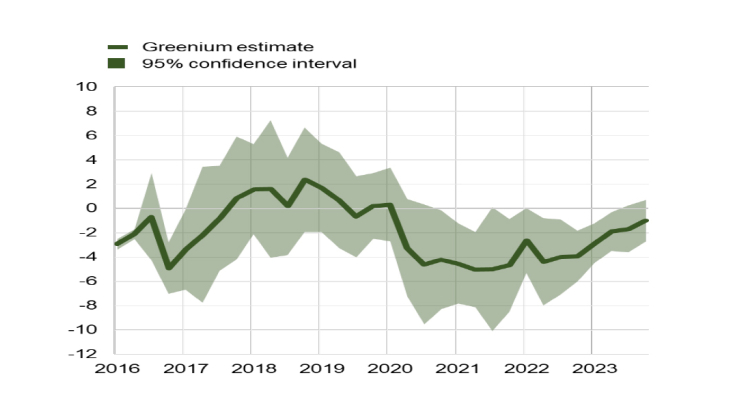

Working Paper Series no. 1010. The green bond market has experienced rapid growth in recent years, driven by increasing global awareness of climate change. However, the existence, magnitude and driving forces behind the “greenium” in the secondary market - a price premium associated with green bonds - remain subject to debate. This study investigates the evolution of the greenium in the euro area from 2016 to 2023, encompassing a period of significant macroeconomic shifts, including the COVID-19 pandemic, energy crisis, and the subsequent period of heightened inflation and monetary tightening. Our analysis applies a k-prototypes matching algorithm to construct a closely matched panel of European green and conventional bonds and documents a novel finding that retail investors' demand for green bonds partly drives the greenium. Sensitivity of retail investors' financial conditions to the macroeconomic situation and particularly tighter monetary policy may explain investors' appetite for green bonds and thus the greenium time dynamics. Finally, we confirm investors' preferences for green bonds with higher credibility of both bonds and bond issuers.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche