Post No. 418. In response to the risks to financial stability posed by climate change, the Banque de France is deploying a diverse toolkit that includes macroeconomic modelling and detailed risk mapping. These tools, developed on the basis of concepts of climate hazard, exposure and vulnerability, provide complementary insights.

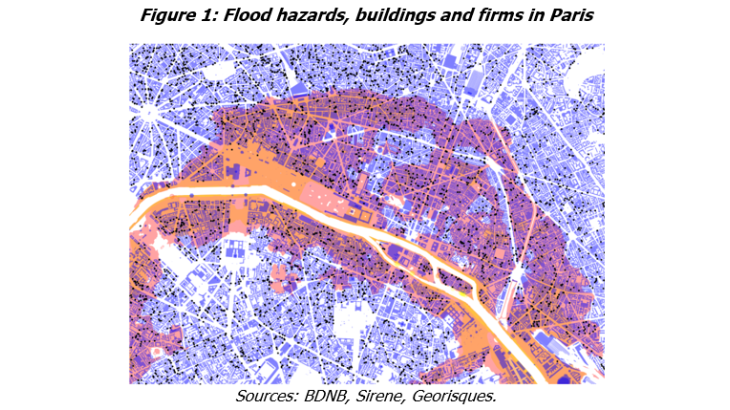

Note: The coloured areas map the potential extent of flooding based on probability of occurrence (orange for a 100-year flood and purple for a 1,000-year flood). Each point represents a firm.

Extreme weather events are becoming more frequent and their economic and financial consequences are ever more tangible: since 2017, average insured losses due to natural disasters have been 1.5 times higher than the 21st century average (AON, 2024). These climate shocks can affect two key aspects of central bank and supervisor mandates: price stability and financial stability. The Network for Greening the Financial System (NGFS) recently published a report on the data challenges associated with climate risk assessment.

To assess the impact on financial stability of acute physical risks (linked to more frequent and intense extreme weather events) and chronic physical risks (due to gradual changes in climate), the Banque de France is combining macroeconomic analyses – to capture aggregate effects – with granular approaches that make the identification of vulnerabilities more precise. These approaches encompass three main layers of analysis: climate hazards (climate events likely to occur), exposures (assets, populations and infrastructure likely to be affected), and vulnerability (the likelihood that exposures will result in both physical and financial damage).

Hazards – the contribution of climate sciences

Climate hazards can be broken down into two types: (i) acute hazards, such as floods or heatwaves, which are sudden, intense and short-lived and whose probability and intensity are affected by climate change; and (ii) chronic hazards, such as increasing average temperatures or rising sea levels, which evolve more slowly. Both can have an impact on the economy.

These hazards have to be modelled both spatially and temporally if we are to understand and anticipate them.

When considering the temporal dimension, we distinguish hazards linked to the current climate from projected future hazards. Climate models take greenhouse gas emission scenarios – such as those proposed by the IPCC – and estimate their expected consequences on climate hazards. Not all hazards are modelled with the same maturity or degree of certainty: while floods are well understood, phenomena such as European megafires or the risk of crossing high-impact tipping points such as the disappearance of the Amazon rainforest, for example, are less so.

The spatial dimension concerns the geographical accuracy of the data. Depending on the scope studied, it is sometimes necessary to choose between an international coverage – which allows for more harmonised analyses – and a local approach, which is more precise and better suited to specific regional characteristics. For example, the Caisse Centrale de Réassurance (the French public reinsurer) is able to model floods in France down to the nearest 10 metres, providing greater precision than harmonised maps for Europe and better capturing the specific characteristics of both the current and future French climate.

Exposures – who is likely to be affected?

In order to quantify the damages associated with climate hazards, we need to have information on the assets and activities that are exposed. Increased exposures, as illustrated by the urbanisation phenomenon in Florida in the United States, are therefore a key factor behind the uptrend in losses due to natural disasters.

The quantity and granularity of the information used vary depending on the objectives of the analysis and constraints in terms of data availability. When assessing macroeconomic vulnerabilities, a high degree of granularity is not essential and may even mask indirect effects. For its 2023 climate stress test exercise dedicated to insurers, the ACPR broke down the impacts of the NGFS's long-term climate scenarios by sector; the organisations only required aggregated information on sectoral exposures to apply the shocks.

However, more granular and more precise data sources, such as on the location and value of buildings, are invaluable for microeconomic approaches. An international project involving the Banque de France, for example, applies a Digital Twin concept to quantify the impact of flooding on firms and their bank loans. In this context, detailed information – location, asset and inventory values, distinctions between owners and occupiers – refines our understanding of how impacts are transmitted.

Whatever the case, the degree of accuracy of exposure data depends on the level of the analysis and the data constraints. The Eurosystem's analytical indicators on physical risk, for example, attribute physical risks to the headquarters of financial institution counterparties, as this is the best harmonised, Europe-wide information available. By contrast, approaches that aim to provide reliable information at individual company level – such as the business climate indicator currently in development at the Banque de France – cannot adopt this type of simplification.

From physical vulnerability to financial vulnerability

Risk analysis distinguishes between physical vulnerability (potential losses suffered by assets and activities exposed to a shock) and financial vulnerability (reflecting the ability of players to absorb those losses). A microeconomic approach may be applied to estimating this vulnerability. It provides a precise picture of individual impacts but mainly captures direct effects, unlike a macroeconomic approach, which can better capture indirect effects (such as the persistence of an economic slowdown), but then provides a less detailed identification of transmission channels.

The microeconomic approach links an event’s intensity to its physical impacts. For example, the Digital Twin project calculates the potential destruction of real estate and equipment owned by firms following a 100-year flood of the Seine in Paris, comparable in scale to the Great Flood in 1910 (see Figure 1). The damages – valued at around EUR 12 billion – are then compared with firms' balance sheets and bank loans in order to establish a link between physical vulnerability and financial vulnerability.

Macroeconomic approaches capture vulnerability more indirectly. They can take a past statistical relationship between climate and GDP and project it into the future, as is the case with the NGFS's long-term climate scenarios (“chronic” risk). They can also separately model the channels through which natural disasters affect the economy, combining disaster models and macroeconomic models (“acute” risk). The NGFS applies this approach in its long-term scenarios, but more particularly in its short-term climate scenarios, which examine risks of plausible but extreme weather events over a short time horizon.

The challenge for these approaches is the same: correctly integrating factors of resilience. Data on adaptation measures remain limited, even if information on certain key structures (such as dykes, used in the Digital Twin project) exists. The role of the insurance system is also crucial: in certain vulnerable areas around the world, premiums are rising or insurers are withdrawing – a phenomenon that the ACPR tried to anticipate in its most recent exercise. More generally, approaches that use statistical relationships (and therefore estimates of past vulnerability) to anticipate future economic vulnerability are subject to considerable uncertainty.

Download the full publication

Updated on the 18th of November 2025