Standard fixed-coupon German government bonds, widely known as Bunds, represent the benchmark class of safe assets in the euro area and are second only to U.S. Treasuries in terms of investor base, liquidity, and market depth. In contrast, German inflation-linked government bonds, though important, have received much less attention. This sense of under-appreciation was further reinforced by the German Federal Finance Agency’s decision, in November 2023, to cease all future inflation-linked bond issuance. This paper is among the first to provide a comprehensive analysis of the market for German inflation-linked government bonds and to study its response to this announcement.

Given the large and well-documented flight-to-safety effects in the German bund market, we conjecture that investors might also be willing to pay a premium, albeit somewhat smaller, for safely storing their wealth in German inflation-linked government bonds despite their lack of market attention. Hence, the main purpose of our analysis is to examine whether there are any convenience premia embedded in the prices of German inflation-linked government bonds, as little is known about the pricing in this market.

To estimate bond-specific convenience premia along with conventional real term premia, we use an arbitrage-free dynamic term structure model of real yields augmented with a bond-specific risk factor. The identification of the bond-specific risk factor comes from its unique loading for each individual bond security as in Andreasen et al. (2021, henceforth ACR). Our analysis uses prices of individual bonds rather than the more common input of yields from fitted synthetic curves. The underlying mechanism assumes that, over time, an increasing proportion of the outstanding inventory is locked up in buy-and-hold investors’ portfolios. Given forward-looking investor behavior, this lock-up effect means that a particular bond’s sensitivity to the market-wide bond-specific risk factor will vary depending on how seasoned the bond is and how close to maturity it is.

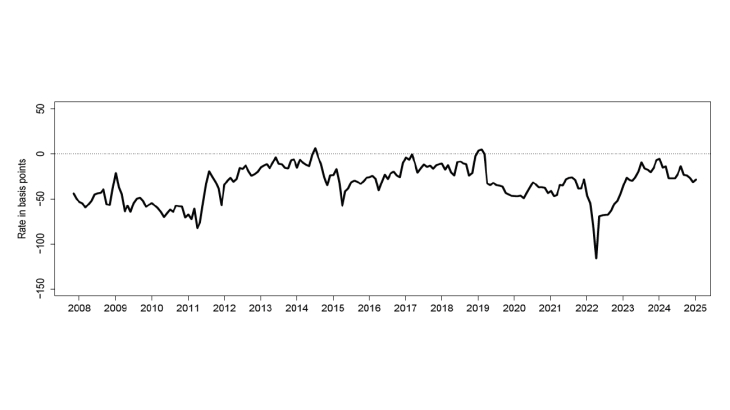

Using this modeling tool, we are the first to document the existence of large, time-varying, and mostly negative premia in this market that average -0.33 percent for our sample period from October 2007 to December 2024. A negative premium reflects the presence of a convenience yield, and given that the German inflation-linked bonds are much less liquid than standard bunds in terms of bid-ask spreads, we follow Christensen and Mirkov (2022) and refer to these convenience premia as safety premia. Such safety premia imply that investors are willing to overprice bonds (or receive a lower return through negative premia) to hold them.

Furthermore, we study the market reaction to the announcement by the German Federal Finance Agency to cease all future issuance of inflation-linked debt made public on November 22, 2023. We find that neither the safety premia nor the trading conditions of the inflation-linked bonds were negatively affected by this decision. Thus, it does not appear that investors positioned themselves for somewhat slower inflation-linked market trading in the future. Overall, the market reaction was tempered and the inflation-linked market has continued to function on par with the past through the end of our sample. Hence, for now, inflation-linked trading remains active despite no new issuance has come to market since before November 2023. These findings support our usage of the inflation-linked data through the end of our sample. They presumably will also support their usage well into the future, given that the longest-dated outstanding German inflation-linked bond can be expected to continue to trade until 2046. Although, at this point, it remains a rich source of information for both policy and trading analysis as we demonstrate in this paper, we caution that the usefulness of this market information will inevitably decline over time as the remaining inflation-linked bonds reach maturity.

Keywords: Affine Arbitrage-Free Term Structure Model, Financial Market Frictions, Convenience Premium, Safety Premium, Rstar

Codes JEL : C32, E43, E52, G12