidity) which is estimated on average at about EUR 1,500 bn, with however a wide confidence interval around this average (Chart 5.b).

But if we were to come to a situation of scarcer liquidity in the euro area, or perceived as such by banks, it would risk provoking an undue credit tightening, as well as an unlevel playing field with international banks.

- Liquidity, as we all know, can be provided “on demand”, through short-term refinancing operations, and/or through structural operations of the Eurosystem, including longer term refinancing operations and a structural portfolio. Short-term refinancing will regain part of its pre-GFC importance, but we also need to build a structural portfolio for at least two reasons: refinancing operations could still be associated for banks with a stigma effect; there is a need for the central bank to remain present on the bonds market, even above the ELB, for several reasons (transmission of monetary policy, climate change, etc.).

3. The name of the game is full optionality

Euro area annual inflation reached 2.2% in November, according to the flash estimate released on Tuesday. This remains a good position, for the seventh month in a row. This average hides nevertheless two paradoxes.

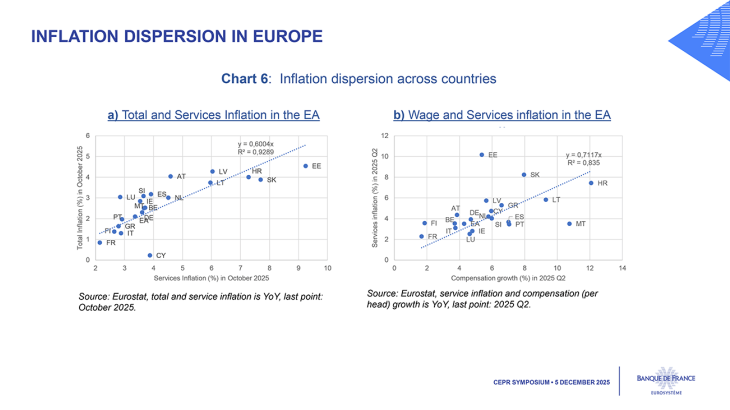

This stability encompasses inflation dispersion across countries

There is significant heterogeneity between countries, between low inflation in France (0.8%) or Italy (1.1%) and still elevated inflation in Germany (2.6%) and Spain (3.1%). This heterogeneity is mainly driven by the price of services: countries with low inflation in services are those with the lowest total inflation rates (Chart. 6.a).

Differences in service inflation are themselves largely due to wage dynamics (Chart 6.b). In Germany, with infrequent wage negotiations, wages are late in catching up with past inflation, compared to France, with annual negotiations and an indexed minimum wage. Once the catching-up is over in each country, we can hope we will see an evolution towards lower inflation rates in the services sector in the euro area.

These apparently stable inflation data are surrounded by significant risks on the inflation outlook.

This is the present paradox: stable data, but significant risks. There are upside risks on inflation, such as global value chain fragmentation, and public spending in defence and infrastructure in Germany. There are downside risks as well: a greater deceleration of wage growth, a stronger euro, and cheaper imports from China. Over the latest six months this year compared to the same period last year (May-to-October 2025 vs 2024), Chinese imports in the euro area increased by 11% in volume, and their price decreased by 9%. To give an order of magnitude, the last two phenomena could reduce inflation by about 0.2 percentage point in 2027 according to Banque de France estimates. The postponement of ETS2 to 2028, voted by the European Parliament, will also post-pone its inflationary impact of around a 1/4 of percentage point from 2027 to 2028. To these “traditional” downside risks, we should add a systemic “Knightian” one with financial instability due to global equity market valuations, private credit and high government debts. Furthermore, this financial instability could be triggered by the attacks to the credibility and independence of the Fed.

Bottom line: (i) the downside risks on the inflation outlook remain at least as significant as the upside risks, and we would not tolerate a lasting undershooting of our inflation target; (ii) the name of the game for our future meetings remains full optionality. The only fixed figure is our 2% inflation target; it is not any terminal interest rate, and we don’t exclude any policy action.

In the battle to reach the inflation target, we have finally taken the lead, and this is no small achievement. But being ahead doesn’t give us permission to relax. As the French tennis champion René Lacoste used to say: “If you’re on the cusp of winning, remember that there is no opponent who plays better than an opponent who is about to lose”. As in a tennis match, it’s not the last shot that matters, it is the next one. We must not stay fixed on the court and should anticipate how the game could evolve. In other words, agility is at the crossroads of two other virtues: extreme clarity about our determination to deliver the 2% inflation target; pragmatic humility and optionality about our next shots to that end.

i In October 2022 the year-on-year HICP Inflation rate reached the peak level of 10.6% in the Euro Area. In May 2025, inflation was 1.9% and never went below 1.9% or above 2.2% since.

ii Brainard (W.C.) (1967), “Uncertainty and the Effectiveness of Policy”, The American Economic Review, Vol. 57 Issue 2, Papers and Proceedings of the Seventy-Ninth Annual Meeting of the AER, 411-425, May

iii Bernanke (B.S.) (2007), “Monetary Policy under Uncertainty”, speech at the 32nd Annual Economic Policy conference, Federal Reserve Bank of Saint Louis, 19 October; Bauer (M.) et al. (2025), “Accounting for Uncertainty and Risks in Monetary Policy”, Finance and Economics Discussion Series 2025-073, Board of Governors of the Federal Reserve System.

iv Lhuissier (S.) (2026), forthcoming.

v Pill (H.) (2025), “Evolving UK monetary policy in an evolving world”, speech at the Institute of Chartered Accountants of England and Wales annual conference, London, 17 October

vi Bauer (M.D.), Pflueger (C.E.), Sunderam (A.) (2024), “Perceptions about Monetary Policy”, The Quarterly Journal of Economics, Vol. 139, Issue 4, 4 November, Swanson (E.T.), Williams (J.C.) (2014), “Measuring the Effect of the Zero Lower Bound on Medium and Longer-Term Interest Rates”, The American Economic Review, Vol. 104, No. 10, pp. 3154-85, October.

vii Villeroy de Galhau (F.) (2024), “Monetary Policy in Perspective (II) : Three landmarks for a future of “Great Volatility””, speech at the London School of Economics, London, 30 October

viii Lagarde (C.) (2025), “From resilience to strength : unleashing Europe’s domestic market”, speech at the 35th Frankfurt European Banking Congress, Frankfurt am Main, 21 November

ix Villeroy de Galhau (F.) (2024), “Monetary Policy in Perspective (II) : Three landmarks for a future of “Great Volatility””, speech at the London School of Economics, London, 30 October

x Schnabel (I.) (2025), “Towards a new Eurosystem balance sheet”, speech at the ECB Conference on Money Markets 2025, Frankfurt am Main, 6 November

Download the full publication

Updated on the 5th of December 2025