Households’ inflation expectations play a key role in macroeconomic dynamics, not only because they influence saving and consumption decisions, but also because they serve as an important gauge of central bank credibility. In the euro area, the European Central Bank’s Consumer Expectations Survey (ECB-CES) provides benchmark indicators of households’ inflation expectations. However, measuring these expectations is challenging. Unlike professional forecasters, households tend to be less informed about inflation, making their responses particularly sensitive to the framing and design of the questionnaire. A key feature of the ECB-CES is that it allows respondents to participate repeatedly, enabling researchers to track how the expectations of the same individuals evolve over time. Yet repeated participation may itself influence responses by prompting participants to acquire information or become more familiar with the concept of inflation. This phenomenon is commonly referred to as learning through survey or panel conditioning which is particularly relevant when the objective is to measure households' expectations as spontaneous answers to the survey. This is especially crucial when assessing the anchoring of inflation expectations or testing theories of expectation formation since any systematic bias introduced by repeated survey participation could distort the interpretation of results. In this paper, we estimate the extent of panel conditioning effects using data from the ECB-CES.

This survey has several distinctive features that make it well suited for this analysis. First, respondents can participate up to 24 times (i.e. months) in the survey, which is much more than in other comparable surveys. Second, the ECB-CES collects a wide range of quantitative expectations, covering not only aggregate inflation but also other macroeconomic variables such as unemployment, as well as household-level variables like income and consumption growth. Third, the survey is large in scale, conducted monthly across 11 different euro area countries, involving about 20,000 households. Finally, it covers the entire inflation cycle from 2020 to 2024, providing sufficient time variation to identify panel conditioning effects on inflation expectations.

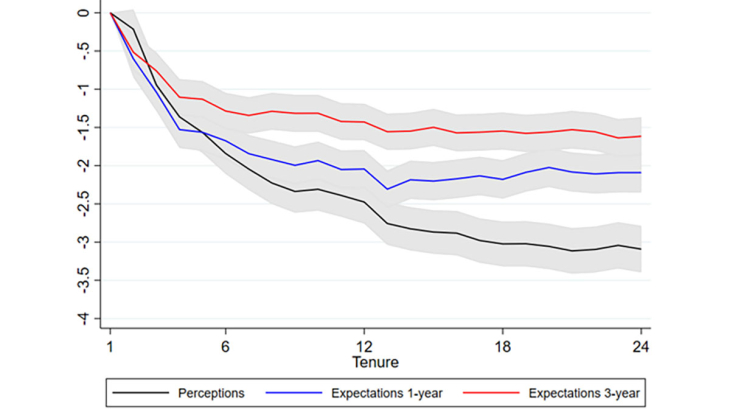

Using more than 950,000 monthly responses from about 100,000 unique participants in the ECB-CES between 2020 and 2024, we show that, all else being equal, households report lower inflation perceptions and lower inflation expectations when they participate in the survey for several consecutive months (Figure 1). This panel conditioning effect becomes significant from the second survey participation, with its magnitude increasing rapidly over subsequent waves before stabilizing at its maximum (in absolute terms). After 12 consecutive participations in the ECB-CES, one-year inflation expectations are, on average, about 2 percentage points lower than at the first interview. Beyond this point, the panel conditioning effect remains stable up to the maximum participation duration. A similar pattern is observed for long-term inflation expectations, although the magnitude of the effect is smaller. When accounting for these tenure effects, aggregate indicators of inflation expectations are, on average, higher than those computed from the raw data, although the two remain highly correlated.

We find that tenure effects are stronger when households initially report very high inflation expectations and that repeated participation leads to less rounding in responses and greater reported certainty. Panel conditioning effects also appear more pronounced among respondents with lower initial attention levels. These findings suggest that households tend to provide more consistent responses over time as they gain experience with the survey. However, only about half of the observed panel conditioning effects can be attributed to improved forecasting performance. Repeated participation may also reduce engagement and lead to less accurate responses. We also document that tenure effects are not specific to inflation but are also obtained for other macroeconomic variables, such as unemployment or economic growth. Panel conditioning effects are much smaller for household-specific variables, such as income or consumption.

Keywords: Consumer Expectations Survey, Inflation, Survey Methods

Codes JEL : D83, D84, E31