Non-Technical Summary

Over the past fifteen years, central banks on both sides of the Atlantic have faced unprecedented challenges, including the 2008 global financial crisis, the European sovereign debt crisis, the Covid-19 pandemic, and the recent surge in inflation. In response to these shocks, both the European Central Bank (ECB) and the Federal Reserve (Fed) moved beyond traditional instruments, introducing large-scale asset purchases, forward guidance, liquidity facilities, and even negative interest rates. While pursuing similar objectives, monetary policies in the euro area and the United States often evolved asynchronously, reflecting differences in the nature of shocks and underlying macroeconomic conditions. Understanding the sources and consequences of these divergences is key for assessing the effectiveness of monetary policy.

To this end, we develop and estimate a two-country model that identifies the drivers of growth and inflation in both regions and enables counterfactual analysis. Unconventional monetary measures are summarized by so-called shadow rates, which capture the policy stance when interest rates are constrained by the effective lower bound. Since different estimation methods yield varying shadow rates, we combine multiple sources to construct a robust proxy of the overall monetary stance.

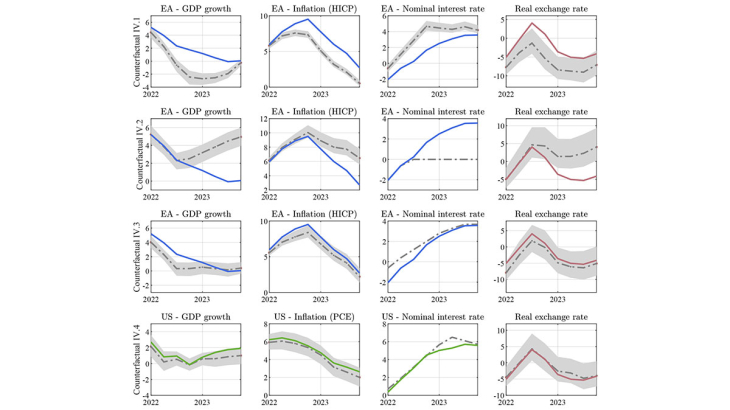

Historical decompositions identify the shocks driving GDP growth and inflation across four distinct phases: (i) the global financial and sovereign debt crises (2008–2014), (ii) the Fed’s normalization versus continued ECB easing (2015–2019), (iii) the Covid-19 pandemic (2020–2021), and (iv) the inflation surge and policy tightening (2022–2023). Counterfactual simulations then quantify the role of unconventional measures, the timing of interest-rate adjustments, and exchange-rate dynamics.

Our findings highlight three main findings. First, macroeconomic fluctuations were largely driven by shocks of differing nature across the two regions. For example, while negative demand shocks dominated in the euro area between 2012 and 2019, positive demand and supply shocks supported US growth and inflation over the same period. During the recent inflation surge, supply shocks were more pronounced in the euro area, whereas demand factors were stronger in the US. This divergence helps explain the occasional lack of synchronicity between ECB and Fed policy stances.

Second, exchange rates shocks played a significant role in shaping overall monetary conditions. US growth benefited from favorable exchange-rate effects in 2008–2017 and again in 2021–2023, while the euro area experienced similar gains in 2018–2020. These results underscore the importance of jointly considering monetary and exchange-rate shocks when assessing the stance of policy.

Third, counterfactual exercises demonstrate that all monetary policy measures, both conventional and unconventional, generally supported economic growth and helped maintain inflation on track in both regions. This suggests that policymakers achieved notable success despite the unprecedented challenges faced since 2008. The main exception is the delayed response of both central banks to the recent inflation surge. In particular, our results suggest that an earlier policy response could have better contained inflation, albeit at the cost of a more pronounced slowdown in economic activity, but without pushing the economy into recession (see Figure below).

Keywords: Monetary Policy, Real Exchange Rate Dynamics, Two-Country DSGE Model, Bayesian Estimation, Counterfactual Exercises.

Codes JEL : E32, E52.