ECB publishes supervisory banking statistics on significant institutions for the second quarter of 2025

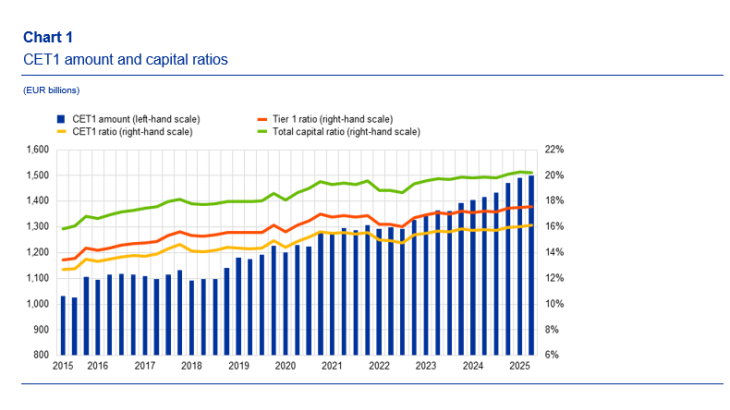

- Aggregate Common Equity Tier 1 ratio at 16.12% in second quarter of 2025, up from 16.05% in previous quarter and from 15.81% one year ago

- Aggregated annualised return on equity at 10.11% in second quarter of 2025, compared with 9.85% in previous quarter and 10.11% one year ago

- Aggregate non-performing loans ratio (excluding cash balances) at 2.22%, down from 2.24% in previous quarter and 2.30% one year ago

- Liquidity coverage ratio at 157.84% in second quarter of 2025, up from 156.24% in previous quarter

Published on 17th of September 2025