How can trade credit be expected to react after a US monetary tightening?

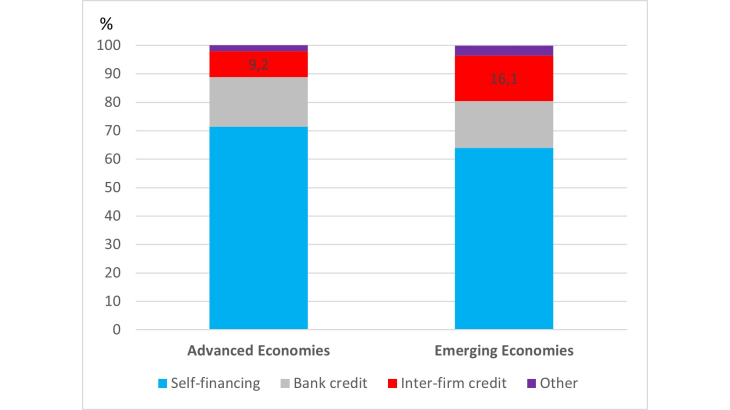

Decisions by the US Federal Reserve (Fed) have significant spillover effects on global financial conditions. A hike in US policy rates tends to trigger capital outflows from emerging markets, as USD-denominated assets offer higher returns. This leads to depreciation of local currencies, upward pressure on domestic interest rates, and, ultimately, a broad tightening of monetary conditions. As a result, access to traditional sources of financing, such as bank credit, becomes more difficult.

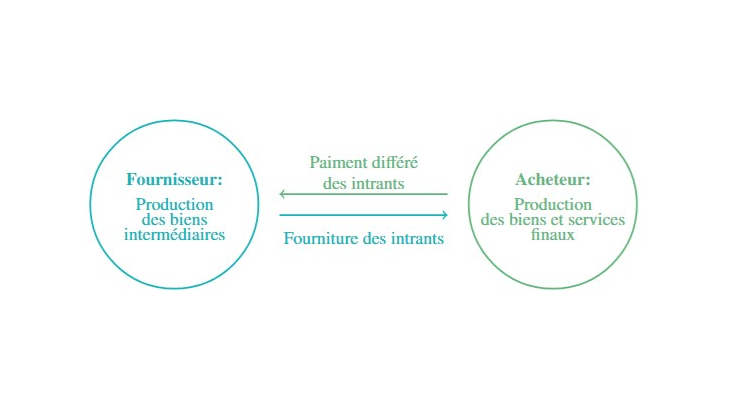

Firms in emerging markets may try to mitigate this effect by turning to their suppliers for additional trade credit. However, suppliers may also be affected by the tighter financial conditions, leading them to restrict their inter-firm lending. Thus, a US monetary shock can potentially generate two opposing effects:

- Trade credit may increase to offset the reduction in bank lending (stabilising effect);

- Or trade credit may decline if suppliers also face difficulties and reduce the amount of credit they provide to customers (amplifying effect).

Few studies have addressed this issue, primarily due to limited data availability. However, thanks to a new database, we propose testing the impact empirically, along with the associated mechanisms.

The cushioning role of trade credit in response to US monetary surprises

Our analysis relies on a unique proprietary dataset provided by the trade credit insurer Coface, covering 10 years (2010-2019) of inter-firm credit agreements between foreign suppliers (from both advanced and emerging economies) and importing firms in six large emerging countries that are historically sensitive to US monetary policy decisions: South Africa, Brazil, India, Indonesia, Mexico and Türkiye.

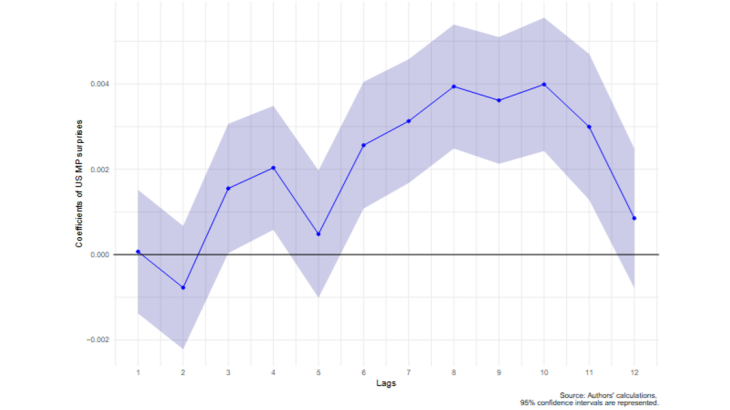

Our results show that, in response to an unexpected tightening of Fed monetary policy:

- The volume of trade credit provided by foreign suppliers to importing firms in emerging countries increases markedly, with the effect peaking about nine months after the tightening;

- An unexpected rise of 2.5 basis points in the US two-year Treasury yield leads to an average 0.4% rise in the amount of trade credit after three quarters (Chart 3).

- This increase is more pronounced for buyers with lower credit quality, who face greater financial constraints. These firms are more affected by the tightening of bank credit, as they are perceived as higher-risk. As a result, they tend to request more trade credit from their foreign suppliers.

We also show that the effect is transmitted through a worsening of financial conditions in emerging countries following a US monetary shock. Faced with more challenging financial conditions, buyers tend to rely more on their suppliers to balance their cash levels, regardless of the supplier’s country of origin.

Overall, the results indicate that trade credit plays a stabilising role by substituting for bank lending when the latter contracts. This stabilising role is particularly evident in long-standing relationships between suppliers and clients, as opposed to newly formed ones. The longer the relationship, the greater the trust between trading partners, allowing suppliers to temporarily ease financing conditions for more exposed buyers.

Chart 3: Impact of a US monetary policy surprise on trade credit