- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Septe...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders who take part in our monthly survey (approximately 8,500 companies and establishments questioned between 27 August and 3 September), activity continued to grow in August.

There were contrasting performances in industrial production, but it continued to rise overall, driven by aeronautics and equipment goods. In market services, activity rose moderately, especially in services linked to the summer holidays (accommodation and food services, etc.) compared with August in previous years. Construction activity grew more than anticipated by business leaders in the previous month’s survey.

With the end of August marked by announcements of a vote of confidence and possible days of industrial action, business leaders highlighted a sharp rise in uncertainty, particularly in construction which is highly sensitive to public policy.

Their expectations for September reflect a greater degree of caution, but activity is not expected to contract and is even seen improving in market services.

In August, selling prices were deemed stable in all sectors due to competition in domestic and international markets. Most industrial sectors were affected by the rise in US trade tariffs, but there was no significant deterioration over the month. Winemaking remained the worst-affected sector, but fewer and fewer firms say they are feeling any indirect effects, especially in market services. Supply difficulties eased, particularly in aeronautics, while recruitment difficulties remained stable, affecting 19% of firms.

Based on the survey results as well as other indicators, we estimate that activity will continue to grow at a similar pace to the previous quarter, rising by around 0.3% in the third quarter.

1. In August, activity rose overall despite contrasting trends across sectors

In August, industrial production rose at a fairly sustained pace, in line with expectations the previous month. The positive performance mainly reflects a marked pick-up in equipment goods and robust activity in aeronautics and pharmaceuticals. In all three of these sectors, business leaders pointed to resilient external demand and a positive impact from the reorganisation of trade flows. However, certain sectors reported a decline in activity, notably the automotive sector, rubber and plastic products and textiles. Overall, despite contrasting performances, industrial production remains on a positive trend.

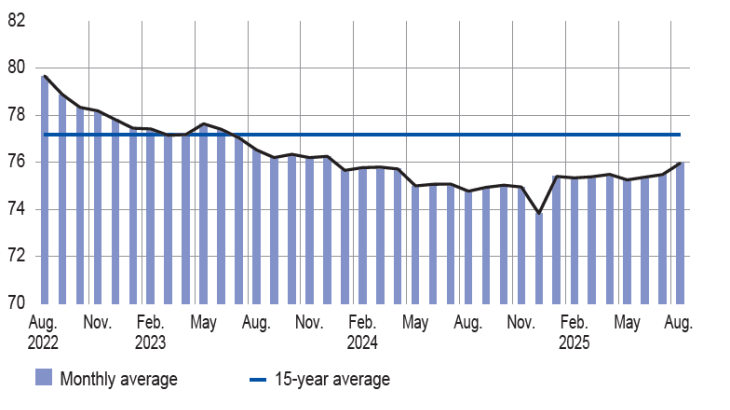

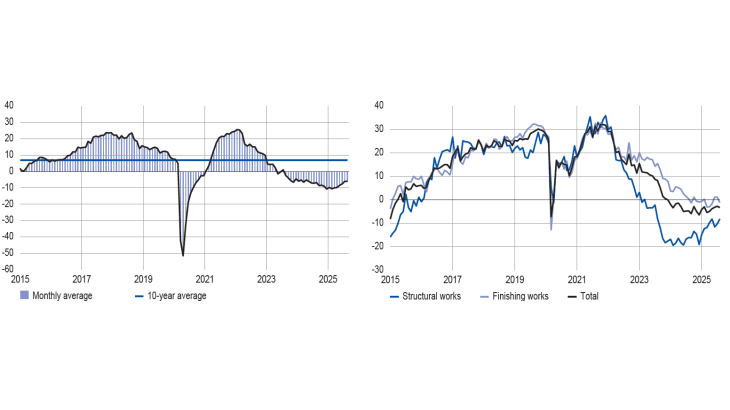

Capacity utilisation rate

The capacity utilisation rate (CUR) for the overall industrial sector rose slightly in August, to 76.0% from 75.5% in July. The increase confirms the acceleration in monthly production in equipment goods, aeronautics and pharmaceuticals. However, the CUR contracted slightly in those sectors reporting lower production for August, such as the automotive sector and textiles.

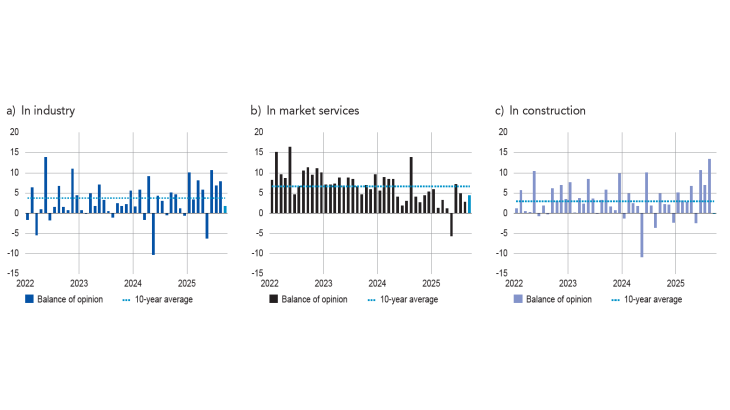

Balance of opinion on the outlook for activity

fall over the past month) stood at +8 percentage points for August in industry. For September (light blue bar), business leaders in industry expect activity to increase by 1.7 percentage points

compared with August. In construction, entrepreneurs do not expect any further rise in activity.

Inventories of finished goods remained high and well above normal, with aeronautics reporting particularly marked growth. The simultaneous rise in both production and inventories in aeronautics mainly reflects the complexity of production chains and the lags between manufacture and deliveries..

In market services, activity grew moderately, in line with expectations. However, performances vary markedly across sectors, despite the overall rise. Some sectors are proving more dynamic, such as business services, publishing, and the repair and renting of motor vehicles, while others saw a contraction in August, including computer services, advertising and temporary work. In accommodation and food services in particular, activity grew more slowly than in July, and more slowly than in August last year when the Olympic Games provided a boost. The slowdown reflects a moderation of demand which had already been partially anticipated by business leaders in the sector.

In construction, despite summer building site stoppages, activity continued to rise in August, and at a faster pace than expected by business leaders last month, both in structural and finishing works. The rise was fuelled by a slight pick-up in the construction of single-family homes, as well as by the installation of solar panels and work linked to climate installations.

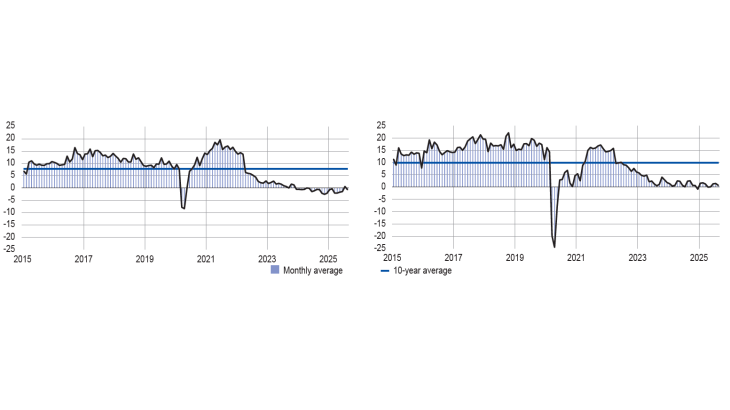

Inventories of finished goods in industry

In August, balances of opinion on cash positions remained broadly stable. In industry, cash levels continued to improve in some sectors (computer and electronic products, chemicals, pharmaceuticals, aeronautics), but deteriorated in textiles, wearing apparel and agri-food. In certain sectors, cash positions have been deteriorating for several months: wood, paper and printing, automotive sector, rubber and plastic products.

In general, business leaders deem their cash positions to be “normal”, albeit well below pre-Covid-19 levels.

Cash position

They may have raised the cash position they deem satisfactory for carrying out their activities, as highlighted in a recent study by Banque de France economists 1.

In market services, as expected, cash positions deteriorated in accommodation and food services, reflecting the weak month of August. However, they remain close to normal levels. They are deemed very satisfactory in vehicle renting, management consultancy and publishing. However, they deteriorated in August in advertising, computer and consultancy services and vehicle repair.

2. Expectations are mixed, reflecting increased uncertainty

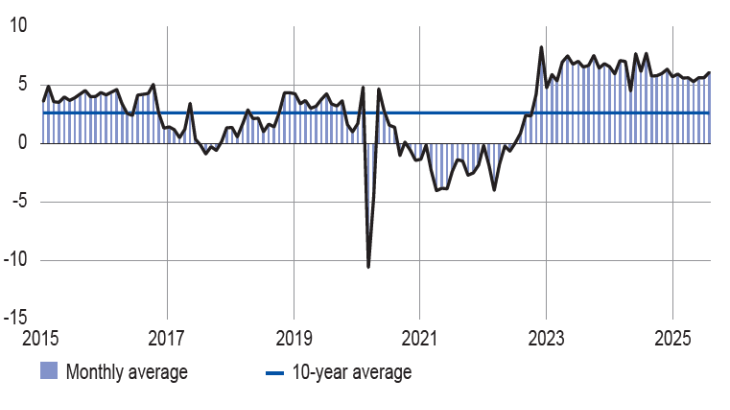

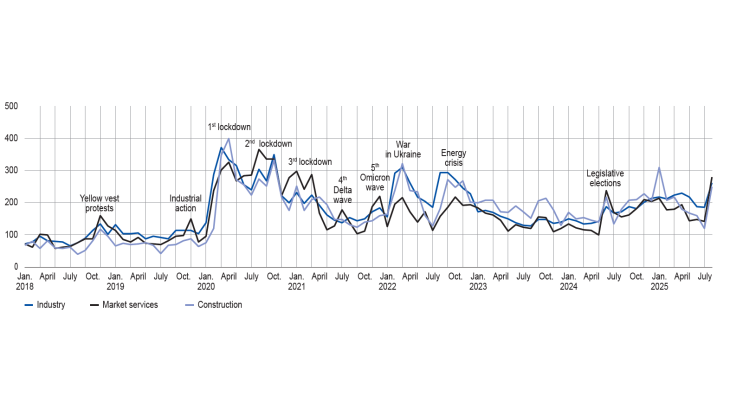

Business leaders’ expectations for September are marked by strong uncertainty about the domestic situation. The survey was conducted during a busy news cycle (announcement by the Prime Minister on 25 August that he would seek a vote of confidence on 8 September, and calls for nationwide protests in September), and this may have increased risk perceptions and explain the sharp rise in our monthly uncertainty indicator – similar in scale to that observed during the last parliamentary elections.

As a result, expectations for September show contrasting trends. In industry, business leaders anticipate a marked slowdown in production growth compared with August, although they still expect it to rise slightly overall. The slowdown is expected to be felt in most industrial sectors, with some notable exceptions. Agri-food and transportation (both the aeronautics and automotive sectors) even expect a pick-up after August, which is generally a slower month for production. In equipment goods, production is seen falling very slightly in September.

In market services, business leaders are more optimistic about future activity and expect September to be better than August. In rental, accommodation, research and publishing services, business leaders anticipate an acceleration in activity in September. Conversely, food and beverage services, as well as certain business services (management consultancy and advertising) are predicting a possible contraction.

In construction, as in industry, entrepreneurs expect activity to slow and even decline in September, notably in structural works.

Regarding order books, the picture is mixed in industry. At the end of August, they were deemed to have scarcely improved compared with July, after remaining weak since the start of the year. They are essentially being supported by the aeronautics sector, where orders are continuing to rise. Meanwhile, all other industrial sectors have seen orders decline since the start of the year, with the biggest falls observed in rubber and plastic products, chemicals, textiles and the automotive sector. However, in August, pharmaceuticals, wood, paper and printing, and equipment goods in general all reported a slight improvement in orders.

In construction, order books declined again in August, with the fall attributable mainly to finishing works.

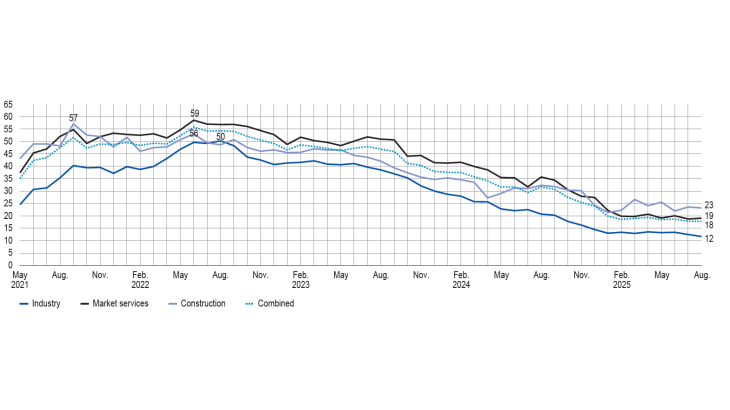

Level of order books

Indicator of uncertainty in the comments section of the monthly business survey (MBS)

(unadjusted data)

3. Finished goods prices were stable in August

In August, supply difficulties eased and were cited by just 7% of firms – the lowest percentage since the Covid-19 crisis. The improvement was particularly noticeable in the aeronautics sector, where constraints had remained very high in previous months. In August, only 7% of aeronautics firms cited supply difficulties, down from 23% in July. However, there are still some supply pressures in the manufacture of machinery and equipment, with 9% of firms saying they were affected. In construction, supply difficulties remain rare (3.4%) but increased very slightly in August.

In industry, raw materials prices remained stable over the month, with business leaders reporting no significant rise. However, the moderation at aggregate level masks contrasting developments across sectors: in August, input costs tended to rise in agri-food and other industrial goods, whereas the chemicals and wood, paper and printing sectors indicated a fall.

Change in selling prices by major sector

The balance of opinion on the selling prices of finished goods 2 was close to zero and very slightly better than in July. The improvement stems mainly from the agri-food industry, which partially passed through higher input costs, as well as from the electrical equipment sector. Finished goods prices continued to fall in wood, paper and printing, reflecting declines in the price of cellulose and paper pulp. The pharmaceuticals sector also reported a sharp drop in finished goods prices in August.

More specifically, only 3% of industry business leaders said they had raised their selling prices in August, which is the lowest proportion since the Covid-19. The rises were mainly in agri-food, where 8% of business leaders signalled a hike, and in the manufacture of electrical and electronic products. In parallel, 2% of industrial firms said they had lowered their selling prices.

In construction, the balance of opinion on price developments remained very close to zero in August, with a fall in quote prices in finishing works offsetting a slight price rise in structural works. This price stability in construction was also reflected in the low share of entrepreneurs saying they had changed their prices: only 1.3% said they had raised their prices and fewer than 5% said they had lowered them. These are the lowest shares since the Covid-19 crisis. Construction entrepreneurs reported strong downward pressure on quote prices.

In market services, the balance of opinion remained stable at close to zero. As in the rest of the survey, the proportion of firms saying they had raised their prices was historically low in August, at just 3%, while 4% reported having lowered prices.

Share of businesses reporting recruitment difficulties

Finally, in August, 19% of business leaders reported recruitment difficulties, a rise of 1 percentage point compared with July. The modest increase was essentially driven by services, where staffing requirements were higher in August, especially in rental services. In industry, staffing levels (including temporary workers) were deemed stable in August. In general, many business leaders, notably in industry, said they were not intending to replace departing staff.

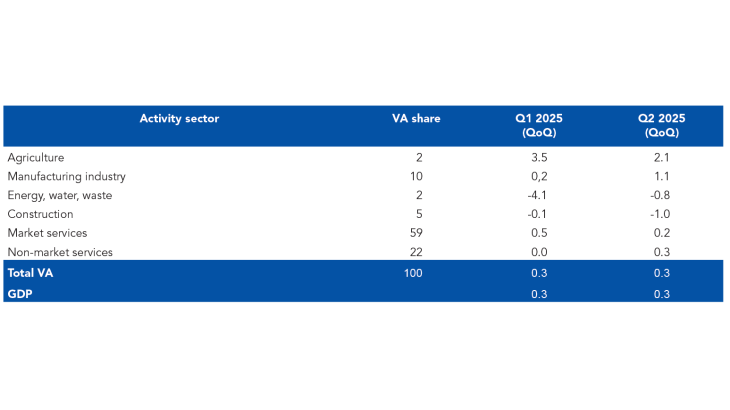

4. Our estimates suggest GDP will rise by around 0.3% in the third quarter

The detailed results of the quarterly accounts published by INSEE at the end of August confirmed that GDP grew by 0.3% in the second quarter of 2025. Activity was mainly buoyed by strong value added in market services, notably in accommodation and food services, financial services and business services. Activity slowed in the manufacturing industry and contracted again in energy. In construction, value added was down slightly.

Based on the results of the Banque de France Monthly Business Survey (MBS), supplemented by other available data (INSEE production indices and surveys and high-frequency data), we estimate that GDP should increase by around 0.3% in the third quarter. As suggested by the MBS, value added should be buoyed by the manufacturing industry. Value added is also expected to rise in market and non-market services, but should fall in construction and energy.

Quarterly changes in GDP and value added in France

Note: QoQ = quarterly change.

1See Eco Notepad blog post No. 375, “Companies’ cash position: understanding the gap between aggregated data and perceptions”, November 2024.

2The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

Download the full publication

Updated on the 30th of September 2025