- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Decem...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

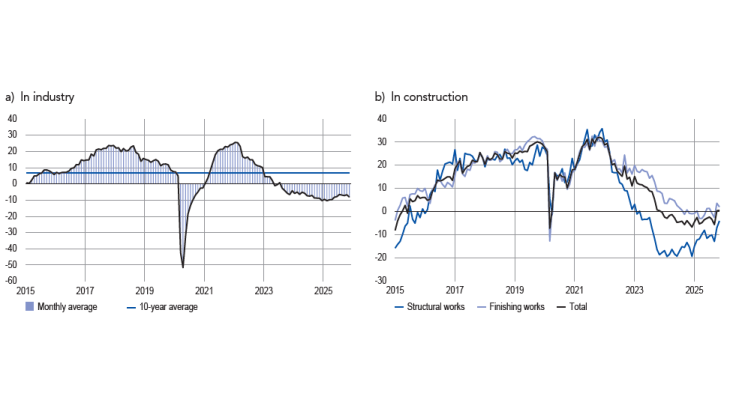

According to the business leaders surveyed (approximately 8,500 companies or establishments questioned between 26 November and 3 December), activity continued to grow in November, with a more marked increase in industry, above its long‑term average for the sixth consecutive month, and more significantly than expected last month. This growth was mainly driven by an acceleration in computer, electronic and optical products, with a rebound in the agri‑food and automotive sectors.

In December, business leaders expect activity to continue to grow in industry albeit at a slower pace, with little change in services and construction. Overall, order books in industry remained weak, but improved in the construction sector.

Corporate cash positions appeared broadly balanced, both in industry and in services.

Our monthly uncertainty indicator, which is based on a textual analysis of comments from the companies surveyed, fell significantly in all three sectors, but remained high, mainly due to the domestic political situation.

Supply difficulties in industry remained modest (8% of companies), except in transport equipment and machinery and equipment. Selling prices were stable in industry, continuing to decline in construction and ticking up in services. Recruitment difficulties, reported by 16% of companies, eased, particularly in the service sector.

Based on the survey results as well as other indicators, we estimate that GDP should increase slightly during the fourth quarter by around 0.2%.

1. In November, activity grew substantially in industry but less so in market services and construction

In November, production in industry production once again grew at a faster pace than business leaders had expected last month. This increase was above the long‑term average for the sixth consecutive month. The agri‑food and transport equipment sectors recovered, while capital goods remained buoyant. More specifically, activity in the computer‑electronics‑optical products sector, underpinned by sales to the defence, aeronautics and nuclear sectors, and other industrial products remained robust. The agri‑food sector rebounded, benefiting from delayed October sales of beverages ahead of the festive season, as well as winter dairy products. The automotive industry recovered with the easing of supply difficulties and the reopening of sites that had been closed in October. In contrast, contrary to expectations last month, production declined in the pharmaceutical sector due to lacklustre sales and remained flat in the wearing apparel/ textiles/footwear sector.

The capacity utilisation rate

The capacity utilisation rate (CUR) for industry as a whole inched up from 76.3% to 76.7% but remained well below its long‑term average (77.1%). It rose in the agri‑food and automotive sectors (up 2 percentage points), but fell in the pharmaceuticals sector (down 1 percentage point).

Inventories of finished goods were seen to be up very slightly. They continued to increase, particularly in the chemicals, electrical equipment, and machinery and Equipment sub‑sectors. At the same time, they declined in transport equipment, albeit from a high level in aeronautics, as well as in the wearing apparel/textiles/footwear sector. They were above the long‑term average for all segments, with the exception of rubber and plastic products and wearing apparel/textiles footwear.

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations, for December: forecast)

Activity in market services grew in line with business leaders’ expectations, i.e. at a slower pace than in October and unevenly across sub‑sectors. For example, it strengthened in the car rental and repair sector (thanks to the fact that vehicles are lasting longer) and remained buoyant in publishing, certain business services (information services, legal and accounting activities) and food services. After sharp growth in October, the temporary work sector grew at a moderate pace. However, the leisure activities, personal services and accommodation sectors lost ground. Advertising continued to decline for the fourth consecutive month, penalised by political and economic uncertainty.

Construction activity continued to grow above its long‑term average in November and remained healthy, particularly in the finishing works sector, driven by renovation and thermal insulation projects. The structural work sector was boosted by the construction of industrial buildings (for clients in data centres, energy and defence sectors) and by sales of single‑family homes, whose recovery appears to be gaining momentum.

Inventories of finished goods in industry

Cash position

At the end of November, the balance of opinion on cash positions remained slightly negative in industry. It deteriorated in the wearing apparel/textiles/footwear, machinery and equipment (due to late payments by public authorities in particular), IT, electronic and optical products, and agri‑food sectors. It also fell in pharmaceuticals, although it remained at a satisfactory level. At the same time, it improved in the electrical equipment sector.

In market services, the balance of opinion on cash positions fell slightly, while remaining positive, varying widely across sub‑sectors. It strengthened in information services and improved in car repairs and rentals. Conversely, it declined in engineering and programming consultancy activities.

2. In December, activity should continue to grow in industry at a fairly sustained pace, with little change in services and construction.

According to business leaders’ expectations, industrial activity is expected to grow again in December, albeit at a more moderate pace than in November. It’s expected to rebound in rubber products and pharmaceuticals, strengthen in machinery and equipment and aeronautics, and remain buoyant in computer, electronic and optical products. However, after picking up again in November, it is expected to decline in the automotive sector, mainly due to longer end‑of‑year holidays than last year.

In market services, activity is expected to show little change overall, although there are expected to be significant differences between sub‑sectors. It is expected to grow again in the accommodation and publishing sectors. With the exception of consulting services, which are expected to decline, business services (information services, legal and accounting activities, engineering) are expected to continue growing at a fairly steady pace. At the same time, temporary work is expected to decline again, and leisure and personal services activities should continue to fall.

In the construction sector, following the rebound in October and November, activity is expected to decline in the structural works segment, with construction sites also closing for the end‑of‑year holidays for longer than last year. It is expected to rise slightly in the finishing works segment.

At the end of November, order books in industry were still considered to be low, against a backdrop of heightened foreign competition and general gloom leading to order postponements. Only the aeronautics and shipbuilding segments have benefited from strong order books over several months or even years.

In construction, order books were considered to be increasingly healthy, particularly in the structural works sector, where the balance of opinion was less negative, thanks in particular to the recovery in the single‑family home market and large‑scale public building renovation contracts.

Our uncertainty indicator, constructed from a textual analysis of company comments, fell significantly to return to the levels observed in July. However, it remained high in all three major sectors, close to the levels seen at the end of last year during the budget debate. Business leaders cited the national situation, mainly the lack of visibility surrounding the 2026 budget vote and the gloomy economic climate.

Level of order books

Indicator of uncertainty in the comments section of the monthly business survey (unadjusted data)

3. Prices rose slightly in services and continued to fall in construction.

In November, only 8% of companies reported supply difficulties, unchanged from October. However, these difficulties remained higher in transport (19%) and in machinery and equipment (11%).

In industry, raw material prices were reported to be rising in several sub‑sectors, particularly in computer, electronic and optical products (due to higher gold prices), electrical equipment, metal and metal products, and wood, paper and printing. However, they were reported to be declining in the pharmaceuticals, chemicals, and wearing apparel/textiles/footwear sectors.

The balance of opinion on industrial finished goods prices1 declined compared to October, and stood at close to zero. Selling prices continued to fall in the chemicals industry and, to a lesser extent, in machinery and equipment, while they maintained an upward trend in aeronautics and pharmaceuticals. In terms of setting sales prices, 6% of companies reported lowering their prices in November, compared with 4% that reported raising them. These declines were mainly seen in the chemicals (16%) and agri‑food (11%) sectors. The increases were primarily observed in aeronautics (7%) and other manufacturing industries (6%).

In construction, the balance of opinion on price developments continued to reflect price decreases in November, both in the structural works and finishing works sectors. As a result, 11% of building contractors lowered their prices in November, particularly in order to win contracts from the competition; only 2% increased them.

In market services, price developments were considered slightly positive, driven by accommodation and food services, car rentals and engineering. Conversely, prices continued to fall in information services. More specifically, 5% of companies reported an increase (in engineering and accommodation and food services), while 5% reported a decrease.

Recruitment difficulties eased by one percentage point in November, reaching 16% across all sectors. This proportion was stable, with higher levels in construction (23%) and lower levels in industry (13%). At the same time, they fell by 2 percentage points in market services to bring them in line with the average rate for all sectors. In industry, staff levels (including temporary workers) increased significantly.

Change in finished goods prices by major sector

Share of businesses reporting recruitment difficulties

4. Our estimates suggest GDP will rise by around 0.2% in the fourth quarter

The detailed results of the quarterly accounts published by INSEE at the end of November confirmed that GDP grew by 0.5% in the third quarter of 2025. Activity was mainly driven by strong growth in value added in industry, particularly aeronautics, in market services, notably information and communication, and in the energy sector. In construction, value added rose slightly.

Based on the results of our monthly business survey (MBS), rounded out by other available data (INSEE service and industry production indices and surveys and high‑frequency data), we forecast that GDP will grow in the fourth quarter, by around 0.2%. Activity is expected to be underpinned by strong growth in value added in manufacturing, as suggested by the monthly business survey. Value added is also expected to expand in market services, driven by trade, information and communication, and business services. Value added in the energy sector is expected to remain buoyant this quarter, while remaining virtually stable in the construction sector.

Quarterly changes in GDP and value added in France (%)

Note: QoQ = quarterly change.

1 The balance of opinion is the difference between the proportion of business leaders reporting increases or decreases, weighted by the intensity of the variation (with three possible grades in the monthly business survey: low, normal and high). A business leader indicating a “high” increase in prices will, all other things being equal, influence the balance of opinion more than a business leader indicating a “low” increase.

Download the full publication

Updated on the 22nd of December 2025