Our economic decisions are influenced by our expectations, particularly with regard to bank lending rates. Whether you are an individual considering a real estate project or a business leader seeking to invest (or seeking to predict the cost of refinancing your maturing debt), one key question arises: should you borrow today or wait for rates to fall?

But can we really forecast changes in bank lending rates? This article answers that question in the affirmative. We show that borrowing rates can be forecasted using the information content of interest rates observed on financial markets, available in real time.

The ability to forecast changes in lending rates is also key for central banks. On the one hand, it enables them to analyse the transmission of monetary policy to lending by identifying what remains to be transmitted from past decisions. Since changes in key rates take time to be passed on to lending rates, and since “governing means anticipating”, forecasting rate changes makes it possible to estimate the monetary impulse still being transmitted. On the other hand, forecasting lending rates helps central banks refine future decisions by assessing future financial conditions. Exogenous factors—such as high long-term rates due to strong economic uncertainty—can lead to higher lending rates, lower demand for loans, and ultimately weigh on growth and employment.

To forecast changes in lending rates, one approach is to rely on surveys conducted among banks, such as the Bank Lending Survey. Another approach aims to look at how lending rates are set using granular microeconomic data (Baptista et al., 2025). In this article, we adopt a complementary approach based on an autoregressive model augmented with market interest rates.

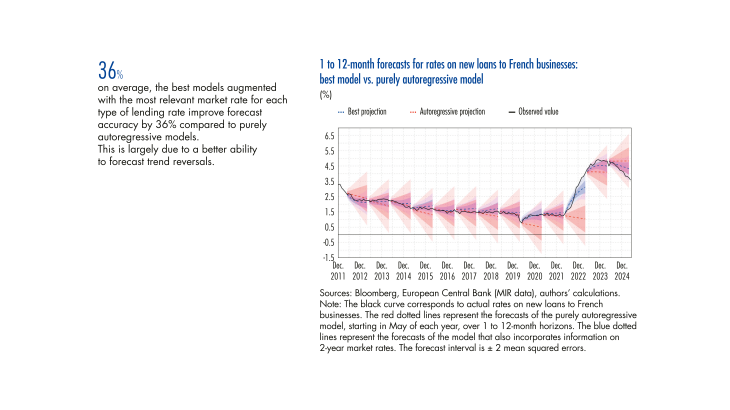

Our results show that, on average, the best models augmented with the most relevant market rate for each type of borrowing rate improve the accuracy of forecasts up to one year by 36% compared to purely autoregressive models, in which future lending rates are projected solely on the basis of their past values. What is particularly interesting is that our model is able to detect turning points, i.e., changes in trends, fairly accurately even before the first observed data signal a reversal. This performance can be explained both by the slow adjustment of lending rates and by the close link between borrowing rates and market rates, which serve as a reference for banks’ lending policy. ..