Post n°190. Less than a generation lies ahead of us to carry out the bulk of the changes needed to attenuate climate change. Such a rapid transition will imply the loss of a significant share of the physical, human and financial capital accumulated in carbon-intensive sectors. We need to acknowledge this loss and look at ways of making it tolerable.

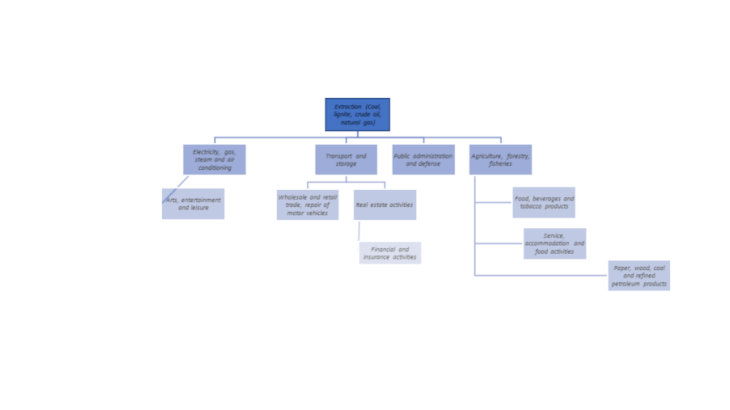

Sources: authors and Cahen-Fourot et al. 2019.

Note: Stranded assets (forced capital under-employment) in the fossil extractive sector will directly or indirectly lead to asset stranding in sectors downstream.

In any case, it will hurt: the dilemma between physical risk and transition risk

The current trajectory of greenhouse gas emissions could subject the Earth's surface to an average global warming of 2.6°C to 4.8°C by the end of the 21st century (IPCC, 2013). Such increases will be accompanied by more frequent and longer waves of extreme temperatures, leading to an unprecedentedly acute deterioration in living conditions on earth and in the capital accumulated so far.

In order to minimise this "physical" risk, it is imperative to limit global warming to 1.5°C by cutting global greenhouse gas emissions to a level close to zero by the middle of the 21st century. We must therefore achieve these objectives within the next thirty years.

This requires a rapid and thorough transformation of our production and consumption patterns, which are currently based on fossil fuels. This, in turn, poses a second type of risk to our economies, known as “transition risk” (Carney, 2015). One of the forms this risk may take is the emergence of a large number of "stranded" assets, i.e. physical capital (machinery, infrastructure), human capital (jobs, know-how) and financial capital made obsolete by the low-carbon transition.

While abandoning fossil fuels will no doubt result in massive losses for the energy sector (pipelines, coal-fired power plants, etc.), other sectors could be just as negatively affected by these changes, notably through a spillover effect. For example, the ending of fossil fuel extraction will have repercussions on the transport sector (thermal vehicles will become stranded assets), which in turn will affect other activities downstream ((Cahen-Fourot et al., 2019, see chart). It should be noted that stranded assets downstream of the production chain may also in return affect assets upstream.

This trade-off between physical risk and transition risk seems to justify strong state intervention to break the dependence on the high-carbon investment path. It is assumed that no sector will be ready to absorb these losses, which must be massive in order to achieve the climate objectives. Other hypotheses are possible, such as the absorption of losses resulting from the energy transition by shareholders and workers of carbon-intensive companies. These are not included in this post.

This state intervention could be planned in order to limit the loss of financial and productive capital, or even human capital, through aid for business conversion or retraining. Introducing a simple carbon price would probably not be enough: if it is too low, it will not allow for a sufficiently ambitious transition, while if it is at an adequate level, and without the presence of transfers, it is likely to run up against political economy constraints that could ultimately render it unviable.

Could transfers be made between winners and losers of the transition?

While the low-carbon transition may generate losses for some economic sectors, we could also hope for gains, possibly even greater than the losses, in other sectors or sub-sectors. Indeed, any economic policy is likely to give rise to winners and losers: a low-carbon effort, for example, would ground most of the aircraft used today to the benefit of rail and river transport. If the losses were compensated or more than compensated by the development of other sectors, a “double dividend” would appear at the macroeconomic level (Goulder, 1995), the gains associated with the transition being both climatic, through the achievement of the objectives, and economic.

In this case, a transition policy is desirable according to the Kaldor-Hicks criterion (Kaldor, 1939). Indeed, Kaldor-Hicks states that an allocation B is socially preferable to an allocation A if, once in the B state, the winners are able to compensate the losers for the inconvenience of moving from A to B. However, according to this criterion, actual compensation is not compulsory. However, the resistance observed so far to certain climate policies suggests that transfers between winners and losers should be made and organised.

This would, for example, involve organising the training and redeployment of workers towards the sectors of the low-carbon economy, partially compensating investors having lost out, or buying back some of the stranded physical capital in order to organise its re-employment. In other words, in addition to the polluter-pays principle on which carbon pricing is based, a "stranded-compensated" principle could be envisaged to facilitate the creation of substitution possibilities between different types of capital.

The question would nevertheless arise as to the possibility of such transfers between winning and losing sectors. First, the winning sectors are currently struggling to emerge and would be penalised by excessively large transfers. Second, and more crucially, it is reasonable to imagine that the low-carbon transition will lead to a net macroeconomic loss, at least in the short term. In this case, the gains achieved by the low-carbon sectors will not be sufficient to offset the losses incurred by the high-carbon sectors. Should the losses then only be borne by the latter?

How to compensate losers if transfers are impossible?

If transfers between private agents prove to be impossible or insufficient, two options remain: either the shareholders and workers of carbon-intensive companies will bear the costs of the transition and the resulting losses, with the risk of a shock to production and employment, or the public sector will bear the losses as a last resort, by having recourse to debt (mitigated if necessary by an ambitious fiscal policy). If the debt is repaid in the next few decades, the winners of the transition (future generations) will have compensated today's losers. These transfers would thus be more a tool for fairly distributing losses than a tool for winners to compensate losers.

The “stranded-compensated” principle could then, for example, be embodied in climate bad banks, based on the model of the institutions created to buy back the illiquid assets of financial agents and prevent their insolvency during the 2008 crisis. These climate bad banks would buy carbon assets that have declined in value, thereby partially compensating investors in carbon-intensive sectors. They could be financed by public debt, with the possible support of monetary policy, or via a European community mechanism, thus reviving the Union's project. In order to mitigate the risk of moral hazard, very recent assets could be bought back at a discount, with strict regulations regarding the construction of new carbon assets.

Of course, the introduction of a "stranded-compensated" principle is not in itself sufficient. Compensating stranded assets could discourage innovation and would raise issues of information asymmetry, allocation and governance in deciding who to compensate first and by what process. Moreover, the idea that the government would organise compensation for these losses raises the question of the sustainability of public debt and the mandate of central banks, especially if monetary financing is involved. Thus, the "stranded-compensated" principle should be accompanied by a reflection on its integration in a broader set of regulations. Nevertheless, it does call for examining the potential of a proactive role for governments in the management of stranded assets, in order to ensure an efficient and fair transition.

Eco Notepad launched its 2020 competition to encourage students to express themselves freely on the issue of climate change. The idea was that all opinions may be expressed as long as they were skillfully argued, even if they did not necessarily correspond to the opinions expressed by the Banque de France. The winners were selected by a jury made up of experts and renowned researchers. The opinions expressed in the selected posts are those of the authors. They do not in any way reflect the position of the members of the jury or that of the Banque de France.

1st prize-winning blog in the 2020 Eco Notepad Challenge - by Mathilde Salin et Louis Daumas : To avoid shipwreck, imagine a "stranded-compensated" principle

Second prize-winning blog in the 2020 Eco Notepad Challenge - By Eugenie Ribault : What if one solution was to empty your neighbours' waste bin?

Concours du blog pour les étudiants 2020 - Remise des prix (FR-EN)

Updated on the 25th of July 2024