With the Fit for 55 plan and the European Green Deal, the European Commission set the goal to reduce greenhouse gas emissions by 55% by 2030 and to reach carbon neutrality by 2050. To direct European firms toward the path of the low-carbon transition, the EU introduced in 2005 an economic mechanism of carbon pricing based on an emissions trading system. This system imposes a cap on emissions of fossil-fuel-intensive businesses in Europe, in particular covering firms that are active in industries such as aviation, electricity supply, and manufacturing of chemicals and metals. The system encourages emissions reduction by decreasing the cap every year and by putting a price on tradable emissions. Firms subject to such a cap-and-trade mechanism need adequate financing to adopt clean technologies and reduce their emissions without constraining their economic activity. The EU’s 2019 Green Deal acknowledges that financing is central to achieving emission reduction. In particular, European firms subject to a cap on their emissions are mostly non-listed and heavily reliant on debt financing. Therefore, the development of debt markets and the understanding of the debt-emissions nexus is crucial to efficiently reaching carbon neutrality.

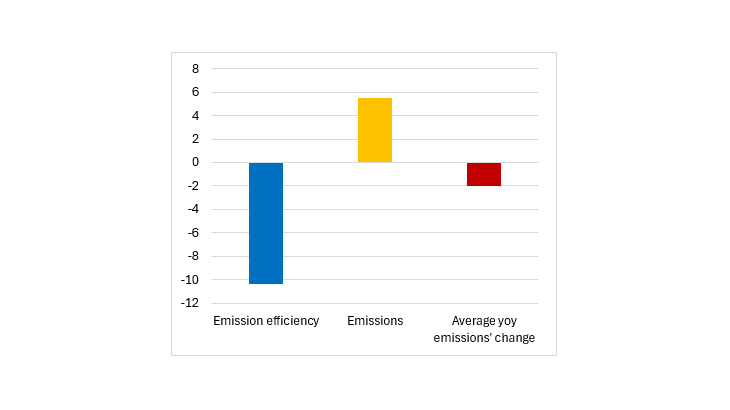

We rely on evidence from a sample of approximately 2400 firms subject to the EU emissions trading system (EU ETS) that are responsible for more than 20% of the total EU greenhouse gas emissions to study how European firms' debt finance relates to changes in emissions. Our findings indicate an inverted U-shape relationship between the level of firm leverage and its transition performance. Firms with leverage ratios (debt/assets) above 40% are associated with higher emissions and worse emission efficiency. Specifically, we find that a one standard-deviation increase in leverage – a 21 percentage point rise – from this threshold leads to a 10% decline in emission efficiency (blue bar) and a 5.5% increase in absolute emissions (yellow bar). These economically meaningful effects, particularly when compared to the average annual reduction of 2% in the emissions cap imposed by the EU ETS (red bar), indicate that capital structure constraints can significantly hinder firms’ transition efforts. The findings are consistent with theoretical models showing that high indebtedness constraints firms' capacity to undertake profitable – and in our case green – investment opportunities.

In particular, we investigate firms' reaction to a quasi-exogenous regulatory shock that imposed a more stringent cap on emissions. We find that highly indebted firms did not reduce their emissions even when exposed to this growing constraint on their emissions, while other firms successfully did so. The study sheds light on the existence of a group of European firms that are too indebted for transition. While the higher future cost of emissions upon the formal adoption of the reform would have strongly incentivised all firms to invest in low-carbon technology, possibly by taking on more debt, highly leveraged firms suffering from debt overhang may have found it difficult or costly to access the necessary additional finance.

Our findings highlight significant policy implications for enabling firms under the EU Emissions Trading System (EU ETS) to transition to low-carbon operations while maintaining economic viability. They confirm that debt financing is a viable mechanism to support this transition. However, the EU ETS may fall short of its potential in reducing emissions from highly leveraged firms.

For highly indebted firms with limited growth prospects, market exit in favor of more emission-efficient competitors may be inevitable. In contrast, highly indebted firms with strong growth potential could benefit from tailored transition finance solutions to reduce emissions more effectively. This underscores the importance of expanding green bond and green loan markets through measures such as enhanced transparency, international standards, or tax incentives limited to green debt.

Investor demand for green debt is robust and growing. Green debt instruments may allow highly leveraged firms to secure funding at reasonable premiums, provided they commit to investing the proceeds in low-carbon technologies and demonstrate measurable environmental benefits. Lenders may view such financing as a means to enhance firms' medium-term profitability and resilience, even if these firms face challenges in obtaining general financing.

Keywords: Low-Carbon Transition; Climate Change; Debt Finance; Leverage; Green Investment; EU ETS

Codes JEL : C58, E58, G32, Q51, Q56, Q58