1 The key role of qualitative information in the banking relationship

By exchanging information between credit market participants, lenders are able to better assess the credit risk associated with companies. At the same time, this exchange enables these same companies to prevent the best‑informed lenders from exploiting an informational rent at their expense.

Nowadays, easier access to company data and the development of information and communication technologies facilitate the dissemination of verifiable financial information (hard information). However, qualitative and informal information (soft information), such as that produced by financial analysts, remains costly to collect and difficult to disseminate. This may discourage the use of this type of information in the selection and monitoring of borrowers and thereby be detrimental to the credit market. Indeed, qualitative information plays a key role in facilitating access to credit, especially for small businesses, which are generally more opaque.

In this context, the analysis of banks’ use of external credit ratings, and of their informational content, is interesting for two reasons. On the one hand, it refines our understanding of the mechanisms at work in lending decisions. On the other hand, it enables us to assess whether and how external certification can enhance access to bank credit for companies, especially small and medium‑sized enterprises (SMEs) with the highest level of financial intermediation. This article addresses these issues by analysing how the production of quantitative and qualitative information about borrowers, and its dissemination through a credit register, can influence banks’ lending decisions and thereby improve the functioning of the credit market.

2 The Banque de France rating system and its 2004 reform

The bank credit market in France offers a framework for analysis that is particularly well‑suited to these questions. Indeed, a large number of SMEs are assigned a credit rating by the Banque de France, based on the collection and processing of both quantitative and qualitative information. Ratings are made available to credit institutions via the FIBEN company database, alongside a large quantity of financial information such as balance sheets and income statements.

The 2004 ratings reform: a refinement of the scale

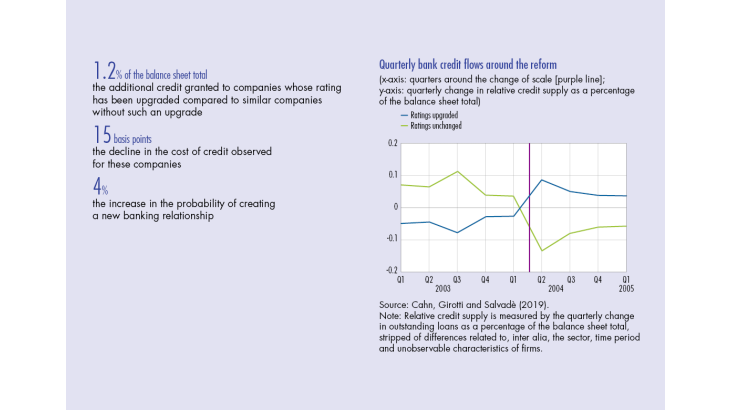

Company ratings reflect a firm’s ability to meet its financial commitments over a three‑year horizon. This rating is represented by a position on a rating scale. The Banque de France’s rating system was reformed in 2004, resulting in a refinement of pre‑existing ratings and thus an increase in the number of levels (see box)

[to read more, please download the article]