Non-Technical Summary

How do differences in banks’ funding structures influence the transmission of monetary policy? This paper explores the role of deposit funding in shaping how policy rate changes affect lending conditions in the euro area.

The euro area recently experienced one of the fastest monetary tightening cycles in decades. Higher policy rates should quickly translate into higher deposit rates, as households seek better returns. Yet, the pass-through to deposit rates has been sluggish and incomplete. This rigidity matters because it affects banks’ funding costs and, ultimately, their lending behavior—a mechanism known as the deposit channel of monetary policy.

We use a unique monthly panel covering more than 120 banks across 19 euro-area countries from 2007 to 2023. The dataset combines granular interest rate information (on loans and deposits) with detailed balance sheet data from the ECB’s IMIR and IBSI databases. Our empirical strategy relies on panel local projections to trace the dynamic response of lending rates and loan volumes to policy rate changes, controlling for macroeconomic conditions and bank-specific characteristics. Robustness checks employ monetary policy shocks as instruments.

Our main results are:

- Incomplete and delayed pass-through: On average, only about one-third of policy rate hikes are transmitted to deposit rates, and the adjustment peaks after six to twelve months.

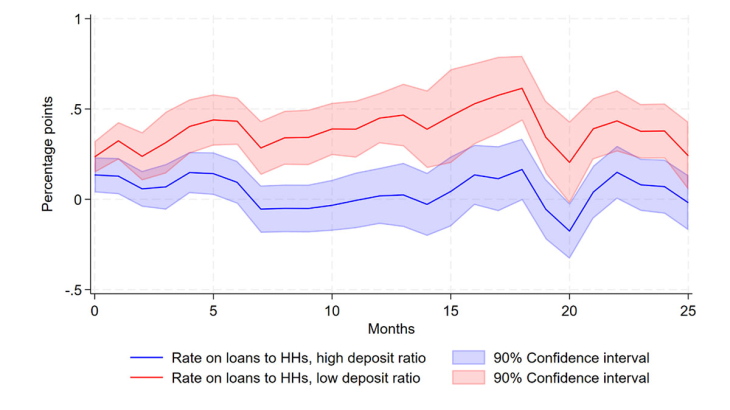

- Loan pricing response: Lending rates rise following monetary tightening, but the magnitude and timing differ across segments. The response of household loan rates is on Figure 1. Corporate loan rates react faster and more strongly than household loan rates.

- Role of deposit funding: Banks with higher reliance on deposits increase lending rates less after a policy hike, reflecting their relatively stable funding costs. Evidence suggests these banks may also contract household lending less sharply, although differences in loan volumes remain modest.

- Alternative funding sources: Interbank and equity funding amplify the pass-through to lending rates, suggesting they are more costly funding than deposits.

Our results highlight that the structure of bank funding is a critical determinant of monetary policy transmission. Heterogeneity across banks means that policy tightening does not affect all institutions—or borrowers—equally. For central banks, understanding these dynamics is essential to ensure effective transmission.