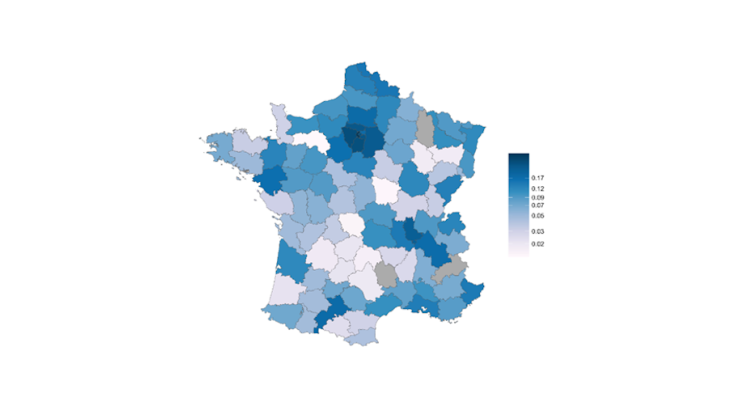

Interpretation: The map shows the teleworking index by département. The départements with the darkest shade are those with the highest teleworking capacity.

One of the main hysteresis effects of the Covid-19 pandemic on the organisation of work is probably the dramatic take-off of teleworking. Forced by circumstances, employers and employees have had to implement new ways of working remotely to limit physical interactions during the acute stages of the outbreak. This experience has prompted companies to invest more in computer equipment and to adapt their management practices. Teleworking has thus already become a standard practice for many workers and is likely to stick in the future (Barrero et al.,2021).

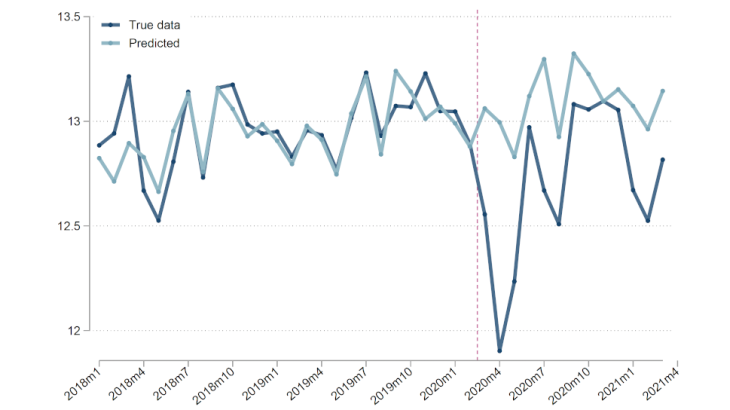

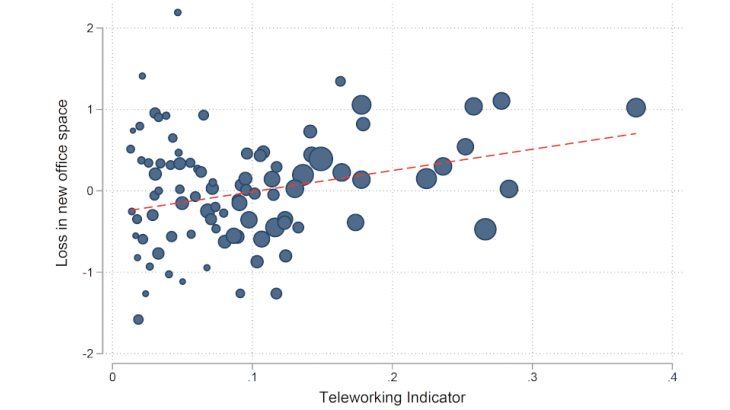

The polarisation of economic activity has led to a significant increase in real estate prices in dynamic areas. Office real estate is no exception and the cost of corporate real estate is increasingly weighing on companies’ bottom line (Bergeaud and Ray, 2020). Companies could thus consider taking advantage of teleworking to reduce their demand for office space. This could result in a structural downturn in the corporate real estate market. In the United States, Bloom and Ramani (2021) show that the pandemic and the rise in teleworking is already having a substantial impact on the spatial dynamics of city real estate (a “doughnut effect” for example). In a recent article (Bergeaud et al., 2021), we look at the first signs of such an adjustment in France.

Local heterogeneity of the propensity to telework

We first define an index that measures exposures to the deployment of teleworking at the département level. The index is the product of two components. First, we use the indicator constructed by Dingel and Neiman (2020) at the occupation level and apply it to the local composition of labour in France. We interpret it as a maximum potential for teleworking. However, this upper bound is unlikely to be reached in practice (Bartik et al., 2020). We then introduce frictions (quality of the internet infrastructure, average commuting time, number of families with children) that prevent the teleworking potential from being fully reached. We extract a principal component from these frictions and combine it with the maximum potential to construct a single index that measures the actual propensity to telework by département.

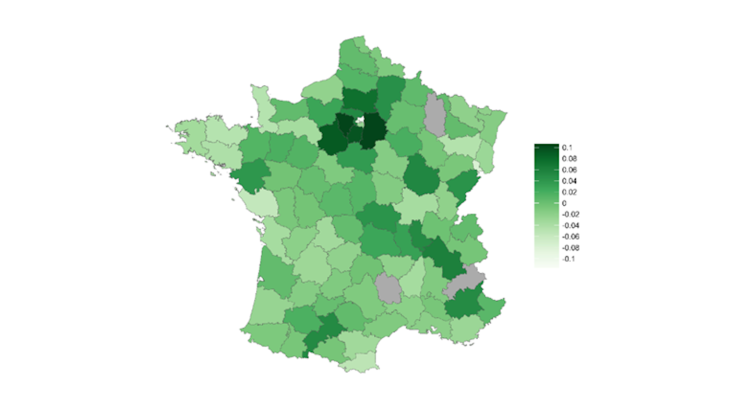

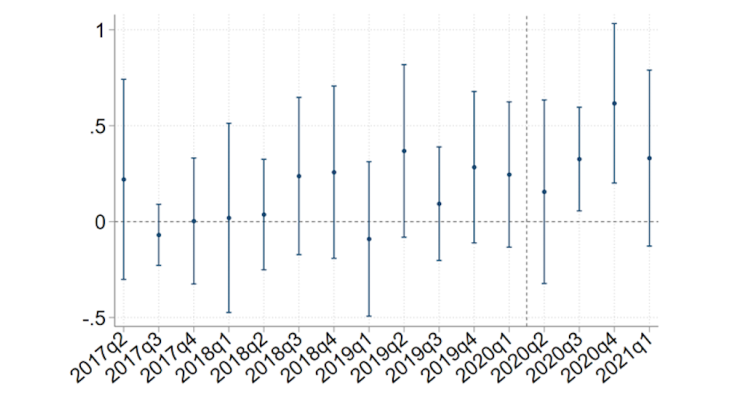

This indicator is presented in Chart 1. While it naturally shows some strong correlation with population density, it remains positively correlated with actual teleworking intensity after residualisation. The chart on the right plots this residualised geographical distribution.