- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Octob...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (around 8,500 companies or establishments questioned between 26 September and 3 October, before the resignation of the Prime Minister on 6 October), activity continued to grow in September in market services and more moderately in industry, while it fell in construction after several months of growth. In October, business leaders in industry expect activity to change little in the three sectors. Order books continue to be deemed weak in industry and construction.

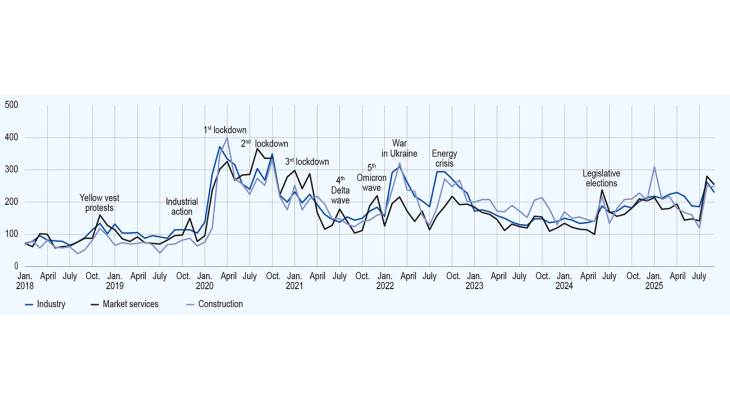

Our monthly uncertainty indicator, which is based on a textual analysis of comments by surveyed companies, remains high in all three sectors. Business leaders pointed to the domestic political climate and trade tensions. The impact of higher US tariffs on activity are the main factors mentioned in the agri-food and machinery and equipment sectors.

Selling prices were generally deemed to be stable in industry and market services and declining in construction. In these three major sectors, the share of businesses that decreased their selling prices over the month was greater than in previous months of September, except those during the Covid period. Supply difficulties remained generally low but rose very slightly in the electrical equipment, and computer, electronic and optical product sectors, while they remained high in aeronautics. Recruitment difficulties affected 17% of companies, one percentage point down on the previous month.

Based on the survey results, supplemented by other indicators, we expect activity to continue to grow in the third quarter at the same pace as in the previous quarter, i.e. by around 0.3%.

1. In September, activity picked up in industry and more markedly in market services, while it fell in construction

In September, industrial activity grew at a more moderate pace than in previous months, in line with business leaders’ expectations in last month’s survey. This growth was apparent in transport equipment, capital goods and agri-food, while other industrial sectors witnessed little change. More specifically, the agri-food sector benefited from a catch-up effect in the meat and dairy products segment. Activity also strengthened in aeronautics and other industrial products, remained buoyant in computer, electronic and optical products (deliveries for the aeronautics and defence sectors) and recovered in the automotive sector after a longer holiday period in August than in previous years. Conversely, it slowed down in the electrical equipment (supply chain problems) and pharmaceuticals segments.

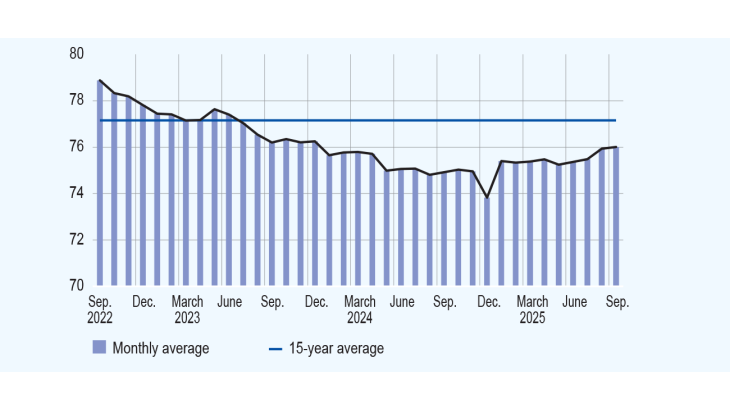

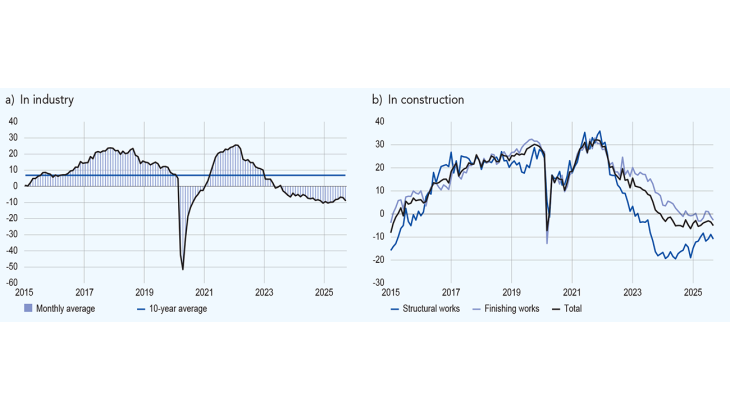

Capacity utilisation rate

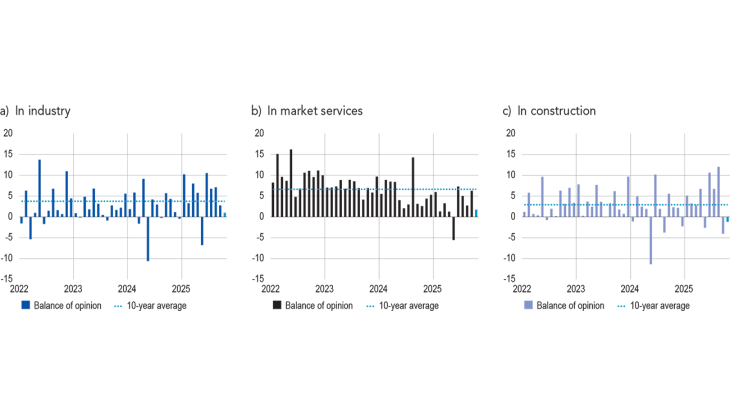

Balance of opinion on the outlook for activity

(balance of opinion, adjusted for seasonal and working-day variations; forecast for October)

over the past month) stood at 3 percentage points for September in industry. For October (light blue bar), business leaders in industry expect activity to increase by 1 percentage point.

The capacity utilisation rate for industry as a whole remained unchanged at 76%, well below its long-term average (77.2%). It increased in computer, electronic and optical products, and in rubber and plastic products (up 4 percentage points), as well as in wearing apparel-textiles-footwear (up 3 percentage points). At the same time, it contracted in chemicals (down 2 percentage points) and pharmaceuticals (down 1 percentage point).

Inventories of finished goods were deemed stable when compared with August. The declines notably reported in

aeronautics, wood-paper-printing, rubber and plastic products, and computer, electronic and optical products, were offset by increases in clothing, textiles and footwear, chemicals and- automotive products. Nevertheless, in most sectors, the balance of opinion on the level of inventories remains well above its long-term average.

In market services, activity generally grew at a faster pace than in August, and by slightly more than had been

expected by business leaders last month. However, this masks considerable disparities between sub-sectors. For example, activity strengthened in transport and storage, accommodation (high tourist numbers, particularly foreign customers in luxury hotels), engineering (driven by the defence and aeronautics sectors) and motor vehicle rental. It picked up in recreation and personal services, programming and consultancy, and to a lesser extent in temporary employment, while it remained strong in cleaning services. Conversely, it declined in vehicle repairs, advertising and management consultancy. In the two latter sectors, business leaders reported that customers are postponing projects due to the domestic political situation.

Inventories of finished goods in industry

In construction, after several months of marked growth, activity in September contracted more sharply than forecast by business leaders, hampered by the decline in the finishing works sector. Activity continued to expand in the structural works sector in the construction of industrial buildings (for clients involved in data centres, energy and defence).

The balance of opinion on cash positions turned very slightly negative in industry. It continued to decline in electricalequipment, machinery and equipment, and computer, electronic and optical products, whereas it rose significantly in pharmaceuticals and more slightly in rubber and plastic products. This balance of opinion remains below its long-term average in all industrial sectors. It is particularly low in electrical equipment, machinery and equipment, agri-food and wood-paper-printing.

Cash position

Business leaders identified longer payment times by customers as the main factor affecting their cash position.

In market services, the balance of opinion on cash positions remained very slightly positive, albeit with significant variability across sub-sectors. The cash position was deemed very satisfactory in motor vehicle rentals and publishing, and satisfactory in temporary employment. However, it was considered weak in programming and consultancy, food and beverage services and management consultancy.

2. In October, business leaders expect activity to change little amidst continuing high levels of uncertainty

In October, business leaders in industry expect activity to remain stable compared with September, with contrasting trends- between sub-sectors. It is expected to recover in particular in electrical equipment, but to decline in the automotive sector (especially among equipment manufacturers), and to slow down in the computer, electronic and optical products, aeronautics and other industrial products sectors.

In market services, activity in October is expected to expand slightly, with considerable disparities between sub-sectors. It is expected to continue to grow significantly in publishing, motor vehicle rental, accommodation and engineering. In contrast, little change is expected in the recreation and personal services, food and beverage services and temporary work sectors, and the decline in advertising is expected to continue.

In construction, activity is expected to contract in structural works and to remain stable in finishing works.

At the end of September, order books continued to be deemed weak in industry, well below their long-term average in all sectors except aeronautics, where they remain high. They are particularly low in wearing apparel-textiles-footwear, rubber and plastic products, chemicals and automotive products.

Business leaders reported a general wait-and-see mindset among customers.

In construction, the level of order books was deemed to have deteriorated slightly in both the structural works and finishing works sectors. Business leaders highlighted sluggish demand in both the private and public sector (notably with the start of the pre-election period, which reduces the number of calls for tenders).

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the respondent companies, remains high. The previous survey was conducted shortly after the announcement of the vote of confidence and the days of industrial action. This month, business leaders were surveyed after the appointment of a new Prime Minister, but before his resignation on 6 October. The factors of uncertainty most frequently cited were the domestic political climate and trade tensions. The impact of higher US tariffs on activity were the

main factors mentioned in the agri-food and machinery and equipment sectors.

Level of order books

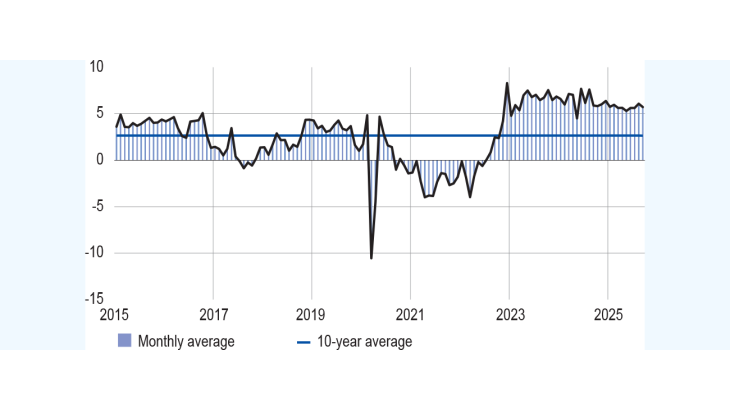

Indicator of uncertainty in the comments section of the monthly business survey (MBS)

(unadjusted data)

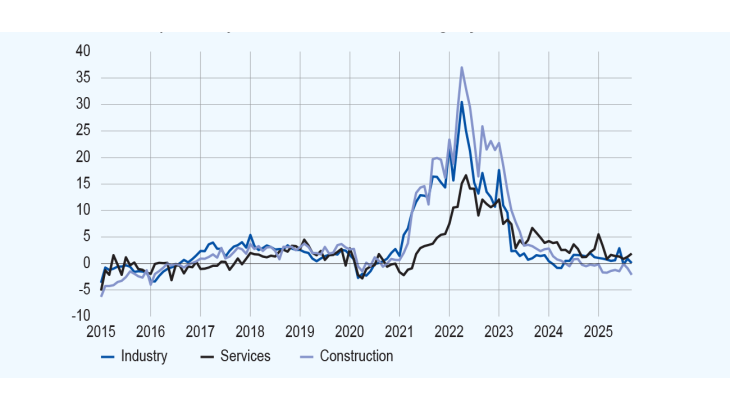

3. Selling prices were generally deemed to be stable in industry and market services, and declining in construction.

In September, 8% of businesses reported supply difficulties (compared with 7% at the end of August). These difficulties remained relatively high in aeronautics (20%) and increased slightly in electrical equipment (13%) and in computer, electronic and optical products (12%). Supply difficulties continued to be rare in the construction sector (3%).

In industry, business leaders reported raw materials prices to be stable. The positive balances reported in electrical equipment and other industrial products were offset by negative balances in wood-paper-printing (fall in the price of paper pulp and wood due to weak demand relative to supply) and chemicals. The balance of opinion on finished goods prices1 declined when compared to August, and returned to around zero. Apart

from pharmaceuticals, it is stable or down in all sub-sectors, and more markedly in chemicals, where Chinese competition and the lower dollar exchange rate are driving prices down.

Change in selling prices by major sector

More specifically, 6% of business leaders in industry reported that they had raised their selling prices this month, which is less than in September in previous years, including during the pre-Covid period. Price increases mainly concern the agri-food sector (7%), computer, electronic and optical products, and wood-paper-printing (5%). Conversely, 6% of business leaders in industry reported cutting their selling prices, a higher percentage than in September of the pre-Covid period. Falls in finished goods prices were mainly concentrated in chemicals (17%), wood-paper-printing (11%) and agri-food (10%).

In construction, the balance of opinion on price movements turned negative again in September in both structural and finishing works. 3% of business leaders reported increasing their quote prices, which was smaller than the proportion observed in September of previous years. Conversely, 7% of business leaders (9% in September 2024) reported having lowered their prices, a much higher proportion than in the month of September in the pre-Covid period through to 2023.

In market services, the balance of opinion was very slightly positive. The proportion of businesses reporting an increase in their prices was 4%, well below previous Septembers. Price increases were mainly concentrated in the accommodation sector. At the same time, the share of companies reporting a fall in their prices stood at 5%, a higher proportion than in September in previous years.

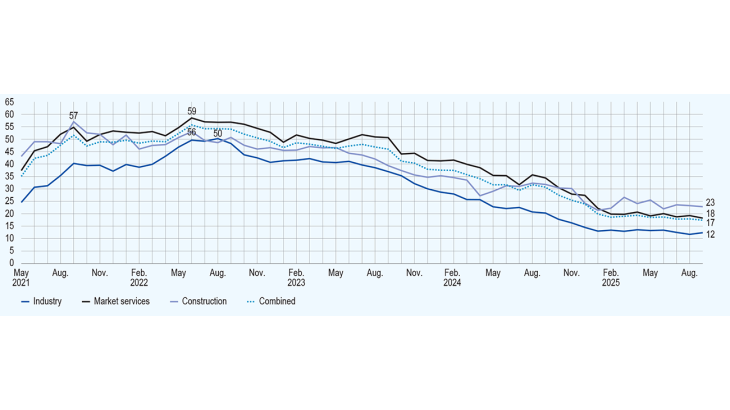

In September of this year, 17% of business leaders reported recruitment difficulties, down one percentage point on August. This percentage remains highest in construction (23%) and lowest in industry (12%). Difficulties in the services sector are close to the overall average. In industry, the workforce (including temporary staff) is deemed to have contracted very slightly.

Share of businesses reporting recruitment difficulties

4. Our estimate for GDP growth in the third quarter remains unchanged at around 0.3%

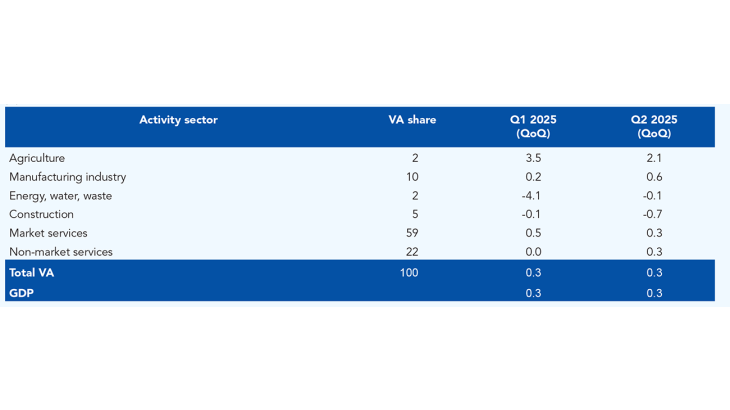

Based on the results of the Banque de France monthly business survey, supplemented by other available data (INSEE production indices and surveys and high-frequency data), we continue to expect GDP to increase in the third quarter by around 0.3%.

This increase should be driven by buoyant value added in the manufacturing industry, as suggested by the monthly business survey for the quarter. Value added should also increase in market and non-market services, but decline in construction and energy.

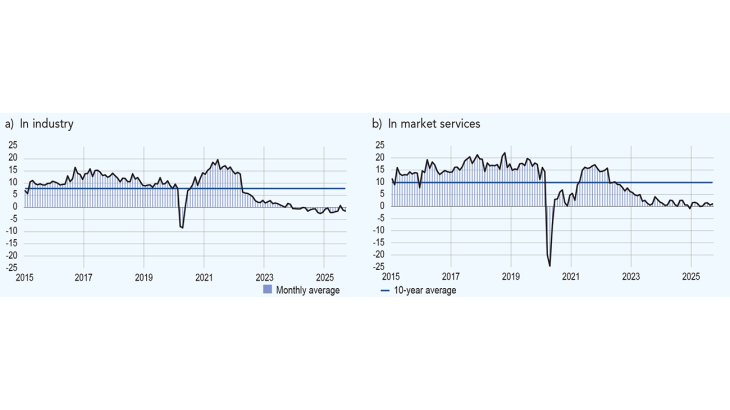

Quarterly changes in GDP and value added in France

(%)

Note: QoQ = quarterly change.

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

Download the full publication

Updated on the 20th of October 2025