In order to assess the quantitative impact of supply bottlenecks, a structural Bayesian vector autoregression (VAR) model including both the SDT and manufacturing output indices is estimated for France. Statistical inference via sign restrictions is based on the notion that a negative demand shock is associated with a decline in both manufacturing output and delivery times - reflected in an increase in the SDT index - and that a supply shock is associated with a decline in output and a lengthening of deliveries - reflected in a decline in the SDT index. This set-up relates to similar work recently conducted by the ECB at the euro area level.

Supply bottlenecks have strongly impeded manufacturing output in recent months

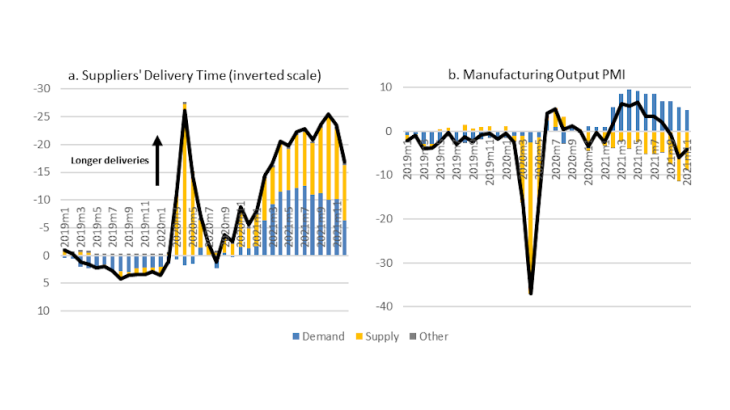

Between January 2020 and December 2021, the cumulative contribution of supply shocks to the increase in delivery times amounted to 62%, compared to 36% on average for demand shocks (Chart 1a). This is in stark contrast with the period between 1999 and 2019, for which the cumulative contribution of supply shocks stood at 26% only. Results for France are comparable with previous estimates by the ECB for the euro area indicating that roughly two-thirds of the lengthening of delivery times during Covid-19 can be attributed to supply-side disruptions. Finally, Chart 1a also shows that during the first lockdown in spring 2020 - which resulted in a partial shutdown of activity in manufacturing, transportation, and service sectors in France - mainly supply shocks made a negative contribution to output PMI and a lengthening of delivery times.

Chart 1b highlights that supply bottlenecks made a negative contribution to manufacturing output, in particular since the end of 2020. Quantitatively, the absolute cumulative contribution of supply shocks has been large over the course of the pandemic (around 60% against 40% for demand shock contributions), especially in comparison to the pre-pandemic period when mainly demand shocks contributed to movements in output PMI (71% against 26% for supply shock contributions). Strikingly, amid a strengthening economic recovery, demand shock contributions to manufacturing output PMI were entirely positive over the course of 2021. However, large negative supply shock contributions related to an even stronger tightening of supply bottlenecks outweighed these positive demand contributions from September 2021 onward.

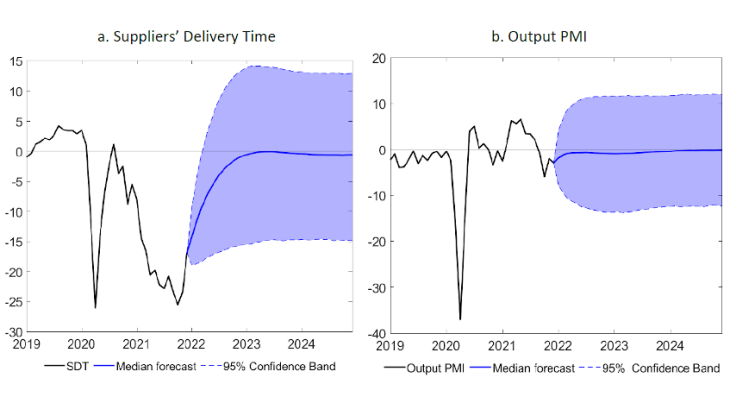

Bottlenecks likely to further affect manufacturing output in early 2022

The abovementioned results show the strong impact of supply bottlenecks on delivery times and manufacturing output in recent months. Thus, depending on the pandemic situation, their unwinding will crucially determine the path of the global economic recovery. In order to assess the potential length of remaining bottlenecks in France, Chart 3 shows the unconditional forecasts of the Bayesian VAR for delivery times and manufacturing output PMIs.