1 The structure of French insurers at end-2018

Investments mainly focused on fixed income products

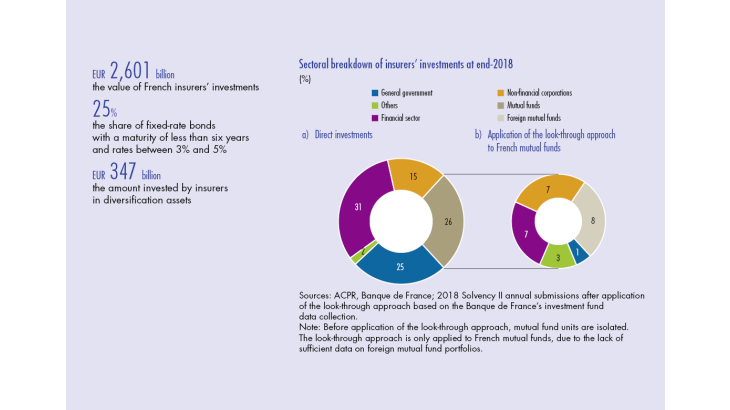

Insurers established in France and subject to the Solvency II Directive hold 35% of the assets managed by euro area insurers. France, the largest European market in terms of balance sheet size, remains dominated by life insurance: 91% of French insurers’ assets are held by life or composite insurers.

The overall structure of French insurers’ portfolio subject to Solvency II is stable over time (see Chart 1). Close to 60% of their investments are made up of bonds, in particular sovereign and financial sector bonds. This high proportion poses a particular challenge in the current environment of persistently low interest rates (see below).

Equities account for almost 30% of the balance sheet of non-life insurers, compared to less than 10% for life and composite insurers. This can be explained by the amount of the former’s participating interests. Excluding participating interests, the two categories of insurers hold the same proportion of equities in their investments.

A decrease in net purchases of mutual fund shares, in particular shares of French mutual funds.

The relative share of mutual funds in the financial investments of insurers established in France fell slightly in 2018 (down 0.8 points), in contrast to what was observed in 2017.

Net purchases of mutual fund shares dropped sharply in 2018, slipping to EUR 10.4 billion from EUR 55.6 billion in 2017 (see Chart 2a). On the one hand, insurers were net sellers of money market fund shares (–EUR 8.2 billion), after having been net buyers in 2017 (+EUR 16.3 billion). On the other hand, net purchases of non-money market fund shares fell by half to stand at EUR 18.5 billion in 2018, compared to EUR 39.3 billion in 2017.

Within non-money market funds, insurers maintained a high level of net purchases of equity funds (EUR 6 billion in 2018 and 2017) and real estate funds (EUR 7.4 billion in 2018, after EUR 9.8 billion in 2017). This trend reflects an attempt to diversify and a search for yield (such as rents for real estate funds) in a context of persistently low interest rates.

At the same time, insurers significantly cut back their net purchases of bond and mixed mutual fund shares, thus reducing the share of their investments intermediated through investment funds compared to 2017.

The sharp decline in net purchases of mutual fund.

[to read more, please download the article]