- Home

- Publications et statistiques

- Publications

- Bank stress tests: tools for prudential ...

Post n°195. In order to protect banks from macroeconomic and financial shocks, prudential authorities use a range of risk analysis tools, among them stress tests. What are they? What purpose do they serve? This blog post answers these questions and is accompanied by a second post on the “real-life” stress placed on banks by the Covid-19 crisis.

Anticipating adversity and ensuring the sound financing of the economy by banks

Stress tests first became part of the regulatory framework in 2004 under the Basel II accords: these accords authorised banks to develop their own in-house risk models in order to calculate their capital requirements. At the same time, however, it also became clear that supervisors needed stress-test tools to allow them to verify the soundness of bank models in capturing a deteriorated economic and financial scenario. With the Great Financial Crisis of 2008, these exercises became even more useful, notably for evaluating and communicating on banks’ ability to withstand a shock of that scale. As a result, the Basel Committee introduced its Principles for sound stress testing practices and supervision in 2009. Stress tests have since become a recurrent exercise at the European level and are carried out every two years by the European Banking Authority.

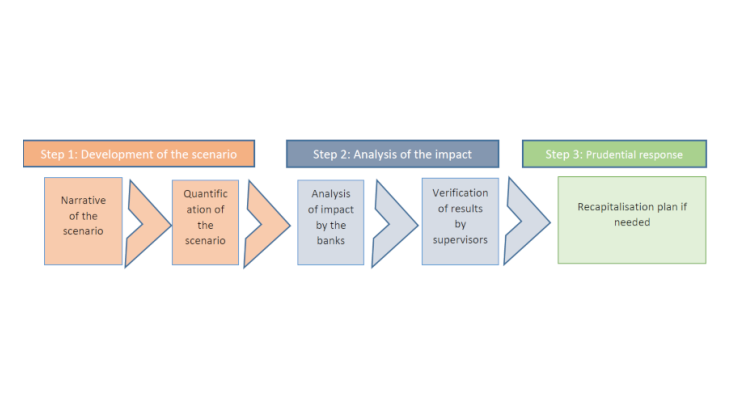

A stress test consists in simulating the impact of an economic and financial crisis on each of the tested banks and, by extension, on the solidity of the banking system. Since 2009, 6 European stress tests have been carried out, each involving three steps (see Chart 1):

- the definition of a unique adverse scenario that is specific to each country, which consists in defining deteriorated trajectories for each relevant macroeconomic and financial variable over the stress-test horizon (generally three years): the main simulated variables are the rate of growth in gross domestic product (GDP), the unemployment rate, interest rates, equity prices and real estate prices. The European Systemic Risk Board (ESRB) is responsible for defining these scenarios and publishing their content for all European Union (EU) countries (see ESRB, 2020 for a description of the scenario for the stress test scheduled for 2020 but postponed due to the Covid-19 crisis).

- an impact assessment, carried out by the banks, which evaluates the consequences of the adverse scenario for their balance sheet (especially for the income from their activities, their own funds and the risks associated with each asset class held). The European Banking Authority (EBA), in close conjunction with the European Central Bank (ECB) and the national supervisory authorities (in France, the Prudential Supervision and Resolution Authority or ACPR), coordinates this exercise and verifies that the banks’ risk assessments are coherent. The authorities then publish the results on their websites, either for each bank individually, or in aggregated form to avoid any stigma;

- a prudential response: if the stress test shows that an institution has insufficient capital, meaning that it does not have enough own funds to absorb the shock resulting from an adverse scenario, the supervisor may then take a number of corrective steps, which can even go so far as a recapitalisation plan. Under the Single Supervisory Mechanism (SSM), this response is the responsibility of the ECB, working in close collaboration with the national supervisors.

The capital ratio: the stress-test thermometer

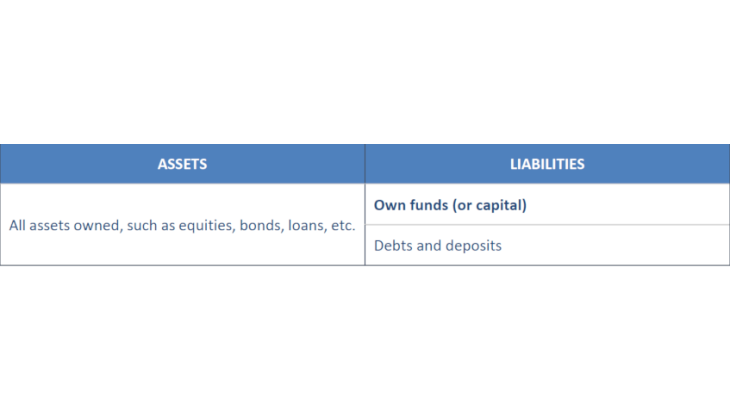

The loss of capital revealed in a stress test is expressed in terms of the decline in the “capital ratio”. Chart 2 shows a very simplified version of a bank balance sheet: the capital (i.e. own funds) is used to cover unexpected losses incurred by the bank on its assets.

The capital (or solvency) ratio is the amount of own funds expressed as a percentage of risk-weighted balance sheet assets, i.e.:

Capital ratio (%) = Own funds/Risk-weighted assets

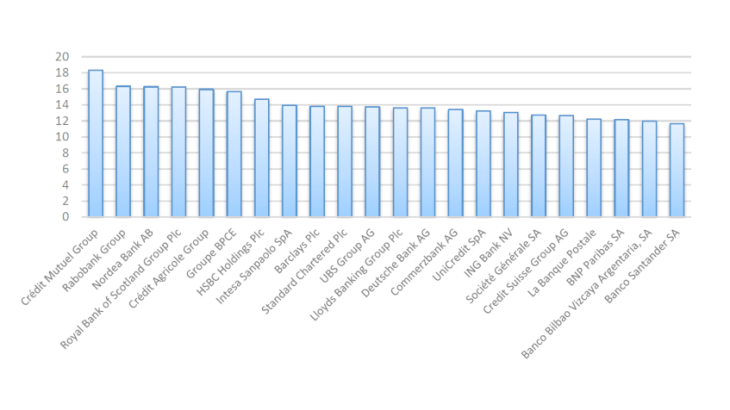

Risk-weighted assets are defined as the sum of each line of a bank’s balance-sheet exposure multiplied by a weighting that reflects that exposure’s level of risk. Certain assets are deemed to be “risk-free” and are given a zero weighting (0%), for example certain government securities or guaranteed securities, whereas others are considered very high-risk and can have a weighting as high as 1,250% (i.e. full coverage of the asset by capital for a regulatory capital ratio of 8%), for example some equity exposures. The capital ratio is thus a useful thermometer, and any deterioration can be the result of (i) a decline in capital linked to losses (numerator effect); and/or (ii) a rise in risk-weighted assets (denominator effect). Chart 3 shows the capital ratios in December 2019 of the 22 largest banking groups in the European Union.

A bank is deemed to be fragile if, under the stress test scenario, its capital ratio is found to fall below the minimum requirement indicated in the regulations, which is specific to each institution depending on the risks to which it is exposed.

Source: SNL.

Analysis of the risks by the supervisors

As a result of its role in financing the economy, a bank is exposed to a number of risks for which it needs adequate capital coverage. An adverse scenario affects various classes of risk, notably:

- Credit risk which reflects the actual or potential losses on a bank’s lending activities caused by the borrower’s inability to honour its commitments.

- Market risk which is linked to fluctuations in the prices of financial instruments (government bonds, corporate bonds, equities, derivatives, etc.).

- Operational risk resulting, for example, from fraud, natural disasters or cyber-attacks.

The channels whereby these risks are transmitted are complex and differ according to each bank’s business model. To illustrate (non-exhaustively):

- A downturn in economic activity reduces banks’ income by slowing demand for new loans (due to a fall in investment and consumption, for example). It also affects borrowers’ (businesses and households) income levels, which may undermine their ability to repay. Losses on default are also higher if the prices of the assets pledged as collateral fall sharply (e.g.: residential real estate in the United States during the 2008 Great Financial Crisis). These heightened risks of potential non-repayment or of a loss of collateral value increase the banks’ capital requirements, while the losses incurred reduce their income.

- The increase in risk aversion raises banks’ cost of refinancing (cost of debt or capital on the liabilities side – see Chart 2); they may then decide to pass these higher costs on to the interest rates charged to borrowers. This can create difficulties for businesses or households that need to renew their loans or borrow at floating rates, slowing the economic recovery and even generating an increased credit risk. Conversely, if banks decide not to pass on the rise in their cost of refinancing to interest rates, their interest margins shrink and hence their income.

Under the coordinated stress-test exercises, the way banks take these transmission channels into account is determined by the prudential authorities, to ensure consistent treatment and comparability of results. In practice, banks are notably required to use a static balance sheet approach: in other words, they must assume throughout the entire stress test that they do not optimise their balance sheet in response to the shocks but instead undergo them “passively”.

While stress tests have become a vital risk management tool for prudential policymaking over the last few years, both in the United States and Europe, the doctrine, models used and even the lessons to be drawn have not yet been harmonised across jurisdictions and are still the subject of debate. They nonetheless remain an extremely useful exercise that provides visibility over the banking system’s ability to withstand adverse shocks and support the economic recovery in less favourable periods. It should also be remembered that, at the European level, they are used as the benchmark for the calibration of certain bank capital requirements, especially those known as pillar 2.

Updated on the 25th of July 2024