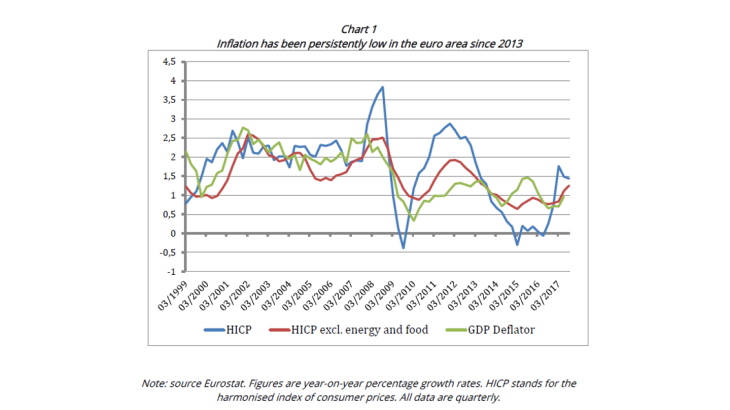

Various measures of inflation have been running significantly below 2% in the euro area since 2013 (Chart 1). Were the situation to last for too long, this might call into question the commitment of the Governing Council to achieve price stability, i.e. a headline inflation rate “below but close to 2%” over the medium run.

While, in the United States, the debate revolves around the appropriateness of raising the inflation target, some commentators contend that the Eurosystem should adjust to the lowflation environment and lower its inflation target. Proponents of a lower target view the current lowflation environment as a structural phenomenon: innovation and globalisation trends dramatically lower production and distribution costs, thereby reducing final goods and services prices. According to this view, central banks are bound to miss on their current inflation targets. This would eventually impair their credibility.

Granted, globalisation and innovation drag down the price of some production factors, thereby lowering the relative prices of some final goods and services. - These changes in relative prices can transitorily impact aggregate consumer price inflation because of price rigidities which prevent the full stabilisation of inflation through upward adjustments in those prices that do not experience downward cost shocks. However, lower relative prices cannot explain a sustained decline in overall inflation per se. By symmetry, an analog example is provided by Germany in the 1980s, where stable price inflation was achieved in spite of upward pressures on oil prices.

Lowflation: an aftermath of the crisis

The Great Recession of 2008-09 and the following euro area sovereign crisis of 2011-12 led to a sharp contraction in every component of aggregate domestic demand from firms, households and governments. Thus, in recent years, the unemployment rate has been above its pre-crisis average level by about 2 to 3 percentage points. The resulting depressed demand brought underlying inflation below its pre-crisis average (on the link between cyclical unemployment and cyclical inflation, see the related blog post by Jardet and Schmidt, 2017).

In order to preempt deflationary risks, the Eurosystem eventually had to cut the nominal short-term interest rate into negative territory. The policy floor rate in the euro area is now -0.40%. The exact level of the Effective Lower Bound (ELB) on nominal interest rates is still uncertain, and other central banks have indeed cut rates to even lower negative values. Nevertheless, there is a broad consensus that the short-term nominal interest rate cannot go much below this level. Unconventional policies were put in place to help lower the yield curve. However, it took time for them to be implemented and to feed through to the macro-economy.

Overall, the ELB constraint on monetary policy delays the adjustment to crises and, with demand below its potential over the long run, inflation may stay below its target for a long time.

Lowering the inflation target would constrain monetary policy more often

The nominal interest rate is the sum of the real interest rate - determined by forces such as productivity growth and demography- and the expected inflation rate – which should coincide in the long run with the inflation target. Everything else being equal, lowering the inflation target reduces expected inflation, and thus mechanically leads to a decline in the nominal interest rate.

As a consequence, there is a greater likelihood of the economy hitting the ELB. To illustrate why, assume the macroeconomic outlook calls for lowering the short-term real interest rate to -2%. In an economy with a 2% inflation target, this is achieved by setting the nominal interest rate at 0%. Now consider the same economy with an inflation target of 1% instead. A real interest rate of -2% would require setting the nominal interest rate at -1%, well below the lowest rates deemed feasible by central banks.

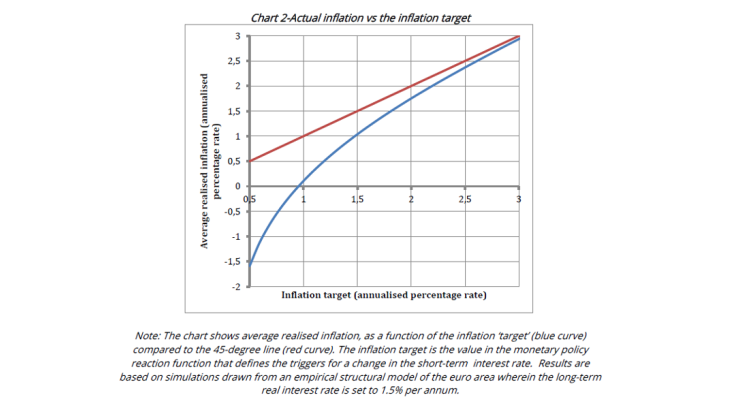

Frequent ELB episodes imply that, on average, inflation undershoots the target

More frequent ELB episodes mean more frequent periods where monetary policy cannot counter headwinds to aggregate demand at full steam. The consequence is more frequent episodes of unemployment above its structural level and inflation below target. By contrast, episodes of above-target inflation, or above-trend output, are not more frequent, as there is no upper bound in the adjustment of policy rates.

The resulting asymmetry is illustrated in Chart 3 which shows the average inflation rate obtained by simulating an estimated macro model of the euro area for various inflation targets (See Andrade, Galí, Le Bihan, and Matheron, 2017). The model describes the euro area economy in a way that is consistent with the data and taking into account the sluggishness of price and wage adjustments, together with the existence of the ELB. For targets around 2%, inflation is on average ‘below but close to 2%’. However, lowering the inflation target to 1% would result in a realised inflation rate of about 0%. This average inflation is clearly below the new and lower inflation target, so that the credibility of the central bank remains at stake.