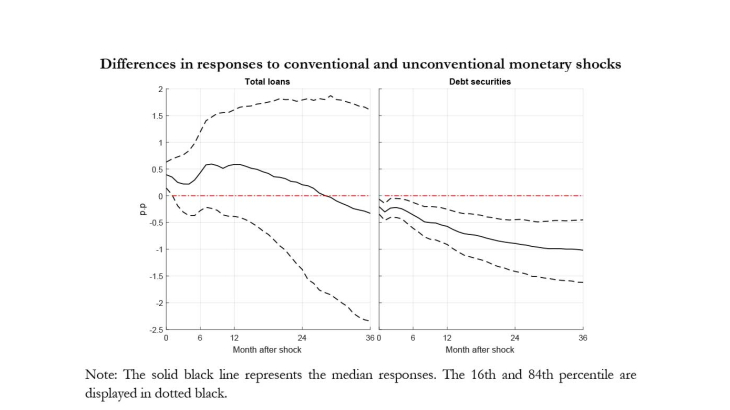

Working Paper Series no. 697. This paper evaluates and compares the effects of conventional and unconventional monetary policies on the corporate debt structure in the United States. It does so by using a vector autoregression in which policy shocks are identified through high-frequency external instruments. Stéphane Lhuissier and Urszula Szczerbowicz’s results show that conventional and unconventional expansionary monetary policies have similar positive effects on aggregate activity, but their impact on corporate debt structure goes in opposite directions: (i) conventional monetary easing increases loans to non-financial corporations and reduces corporate bond financing; (ii) unconventional monetary easing increases bond finance without affecting the loans.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche