Post n°329. Against a backdrop of sharply rising oil and gas prices, France's energy balance deteriorated by EUR 68 billion. With a structural surplus of electricity, France could have benefited from a positive shock for this part of its energy supply, but, according to our estimate, the unavailability of part of its nuclear power fleet added EUR 16 billion to the energy bill in 2022.

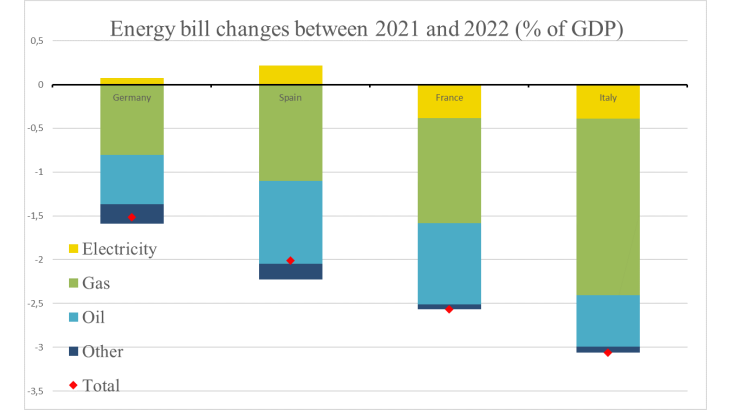

Chart 1 breaks down the changes in the energy balance of the four main economies of the European Union between 2021 and 2022, by main item (as a percentage of GDP). France suffered a greater deterioration in its energy balance (down 2.6 percentage points of GDP) than Germany (down 1.5 pp) and Spain (down 2.0 pp), but less than Italy (down 3.1 pp). France stands out in two ways in 2022: the deterioration in its electricity balance, despite the fact that electricity has long been a strong point of French specialisation, and the deterioration in its gas balance, which is just as marked as in Germany, despite France’s lower dependence on gas.

Source: Customs (via TDM)

The electricity crisis of 2022

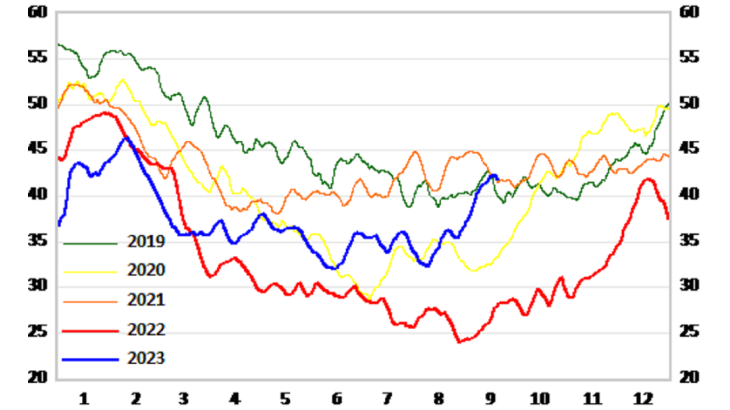

For the first time in history, at least since the commissioning of its nuclear fleet, France was a net importer of electricity in 2022, and the trade balance for this item deteriorated by more than EUR 10 billion in 2022, i.e. 0.4% of GDP (Chart 1). The main cause is the reduction in nuclear electricity production, due to safety problems: stress corrosion of safety and cooling injection pipes was discovered in autumn 2021. The EDF Group shut down 10 reactors for repairs, lowering the power generated by an average of almost 10GW in 2022 (see Chart 2), i.e. a reduction in production of 82TWh. The situation regarding hydraulic reserves, which are very low due to the lack of rainfall, has exacerbated the problem, reducing French electricity production by a further 12 TWh in 2022.

On the x-axis: the month of the year. Source: energygraph.info

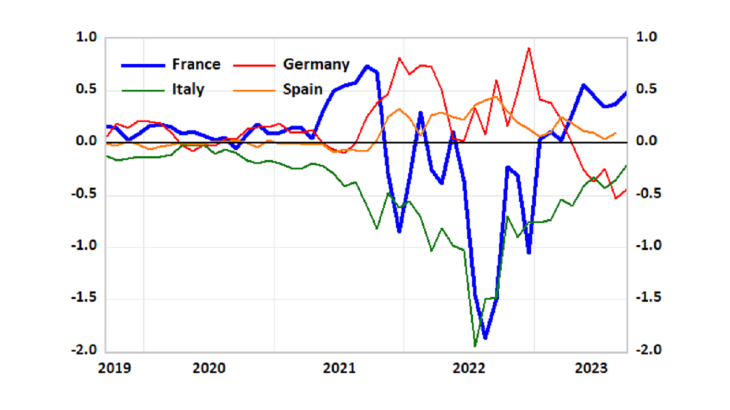

This drop in production resulted in a fall in net electricity exports, which became negative (see Chart 3), whereas electricity was one of the sectors with a continuous surplus in the French trade balance. Italy, an importer of electricity, was adversely impacted by the rise in prices, while Germany, as it regularly does during periods of peak consumption in winter, exploited its dispatchable fossil fuel capacities, particularly coal, and posted a surplus in 2022.

Source: TDM, Banque de France calculations.

The effect of this fall in net exports on the current account was amplified by the rise in electricity prices, which can be attributed to the increase in gas prices. The market price of electricity is generally determined by the price of gas, because gas-fired power stations usually supply the last MWh demanded on the European market, when production facilities with lower variable costs, or even zero variable costs for renewable energies, do not produce enough. The rise in gas prices started as early as the summer of 2021 and gained momentum in November 2021, when it became apparent that Gazprom was not filling the European stocks under its management. This price rise accelerated in 2022 following Russia's invasion of Ukraine.

The drop in demand and the interruption of part of the industrial activity did not prevent gas prices from rising sharply, as imports failed to fall sufficiently. Net gas imports actually rose by 1.4% in volume terms in France, mainly as a result of a rise in stocks, gas consumption having decreased by 9.7% compared with 2021. The reduction would probably have been more marked in the absence of the electricity shortage thanks to the substitution between gas and electricity: in Germany, for example, gas consumption declined by 15.7%.

Other external factors contributed to the rise in the price of European electricity in 2022, such as the (definitive) closure of the last active nuclear reactors in Germany. Conversely, the "Iberian mechanism", which limited the price of gas used in gas-fired power stations in Spain and Portugal through subsidies, had a favourable impact on the price of French electricity imports.

An additional cost of EUR 16 billion

In a counterfactual scenario without stress corrosion, France would have remained a net exporter and its trade balance would have benefited from the rise in the price of electricity. However, export prices would have been lower, given the higher level of European production.

Using data from the wholesale electricity market and taking the price of gas, the price of carbon allowances, the production of intermittent renewables and available nuclear capacity (in France and Germany) as determinants, we estimate that the wholesale electricity price would have been EUR 40/MWh lower, i.e. around 20% of the observed price. In this scenario, France would also have been able to lower its gas consumption by 4% by using less gas in its thermal power stations.

In this scenario, in which 2021 is used as the reference year, France's trade balance would have increased by EUR 16 billion. This is close to the decline in EDF's profitability in 2022: its EBITDA (Earnings before Interest and Taxes and Amortisation) dropped from EUR 18 billion in 2021 to a deficit of EUR 5 billion in 2022.

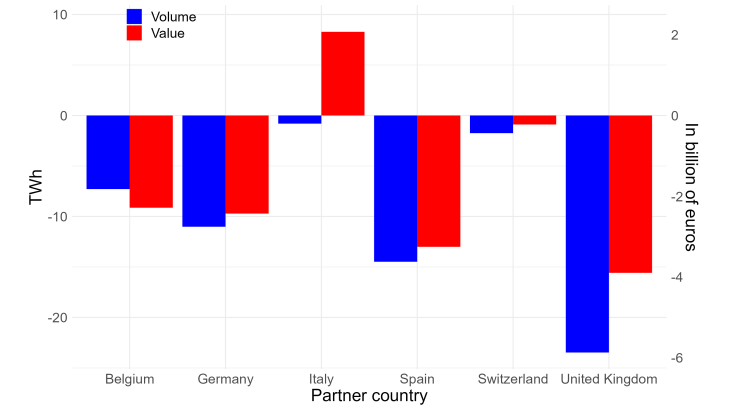

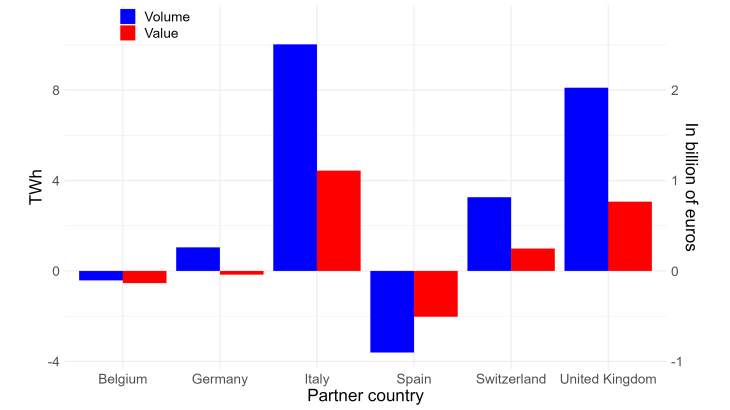

In practice, France was able to offset the fall in its electricity production by reducing its net exports to Germany, the United Kingdom and Belgium. Given the needs of the electricity network, exports to Italy and Switzerland posted a smaller decline (see Chart 4). Gross electricity consumption also decreased by 4% compared with 2021, half of the fall being due to calendar and weather effects: according to RTE consumption adjusted for these effects dropped by 1.7% compared with 2022.

Change in volume in TWh in blue (left-hand scale); change in value in billions of euros (right-hand scale). Sources: Customs (via TDM), Banque de France calculations.

Countries that exported electricity to France did not necessarily enjoy a higher trade balance since the electricity exported to France (or that which was not imported) was produced mainly using hydrocarbons imported from abroad. Only countries producing part of their energy from domestic resources, such as Germany with coal, benefited from a favourable effect on their trade balance. However, the fall in the supply of electricity contributed to raising the need for gas in thermal power stations and no doubt contributed to depressing industrial activity, particularly in Germany.

If we measure the total effect of stress corrosion on France (taking into account shutdowns in 2021, 2022 and 2023), we arrive at a cumulative cost of EUR 20 billion, higher than the shortfall in 2022, since 2021 was already a bad year for the nuclear power fleet, which had suffered from maintenance delays due to the Covid-19 pandemic and strikes.

Trends in 2023

France once again became a net exporter of electricity in 2023. However, this surplus is limited in volume terms due to strikes at nuclear power plants, and limited in value terms due to the fall in wholesale electricity prices. Trade in electricity has returned to normal: while France has remained an importer of Spanish electricity, it has upped its net exports to all its other partners (see Chart 5). By the summer of 2023, nuclear power generation had returned to a level close to pre-Covid levels.

Change in volume in TWh in blue (left-hand scale); change in value in billions of euros (right-hand scale). Sources: Customs (via TDM), Banque de France calculations.

In the future, the growing importance of renewable energies in the European energy mix should result in greater variability in electricity trade balances. Prices will vary widely, from zero or negative during periods of high renewable production, to very high levels during peaks in consumption when there is no wind or sun. The electricity surplus is likely to become less regular and smaller on average, as nuclear power generation more frequently takes a back seat to growing renewable energy generation in Europe.

Download the PDF version of the publication

Updated on the 25th of July 2024