- Home

- Publications and statistics

- Publications

- Reform of the SRI label: what is the imp...

Reform of the SRI label: what is the impact on the carbon footprint of labelled funds?

Post No. 434. The environmental requirements of the SRI label were tightened in 2024. Following this reform, SRI funds redirected their investments towards less carbon-intensive securities. This contributed to reducing their footprint more rapidly than other funds, although other factors may also have played a role. However, this impact is necessarily limited by the fact that the SRI label takes into account other non-financial criteria in addition to the carbon footprint alone.

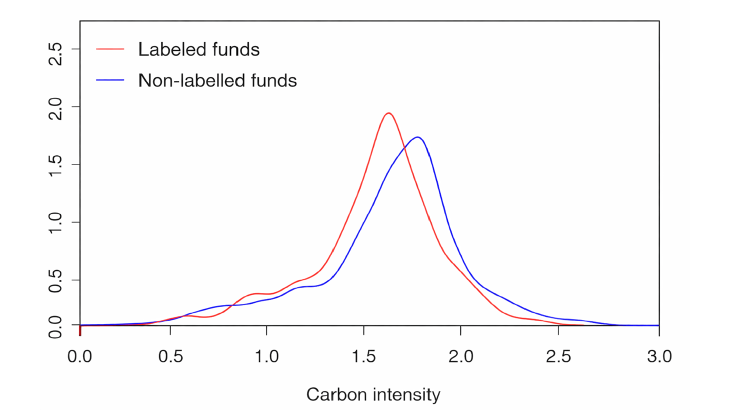

Chart 1 – Carbon footprint of fund portfolios at the beginning of 2025 (in tCO2eq/M€)

Notes: The carbon footprint of a portfolio is calculated based on both the carbon footprint of each security and its weight in the portfolio in terms of market value. Thus, in dynamic terms, the total footprint may vary not only according to companies' carbon emissions, but also according to changes in their stock prices, which alter their weight in the aggregate.

Created in France in 2016, the SRI (Socially Responsible Investment) label has been undeniably successful in recent years judging by the amount of assets under management by labelled funds (31% of all French funds in terms of net assets at the end of 2023 prior to the reform). In order to improve its clarity (see report by the General Inspectorate of Finance, 2020), new specifications, published in December 2023 and effective since March 2024, have strengthened its environmental criteria. These new requirements came into force on 1 March 2024 for funds applying for the label, while those already labelled benefited from a transition period until 1 January 2025. They have resulted in a decline in the number of labelled funds (from 31% at the end of 2023 to 21% of all French funds at the beginning of 2025).

In this post, we analyse the impact of the reform of the SRI label on the carbon footprint of French equity funds. While the label covers a number of non-financial criteria, the study focuses exclusively on the climate aspect. We use the weighted average carbon intensity indicator, which measures the amount of CO2 (in tonnes of equivalent) generated per million euro of revenue of the companies financed. A previous post had already established that the carbon footprint of labelled funds was lower than that of non-labelled funds, but this difference reflected a “generally responsible” policy rather than true “environmental excellence.” Following the implementation of the reform in early 2025 by all players, including existing funds, we find that this gap has hardly changed. Although the new rules strengthen the environmental dimension, the impact on the overall carbon footprint of portfolios remains moderate. Analysing the underlying factors, which we will detail, shows that the initial finding of a “modest” environmental benefit still holds true.

Carbon footprint of SRI funds after the reform

Although the gap between SRI labelled funds and non-labelled funds in terms of average carbon footprint is widening, the distributions of the two populations still overlap significantly:

- At the beginning of 2025, SRI funds had a carbon footprint of 44.9 tCO2eq/M€ (Chart 1, item 2, i.e. the 4th bar), compared with 57.4 tCO2eq/M€ for non-SRI funds (Chart 1, item 1, i.e. the 1st bar), a difference of 22%, which is a slight improvement compared with 2023 (19%). In addition, funds that lost their label following the reform (35% of the funds in our population) also had an average carbon footprint of 50.1 tCO2eq/M€ (see Chart 1 item 1b), which was higher than SRI funds that retained or acquired their label (44.9 tCO2eq/M€ at the beginning of 2025).

- On the other hand, a saver who would have to choose “at random” between a labelled fund and a non-labelled fund would still have a significant probability (41%) of finding that the non-SRI fund is “greener” in terms of carbon footprint than the SRI fund (Chart 2). This probability is nevertheless down from our previous study (47%).

Chart 2 – Distribution of average carbon footprints of portfolios in 2025

Note: Carbon intensity levels are shown on the x-axis on a decimal logarithmic scale (base 10). Equity portfolio of French equity funds (scope 1, as a percentage of the portfolio).

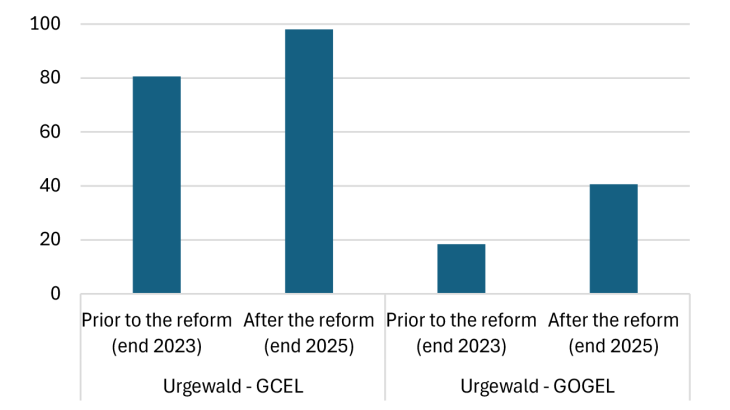

Thanks to new exclusion criteria for the coal and non-conventional energy industries, the reform of the SRI label has reduced the exposure of labelled funds to fossil fuel companies. For oil and gas, the reform has doubled the exposure rate differential between the two categories: SRI funds now have an exposure rate that is 40% lower than non-labelled funds, compared with only 20% at the end of 2023 (see Chart 3, right-hand side). As regards coal, exclusion has become almost total: while SRI funds already had an exposure rate 80% lower than conventional funds prior to the reform, this gap has now reached nearly 100% (Chart 3, left-hand side).

Chart 3 –Total investment of SRI funds by category of fossil fuel companies (as a percentage of non-SRI fund investment)

Note: Before the reform, the exposure rate of SRI-labelled funds to coal-related companies was 80% lower than that of non-labelled funds, and nearly 100% lower after the reform, which means that these securities have been almost entirely absent from SRI funds since that date.

A shift in SRI fund investments leading to a reduction in their carbon footprint

The reform of the SRI label has altered the carbon footprint of the consolidated portfolio of labelled funds through various channels. On the one hand, it encourages SRI funds to increase their investments in companies with a low carbon footprint (flows). This “flow” effect can be broken down into two sub-effects: the first is linked to the dynamics of subscriptions and redemptions by investors who hold the fund's capital (“extensive margin,” linked to investor demand for a given fund, Chart 4), and the second is linked to the manager's active allocation decisions regardless of the level of inflows (“intensive margin,” linked to how a fund allocates its available capital). On the other hand, the label reform results in excluding funds with a higher carbon footprint from the SRI population, thereby improving the average profile for the remaining population (“scope effect,” Chart 4).

In addition to these dynamics, other factors unrelated to the label reform (“passive effects” Chart 4) influence the carbon footprint of funds. These include, for example, stock market fluctuations, which, when calculating the carbon footprint of a fund's portfolio, alter the weighting of each company as it is measured in market value. Or changes in the CO2 emissions of the companies themselves, which impact the overall footprint.

In order to break down these flow effects (intensive and extensive margins), scope effects, and other “passive” effects, we use “counterfactual” scenarios, in which we compare the carbon footprint of portfolios at the end of 2023 with what it would be if one or other of these factors were isolated. This comparison enables us to better understand the origin of variations in the carbon footprint and to analyse the specific impact of the SRI label reform.

Chart 4 – Breakdown of the change in the carbon footprint of SRI funds between the end of 2023 and the beginning of 2025 (before/after label reform) in tCO2eq/M€

According to this analysis, based on a variation in the carbon footprint of SRI funds of -6 tCO2eq/M€ (i.e., -12%) between the end of 2023 and the beginning of 2025, the scope effect (linked to the exit of certain funds from the labelled population) appears modest, standing at approximately -0.6 tCO2eq/M€. In fact, the funds that retained their label following the reform were not ex ante significantly greener than those that lost it in terms of carbon footprint. However, the managers of these funds seem to have deliberately shifted a more significant share of their investments towards securities with a lower carbon footprint: this is suggested by the effect of the intensive margin of flows, at -2.9 tCO2eq/M€. Conversely, the effect of the extensive margin of flows worked against reducing the footprint, albeit marginally (approximately +0.3 tCO2eq/M€). Other passive effects also contributed significantly to reducing the carbon footprint (-2.9 tCO2eq/M€).

While this result is positive from the perspective of the environmental nature of the SRI label, the same analysis conducted on the funds that lost their SRI label following the reform nevertheless raises questions. Although the carbon footprint of these funds decreased by 3% between the end of 2023 and the beginning of 2025, this decline was primarily due to “passive” effects. Conversely, managers' investment decisions – as measured by the contribution of the intensive margin – went against this trend, raising the carbon footprint by +1.7 tCO2eq/M€ (i.e., +3.3% compared to the end of 2023). This suggests that giving up the SRI label enabled those funds that abandoned it to increase their investments in securities with a higher carbon footprint.

The net effect of the reform, taking into account both the greening of labelled funds’ investments and the less green orientation of funds that are no longer subject to the label's constraints, is nevertheless positive. At the beginning of 2025, this will result in a reduction of around -0.8 tCO2/M€, or -1.5%, in the carbon footprint of all funds affected by the reform. However, in the longer term, the outcome of the reform will depend on the investment choices made by subscribers.

***

The reform of the SRI label has improved how environmental issues are taken into account. In particular, it has contributed to reducing exposure to fossil fuels. However, the label remains broad in scope (it is based on an overall assessment of ESG criteria, including governance and social aspects), which has created heterogeneity among labelled funds, where very green portfolios coexist alongside others that are little different from traditional funds. This situation can give rise to a lack of clarity for savers concerned about the climate impact of their investments. To remedy this, the Forum pour l’investissement responsable is proposing a multi-level label. This unique, scaled benchmark would clearly indicate the environmental requirements of each fund. Investors can also turn to specialised labels such as Greenfin for the environment or Finansol for social responsibility aspects.

Download the full publication

Updated on the 13th of February 2026