- Home

- Publications et statistiques

- Publications

- Monthly business survey – July 2023

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (around 8,500 companies and establishments between 28 June and 5 July), activity in industry firmed slightly in June and more markedly in services and construction, with both the latter sectors beating expectations last month. As is often the case ex ante, expectations for the current month are more mixed: business leaders expect industry to remain stable, services to rise and construction to fall.

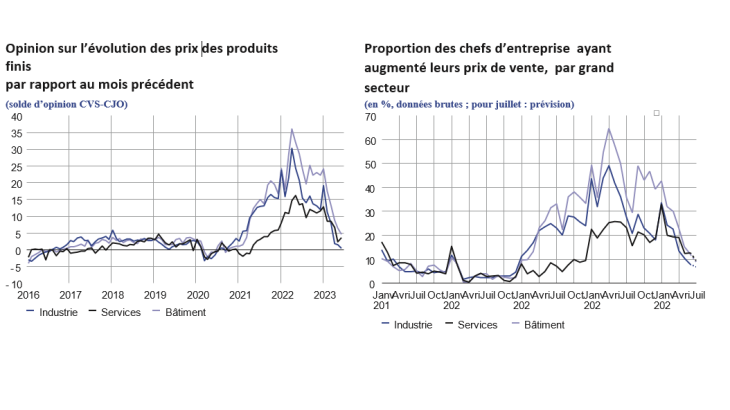

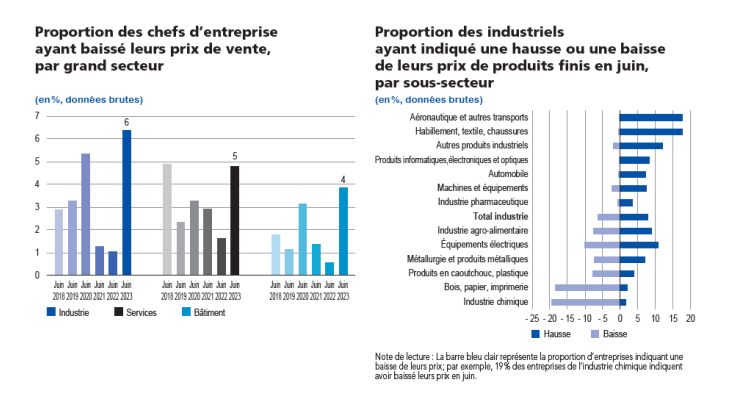

Supply difficulties stabilised at relatively low levels in construction (16% of companies mentioned such difficulties in June, compared with 15% in May) and industry (23%, as in May). For the third month in a row, business leaders reported a sharp fall in raw materials prices, with a stabilisation in finished goods prices.

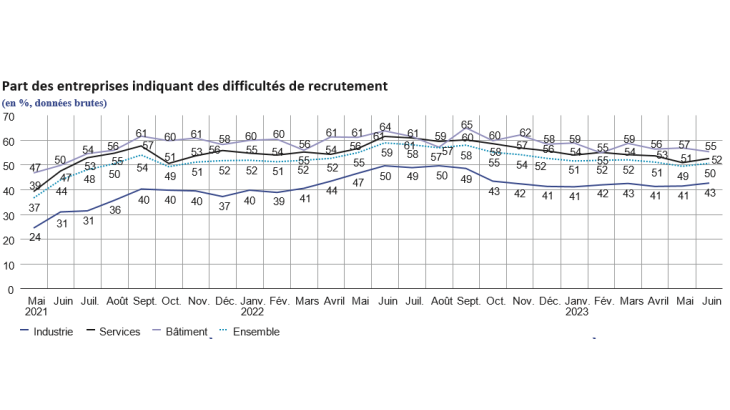

The outlook for prices in the services and construction sectors returned to pre-Covid levels. In industry, disinflation continued: only 8% of business leaders said they had raised their selling prices in June – the lowest since the beginning of 2021 - and 6% had lowered them - the highest for nearly three years. The share of companies that lowered their prices also increased in the construction sector. Recruitment difficulties remained relatively stable, affecting half of all companies (50%).

Our uncertainty indicator rose significantly in services and construction. In industry and structural works, order books stabilised at levels below their long-term averages. The cash position remained weak in industry and services.

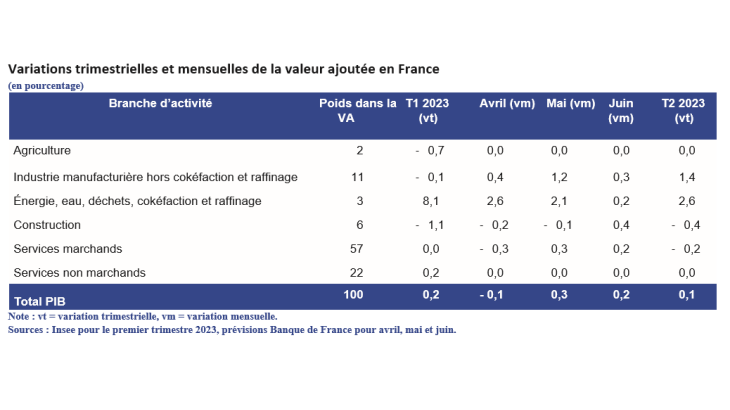

Based on the survey results as well as other indicators, we estimate that GDP grew by around 0.1% in the second quarter of 2023 compared with the previous quarter.

1. Activity increased slightly in industry in June and more sharply in services and construction

In June, activity rose slightly in industry, in line with business leaders’ expectations at the beginning of last month. The balance of opinion points to an increase in production in the automotive, aeronautical, computer, electronic and optical products, and other industrial products sectors. In contrast, activity declined in the wood-paper-printing sector, where production has been falling steadily since the end of 2022, and to a lesser extent in the electrical equipment and chemicals sectors.

The succession of shocks that have occurred since the start of 2022 have hit certain sectors particularly hard. While the capacity utilisation rate (CUR) fell by 2 percentage points overall in the manufacturing industry (77% in June 2023, after 79% in January 2022), some sectors saw sharper declines: wood-paper-printing (-10 percentage points), wearing apparel-textiles-footwear (-7 percentage points), chemicals (-7 percentage points) and rubberplastic products (-6 percentage points). Conversely, the easing of supply disruptions contributed to a rise in the CUR in the automotive sector, which has climbed by 10 percentage points to 75% since January 2022.

Inventories of finished goods remained at a high level in June, with variations across sectors: they rose in the wood-paper-printing sector and in machinery and equipment, but fell in computer, electronic and optical products, as well as in electrical equipment.

In the market services sector, activity rose more strongly than expected last month by business leaders, albeit with contrasting trends across sectors. It improved in services to individuals (accommodation, food services, personal services), as well as in publishing and architecture, engineering and technical controls. Conversely, activity contracted in the transport and automotive repair sectors. Activity in the construction sector picked up, mainly in the finishing works sector. The balance of opinion on the cash position stabilised in industry, reflecting the continued easing of energy and commodity prices. However, it remained below its long-term average. There was little change in the cash position in the services sector in June, and it was well below its long-term average in most business services (particularly legal and accounting activities and information services).

Activity in the construction sector picked up, mainly in the finishing works sector.

The balance of opinion on the cash position stabilised in industry, reflecting the continued easing of energy and commodity prices. However, it remained below its long-term average. There was little change in the cash position in the services sector in June, and it was well bellow its long-term average in mot business services (particularly legal and accounting activities and information services).

2. In July, business leaders expect activity to be stable in industry and to rise in services; however, they expect it to decline in construction

For July, business leaders expect activity in industry to remain broadly stable. Activity is expected to improve in the pharmaceutical and agri-food sectors, but to weaken in rubber and plastic products, and machinery and equipment.

In services, activity recorded further gains. Business leaders are expecting activity to grow in the food services, publishing, management consultancy and car rental sectors. Conversely, activity appears to have contracted in the transport and automotive repair sectors.

Finally, in the construction sector, business leaders expect a drop in activity, particularly in structural works.

Our monthly uncertainty indicator, which is constructed using text mining of respondents’ comments, suggests an increase in uncertainty in services and construction. By contrast, it continued to ease in industry.

The balance of opinion on order books in industry stabilised at a level below its long-term average. In construction, order books showed little change, hovering around their long-term average. Since mid-2022, the decline in construction order books has been exclusively confined to the structural works sector, which has suffered from a sharp fall in sales of new single-family homes. By contrast, order books in the finishing works sector have been stable for the past nine months, at a level close to their long-term average, reflecting energy renovation activities.

3. Supply difficulties stabilised; the pace of price rises slowed sharply in all sectors

In June, supply difficulties stabilised in industry (23%) and construction (16%, after 15% in May). Business leaders specifically mentioned the shortage of lorry drivers as a factor in the disruption of supply chains.

The balance of opinion on raw materials prices suggests a further decline in industry, for the third month in a row. Finished goods prices slowed again this month: the balance of opinion has tended to stabilise in industry and services, confirming that price rises have returned to a level comparable to the pre-Covid period. In construction, prices slowed significantly again.

More specifically, 8% of business leaders in industry reported an increase in their selling prices in June, compared with 10% last May and 36% in June 2022. In the agri-food sector, this proportion fell to 9% (after 13% last May and 39% a year ago). Furthermore, 6% of business leaders stated that they had lowered their selling prices in June, in line with the decline in raw material prices, the highest proportion since the start of the year. This compares with around 3% in the pre-Covid period (2017-19), and almost 1% a year ago. Decreases in finished goods prices were more widespread in chemicals, wood-paper-printing and rubber products.

In construction, 12% of companies increased their selling prices in June (compared with 15% last May and 50% in June 2022), while 4% of companies said they had cut prices, compared with less than 1% on average between mid-2021 and the end of 2022.

In services, the share of companies reporting an increase in June was stable at 13%, to be compared with 25% a year ago.

The percentage of business leaders planning to raise prices in July was down again in industry (7%), market services (9%) and construction (9%).

Business leaders were also surveyed about their recruitment difficulties. There was little change in these figures, which affected 50% of the companies surveyed across all sectors.

4. Our estimates suggest GDP growth of 0.1% in the second quarter

For June, using granular survey data as well as other available data (INSEE and high-frequency), we estimate that GDP was up compared with May. This increase in activity was observed in industry, construction and market services.

More specifically, using survey data, value added in June was up in the manufacturing industry and down slightly in the agri-food industry. Value added in the services covered by the survey is also expected to increase, in household services, accommodation and food services, and business services.

The high-frequency data, which we also monitor for the service sectors not or only partly covered by the survey, indicate, like in May, a sharp rise in transport services. In the retail trade sector, however, value added slowed in June.

For the second quarter, our forecast of 0.1% is unchanged from the previous month. While the survey was better than expected in June for services and construction, the inclusion of INSEE’s production data for services, which fell in April, offset this positive surprise for activity in the quarter.

Overall, our forecast for the second quarter, as well as early indicators for the third quarter, are in line with the growth path of our June macroeconomic projections

Download the paper

Updated on the 25th of July 2024