Non-Technical Summary

This paper quantifies how the world economy would react if trade were to fragment into rival blocs. Using a detailed multi-country, multi-sector model calibrated to OECD input–output data, the authors simulate scenarios in which a “Western” bloc and an “Eastern” bloc raise trade barriers against each other, while some economies initially remain neutral.

The model captures global value chains: countries import large volumes of intermediate inputs, so trade disruptions cascade across sectors. Under all fragmentation scenarios, world trade and world welfare decline. Losses are substantially larger when decoupling occurs through higher non-tariff trade costs than through tariffs, because tariffs generate revenue that partly compensates domestic consumers. If inter-bloc trade is made fully prohibitive, global real consumption falls by about 0.8 percent—a sizeable reversal of the gains from decades of integration.

A benchmark scenario with a 20 percent rise in inter-bloc trade costs illustrates the distributional patterns. Trade between blocs falls by almost two-thirds, while intra-bloc and neutral-bloc trade increase modestly. Western and Eastern bloc members experience welfare losses, typically between 0.1 and 0.8 percent, with larger declines for economies tightly linked to the other bloc. China and Russia face larger losses than the United States or Europe, reflecting narrower trade networks. In contrast, neutral economies such as Vietnam or Mexico often gain, as they attract production and supply-chain re-routing from both sides.

The paper also analyzes the strategic logic of tariff wars. A unilateral tariff can improve welfare for the bloc that imposes it by improving its terms of trade. Retaliation by the other bloc is nonetheless a best response and recovers part of its own losses. As a result, a bilateral tariff war is an equilibrium even though both blocs end up worse off than under free trade—a classic prisoner’s dilemma.

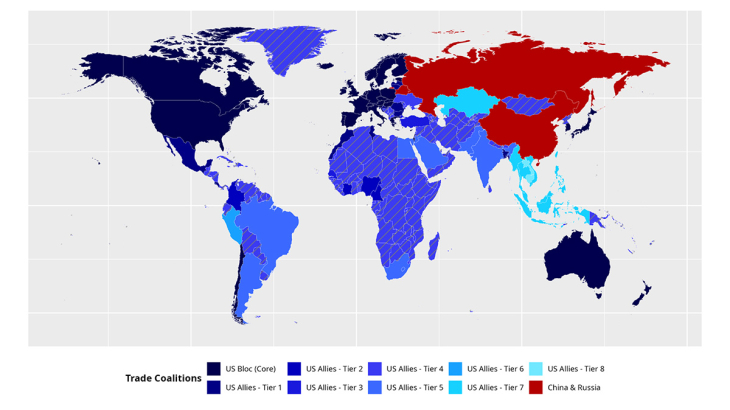

Because neutral countries gain while bloc members lose, blocs are intrinsically fragile. The paper therefore investigates which bloc neutral countries would join if they could no longer remain neutral. The Western bloc’s larger economic size makes it more attractive. Simulating successive “rounds” of accession shows that it would progressively expand, ultimately attracting all neutral economies. The accompanying map illustrates the sequence of these enlargement rounds.

Overall, the results highlight three insights: moderate fragmentation can already erase a meaningful share of global gains from trade; tariff wars are strategically rational yet mutually damaging; and bloc size strongly shapes the future architecture of global trade.

Keywords: Geoeconomic Fragmentation; Trade Blocs; Global Value Chains; Tariffs; Welfare.

Codes JEL: F11, F13, F15, F60, F61, C67, C68.