- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Febru...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

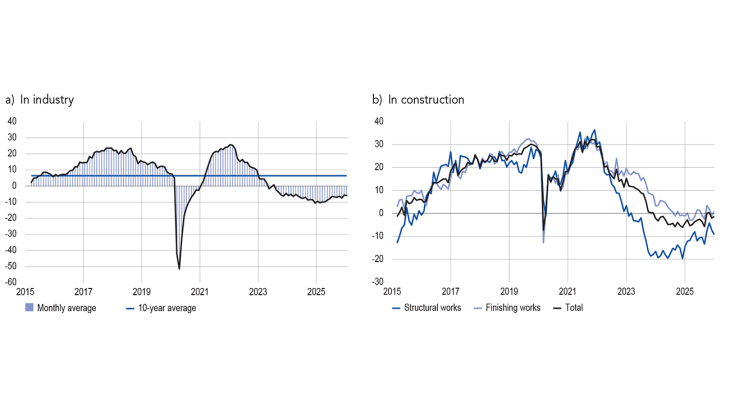

According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 28 January 2024 and 4 February 2026), activity in January strengthened across the three sectors – industry, market services and construction – at a faster pace than business leaders had forecast in December. Industrial activity exceeded the long-term average for the eighth consecutive month, especially for computer, electronic and optical products, machinery and equipment, and other industrial products, where activity is driven by the defence and aerospace sectors.

In February, business leaders expect a sustained increase in industrial activity and a more moderate increase in services and construction.

Our monthly uncertainty indicator continued to decline in services and construction, but remained at a high level. It even rose very slightly in industry, in line with the uncertain international climate and persistent geopolitical and trade tensions.

The cash position was deemed to be slightly below normal in industry, but improved in services, albeit with significant variations between sectors. Supply difficulties in industry, which were generally stable, became somewhat more pronounced in aeronautics and computer, electronic and optical products. Selling prices rose moderately across the three main sectors.

Recruitment difficulties increased, affecting 17% of businesses overall and 23% of companies in the construction sector.

Based on the survey results as well as other indicators, we estimate that GDP in the first quarter of 2026 should increase slightly by between 0.2% and 0.3%. Naturally, this estimate, calculated at the end of the first month of the quarter, remains highly provisional.

1. In January, activity strengthened across all three sectors – industry, services and construction

In January, industrial production strengthened, growing at a faster rate than forecast by business leaders and remaining above the long-term average for the eighth consecutive month. The overall momentum was mainly driven by capital goods and other industrial sectors. In particular, computer, electronic and optical products, machinery and equipment, and other industrial products benefited from sales to the defence and aerospace sectors in both France and abroad. While metal and metal products rebounded, aeronautics and agri-food continued to grow, but at a slower pace than in December. The automotive sector registered little change, while pharmaceuticals and non-metallic mineral products (rubber, plastic and glass) declined. At the same time, the leather and footwear segment penalised the apparel, textiles and footwear sector, against a backdrop of sluggish European and Chinese markets.

The capacity utilisation rate (%)

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations, forecast for February)

The capacity utilisation rate (CUR) stood at 76.6%, still slightly below its long-term average (77.1%). It increased in wood, paper and printing, the automotive industry and metal and metal products manufacturing (up 1 percentage point), but declined in electrical equipment (down 2 percentage points).

According to business leaders, inventories of finished products were deemed to be high in most sectors and continued to rise very slightly. When compared with December, however, they declined in the pharmaceutical, metal and metal products and electrical equipment sectors.

In market services, activity picked up in January, slightly exceeding the previous month’s expectations. All subsectors grew, apart from accommodation, which faltered after a very robust performance in December. The increase was driven in particular by publishing and business services (programmingconsulting, information services, engineering, legal and accounting activities) and food services. The temporary work sector benefited from higher demand across several sectors, namely aeronautics, agri-food, construction and the automotive industry.

In construction, activity in January grew at a much higher rate than forecast in the previous month. It rebounded in structural works, due to a catch-up effect after a month of December marked by more closures than in the previous year. It strengthened in the finishing works sector, underpinned by renovation work (electrical installations, heating), insulation and roof waterproofing, following the bad weather of early January.

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working-day variations)

Cash position (balance of opinion, adjusted for seasonal and working-day variations)

At end-December, the balance of opinion on cash positions remained very slightly negative in industry, with significant variations between sectors. The cash position was deemed to have improved in apparel, textiles and footwear, machinery and equipment, non-metallic mineral products (rubber, plastic and glass) and chemicals. Conversely, it was deemed to have deteriorated in electrical equipment, other industrial products and, to a lesser extent, in wood, paper and printing. Business leaders reported difficulties in passing on raw material price increases.

In market services, the cash position was considered to have improved very slightly when compared with January, but here too there were significant differences between subsectors. It was deemed comfortable in vehicle rental, information services and publishing but remained poor in advertising, food services and vehicle repair, and continued to decline in cleaning.

2. In February, activity is expected to continuento grow markedly in industry, but more moderately in services and construction

Business leaders expect industrial production to remain strong in February, particularly in computer, electronic and optical products, and to strengthen in electrical equipment and aeronautics. It is expected to pick up in the automotive sector after a month of January that was deemed weak. It should remain stable in non-metallic mineral products, machinery and equipment, and metal and metal products.

Activity in the market services sector should continue to grow, albeit at a more moderate pace than in January. The increase is expected to benefit the vast majority of services. Publishing, legal and accounting activities, engineering and cleaning are expected to continue to grow in line with January’s trend, while vehicle repairs and programming-consulting are expected to slow down.

In construction, contractors forecast a significant slowdown in activity, with a slight decline in structural works following January’s catch-up. Finishing works are expected to continue to perform well, still underpinned by renovation work.

At the end of January, order books were still deemed to be weak in most sectors except aeronautics, where they were bolstered by defence and aerospace contracts, including international contracts. They were considered especially low in chemicals, apparel, textiles and footwear, agri-food, pharmaceuticals and non-metallic mineral products. In construction, order books recovered in finishing works, but continued to decline in structural works. Business leaders highlight the shortage of public orders and the still very weak upturn in the single-family home segment.

The uncertainty indicator, based on a textual analysis of company comments, remained relatively high across all three sectors. It continued to ease in services and construction with the end of the parliamentary budget voting period. However, it rose slightly in industry, which is traditionally more sensitive to the international context and continued to be marked by recurring geopolitical and trade tensions.

Level of order books (balance of opinion, adjusted for seasonal and working-day variations)

Indicator of uncertainty in the comments section of the monthly business survey (unadjusted data)

3. Small increases in selling prices across all sectors

In January, the proportion of manufacturers reporting supply difficulties remained stable at 7%. However, tensions persist in the computer, electronic and optical product sectors and in aeronautics, where 17% of companies experienced problems in their supply chains (memory components).

In industry, business leaders generally noted a slight increase in raw material prices. The metal and metal products, electrical equipment and machinery, and equipment sectors reported increases in the price of steel, copper and precious metals.

The balance of opinion on the selling prices of industrial finished goods rose in January, driven by computer, electronicand optical products and metal and metal products, as well as electrical equipment to a lesser extent.

These manufacturers are able to pass on most of the increase in raw material prices specific to their sector. Conversely, prices continued to fall in the chemical and agri-food sectors. In the agri-food industry, ongoing negotiations with large retailers are expected to result in a further drop in prices.

Change in selling prices by major sector (balance of opinion, adjusted for seasonal and working-day variations)

In total, 17% of manufacturers reported having increasedtheir selling prices in January while 6% lowered them. Price decreases were mainly observed in the chemical, agri-food and wood-paper-printing sectors (18%, 13% and 8% of companies in these sectors, respectively), while increases were most frequent in pharmaceuticals (39%), apparel, textiles and footwear (29%), and computer, electronic and optical products (27%).

In construction, the balance of opinion on price movements turned slightly positive for the first time in a year, underpinned by finishing works. Business leaders are managing to pass on part of their higher costs.

In market services, selling prices are deemed to have risen slightly in almost all subsectors. 18% of business leaders report having increased their prices and only 4% report having lowered them. The increases mainly concerned information services, accommodation and food services, and publishing.

Finally, recruitment difficulties rose slightly in all sectors, affecting 17% of businesses in January. They were mainly concentrated in construction, where 23% of business leaders reported such difficulties.

Share of businesses reporting recruitment difficulties (%, unadjusted data)

4. Our estimates suggest that GDP will grow by around 0.2% to 0.3% in the first quarter

According to the initial results of the quarterly accounts, published by INSEE at the end of January, GDP grew by 0.2% in the fourth quarter of 2025, in line with the forecast in our last monthly business survey published in early January. Activity was mainly buoyed by strong gains in value added in market services (notably in information-communication and business services) and in non-market services and energy. Value added in manufacturing declined slightly, while it remained stable in construction.

Based on the results of our monthly business survey, supplemented by other available data (INSEE industry production indices and surveys and high-frequency data), our models point to a provisional estimate of GDP of around 0.3% in the first quarter of 2026. It is therefore reasonable to consider that current economic momentum is compatible with quarterly growth of between 0.2% and 0.3%. Activity should be sustained by an increase in value added in the manufacturing sector, as suggested by the monthly business survey. Higher value added in market services should be sustained by good momentum in business services, information and communication, and accommodation and food services. Value added is forecast to grow slightly in energy and to decline in construction.

Quarterly changes in gdp and value added in France (%)

Note: QoQ = quarterly change.

Download the full publication

Updated on the 19th of February 2026