The cash cycle comprises all stakeholders involved in managing and circulating banknotes and coins. In France, the main pillar of the sector is the Banque de France, as it participates in all stages of the cycle, from the manufacture, issuance and quality control of banknotes to their withdrawal at the end of their useful life. The cycle also includes a network of private operators such as cashin-transit firms, commercial banks and certain large retailers. These help to sort and recirculate banknotes, ensuring a constant, high-quality supply of cash to the economy.

This article provides an overview of the main trends in the cash cycle, notably:

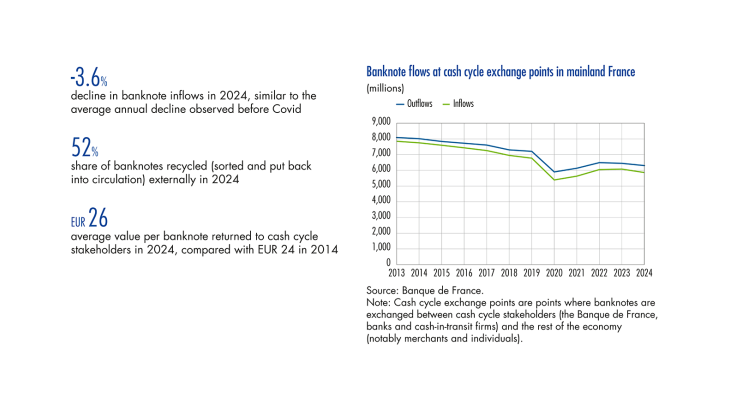

- banknote flows at different points of exchange, to illustrate changes in French households’ attitudes to cash over the past decade; flows are generally following a downward trajectory;

- stocks of euro banknotes in circulation (also known as net banknote issuance) in France, the euro area and the rest of the world, to illustrate the impact of recent disruptions (high inflation and hikes in interest rate) on banknote demand; after rising steadily, stocks stagnated as of 2022 but have begun to pick up again more recently.

1 Cash cycle flows have resumed their downward trajectory

Banknote inflows and outflows began to decline again in 2024

The French cash cycle was marked by a decline in banknote flows in 2024. Inflows – which refers to banknotes returned to cycle stakeholders – fell by 3.6% versus 2023 (to 5.9 billion banknotes; see Chart 1), which is roughly in line with the average annual fall observed before the Covid pandemic (2017-19). The decline in outflows was slightly smaller at -2.2% (to 6.3 billion banknotes).

The trend was interrupted in 2020-23

The period 2020-23 was marked by a succession of events, notably the public health crisis, and can be seen as something of an exception. Firstly, in 2020, the lockdowns and shop closures linked to Covid triggered a sharp drop in household spending and hence in cash purchases and banknote flows. However, the following year, flows began to rise again as household spending rebounded. This recovery then continued in 2022-23, fuelled by high inflation linked in part to global geopolitical tensions. Since 2023, however, with the dissipation of inflation and of the effects of the health crisis, banknote flows have returned towards their pre-Covid trend.

Outflows are structurally higher than inflows. In other words, “net outflows” of banknotes (outflows less inflows – see Chart 2) remain positive, indicating there is still strong demand (see section 2). …