Green Finance Research Advances Conference – Paris, 16 December 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

It is a great pleasure to welcome you to the tenth edition of the Green Finance Research Advances Conference. For a decade now, the Banque de France has proudly co-hosted this event with the Institut Louis Bachelier. Today, I would like to pay tribute to Jean-Michel Beacco, the Institute’s General Director, who tragically passed away last September: this conference is part of his enduring legacy.

The very first edition took place in the wake of the Paris Agreement. Precisely ten years after, it’s time to celebrate, with pride and despite the recent noise of “denialists”: yes, the Paris agreement was a decisive breakthrough under the COP 21 French presidency. Yes, the world would be worse off without the Paris agreement and the progress it triggered, although not sufficient. But this anniversary is also a moment for reflection and forward planning; we find ourselves in the posture of Janus, the Roman god of transitions: one face toward the path we have travelled, the other toward the road ahead. In that spirit, I would like to take stock of where we stand ten years after the Paris Agreement (I), and share the convictions that will guide our action in the years to come (II). It’s time to celebrate, but also to combat.

I. Ten years after the Paris Agreement, we have made significant progress both in numbers and substance

A. The quantitative trends show positive signals, but we must not lose sight of what remains to be done

The Paris Agreement has undeniably created momentum for climate action. Global warming projections have fallen compared to 2015: before the Agreement, the world was heading for up to 3.5°C of warming by the year 2100; today, current policies point to around 2.8°C, and full implementation of national pledges could bring this down to 2.3°Ci.

Beyond the need to address macroeconomic and financial risks, the economic rationale for the energy transition is gaining additional ground.

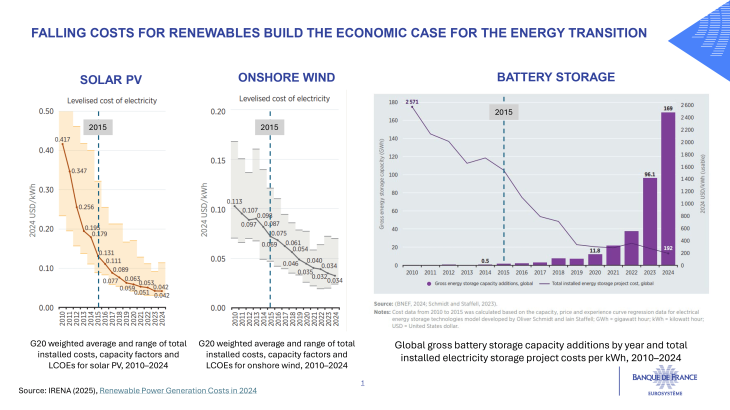

Renewable energy is now the most cost-competitive source of new electricity generation worldwide: in 2024, 91% of newly commissioned renewable projects delivered cheaper power than the lowest-cost fossil fuel alternative, with the levelized cost of energy for solar photovoltaics and onshore wind costing 41% and 53% less, respectivelyii. Renewables therefore dominate new capacity: 92.5% of global power expansion in 2024 came from renewables, bringing total installed renewable capacity to more than half of global power generation capacityiii.

This is progress, but still far from the Paris goal of “well below 2°C” and ideally 1.5°C. 2024 was the first year in which global average temperatures exceeded the 1.5°C threshold for an entire calendar year, reaching 1.6°C above pre-industrial levelsiv. Scientists warn that a temporary overshoot is now inevitable, and without rapid emissions cuts, we are on track for a level of warming that would trigger severe and irreversible impacts.

Despite these warnings, and despite the dynamics on renewables, investments in fossil fuel projects remain stubbornly high. In 2024, global spending on oil, gas, and coal still reached $1.1 trillion, against $2.2 trillion to decarbonized energyv. Our experience over the decade demonstrates that such investments are not just ecologically dangerous, they are financially irresponsible, exposing investors to stranded assets and transition risks.

B. We can be proud of the progress already made in our approach to climate change

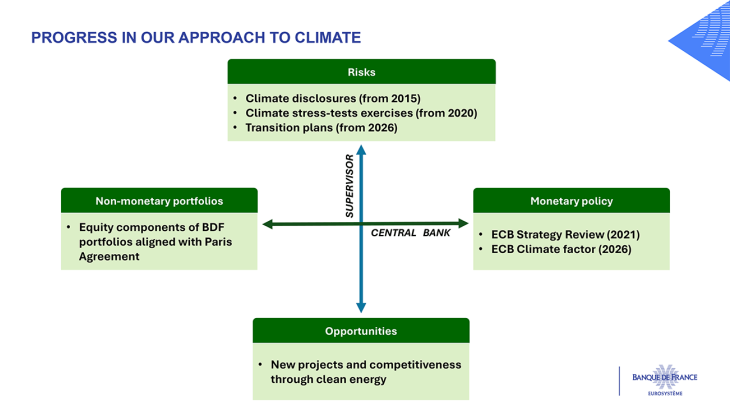

As financial supervisors and central banks, we have adapted our toolkits and integrated climate change along two main lines and between four key areas. These efforts are not cosmetic, nor “activist”; they belong to our core mandates of price stability and financial stability in a world where climate shocks increasingly shape macroeconomic conditions.

As supervisors, we now have a much better understanding of climate-related risks and their transmission channels to the financial system. Disclosures and reporting have been instrumental: they provide a snapshot of an institution’s exposures, enabling supervisors to identify vulnerabilities. By end-2024, over 80% of euro area banks acknowledged material exposure to transition risksvi. The challenge ahead is simplification of reporting without sacrificing quality. In between, we introduced two major new tools: climate stress tests to forecast future risks – they were utopia ten years ago; and new compulsory prudential transition plans (to be submitted by banks by 2026) to reduce these risks.

Turning to monetary policy, the Eurosystem has taken pioneering steps since our Strategy Review of 2021. This is not about “greening” monetary policy for its own sake; it is about safeguarding the resilience of our balance sheet and refinancing operations against climate-related shocks. The most recent milestone came in July 2025, when the ECB announced the introduction of a “climate factor” in its collateral frameworkvii. Starting in 2026, corporate assets pledged as collateral will have their value adjusted based on their exposure to climate transition risks. Carbon-intensive assets will face higher haircuts.

Finally, Banque de France is also an investor, and we have a duty to lead by example. That is why we have adopted a Responsible Investment approach in 2018, which now covers portfolios worth EUR 130 billion. We have aligned our own-account equity portfolios with a 1.5°C warming trajectory in 2023 and applied Paris-aligned fossil fuel exclusion thresholds for oil and gas to all our own-account portfolios in 2024.

I must highlight one key enabler of this progress: the Network for Greening the Financial System (NGFS), for which we proudly host the Secretariat at Banque de France. From 8 founding members in 2017, the network now counts 148 members across 91 countries and has released over 50 publications that inform policy worldwide. We regret the withdrawal of most of the U.S. institutions from the NGFS, but it does not block us from working further, and it won’t. In a context where progress in traditional international forums is stalled for U.S. unilateral political reasons, the NGFS demonstrates the value of a “coalition of the willing”: it is a model that could inspire cooperation on other global issues and common goods, such as open trade or fair taxation.

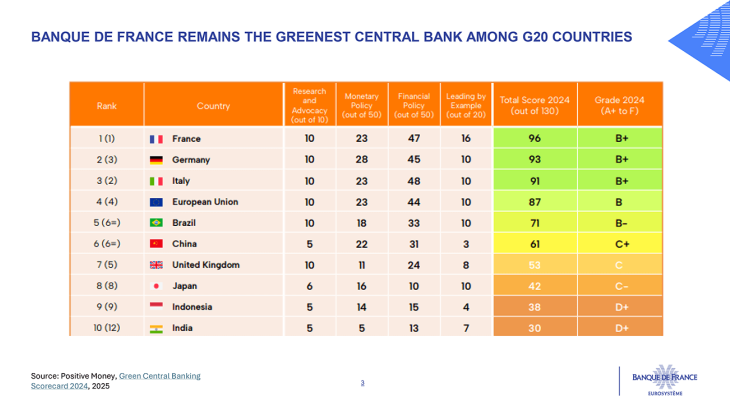

Thanks to all these achievements, the Banque de France has been acknowledged by NGOs as the greenest among the G20, for the third time in a rowviii. But we will not rest on these laurels.

II. To counteract the weakening of climate ambition, we must combat certain misconceptions

Looking forward, as climate-related issues are increasingly and unfortunately politicized, let me state the obvious: the reality of climate change is here to stay. One does not cure a fever by breaking the thermometer. Denial does not eliminate risk, it amplifies it. At the same time, we must reject the false narrative that the transition is only a burden for the economy. Yes, the transition will be costly in the short run. But it also represents a historic opportunity for Europe: to modernize our economy, strengthen competitiveness, and secure long-term prosperity. The transition is essential to ensuring both environmental and macrofinancial stability, which are the foundations of economic growth. This conviction must guide our action in the coming years.

A. First, the energy transition is compatible with economic rationality

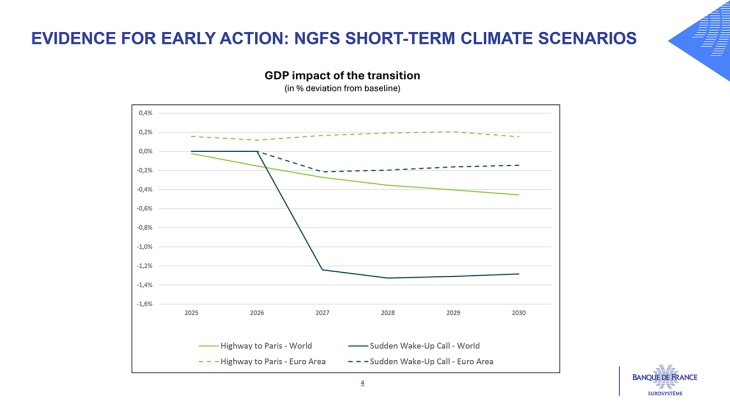

The NGFS climate scenarios are a key resource to inform decision-makers and anchor the debate in science-based evidence rather than perception. Developed jointly with the scientific community, they quantify both transition and physical risks and assess their macroeconomic and financial implications. We are continuously improving sectoral and regional details, and will publish updated scenarios by end-2026.

What our work already shows very clearly is that, at the global level, investing in the transition is economically rational. Early and ambitious climate action reduces long-term macroeconomic losses by limiting physical damages and avoiding abrupt, disorderly adjustments later on. In parallel, NGFS short term scenarios find that early action could halve the cost of the transition by 2030, at 0.5% of global GDP against 1.3% in the case of a three-year delay.

However, we must be pragmatic. The global political landscape is heterogeneous, and not all countries are moving at the same pace. This calls for a more strategic allocation of mitigation efforts. Supporting low-carbon investment in emerging and developing economies can be both a matter of international responsibility and economic efficiency, as the same euro invested can often deliver higher emissions reductions than in advanced economiesix. This is not a trade-off, but a way to maximise global climate impact and maintain the 1.5°C target within reach for 2100.

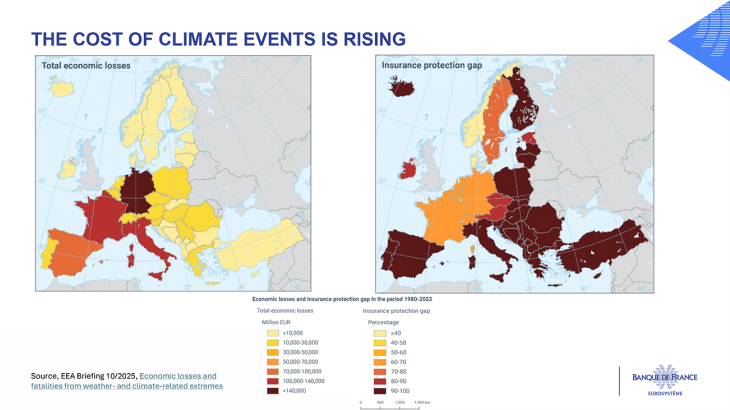

However, the likely climate overshoot and the already tangible impacts of climate change compel us to dedicate resources to adapt our economies and infrastructure to withstand climate shocks. The increasing cost of extreme weather events already provides a clear signal. Since 1980, extreme events, such as floods, heatwaves, wildfires, and droughts, have caused more than €800 billion in losses in Europe, with more than a quarter of these losses occurring in just the last few yearsx. Globally, only around 40% of recent disaster losses are insured, leaving a growing share of risks borne by households, firms and public budgetsxi. Two years ago, nobody cared about this “insurability” issue; now it’s everywhere in the media and in deciders’ minds. In this context, adaptation is not a substitute for mitigation, but a rational complement: a form of economic “insurance” against risks that are already materialising.

B. Second, the energy transition is compatible with the EU’s strategic autonomy

It is too often argued that accelerating the green transition could weaken Europe’s position in global markets or divert resources from other strategic priorities. On the contrary, as highlighted by the Draghi report, clean technologies and energy efficiency are environmental imperatives as well as industrial opportunities.

Reducing our reliance on imported fossil fuels enhances energy security and shields us from geopolitical shocks: after the two oil shocks of 1973 and 1979, and the Russia shock of 2022, we have had more than enough of early warnings and wake-up calls. The volatility of fossil fuel prices has repeatedly strained European budgets and exposed vulnerabilities during crises. But in 2024 alone, renewables avoided an estimated 467 billion US dollars in fossil fuel costs globallyxii.

True, the investment needs are significant: according to I4CE, the current gap is estimated at €344 billion per year in the EUxiii. But these investments enhance sovereignty and competitiveness, with the private sector playing a crucial role in achieving these targets. Each year, Europe exports about EUR 400 billion of its abundant saving, net, for investment outside of Europe. That is why our Savings and Investments Union (SIU) must play a key role in mobilising private funding for this transformation.

Ten years after the Paris Agreement, we can celebrate, but we must keep up the fight. At Banque de France, we will continue to make the fight against climate change a priority, strengthening our understanding of a changing world in order to better fulfil our mandates. In that spirit, I would like to wrap up with five commitments.

First, as regards our proprietary portfolios, after aligning all our equities holdings, we are committed to pursue this effort by aligning our corporate bonds’ portfolio with a 1.5°C trajectory by the end of 2026.

Second, we will work with French and European banks to help them develop and implement credible and operational prudential transition plans starting next year.

Third, together with the ECB, we will integrate a climate factor into the framework for private collateral by the second half of 2026.

Fourth, we will maintain and reinforce the NGFS Secretariat in Paris, with NGFS deliverables that aim to continue to clarify the “economy of climate”, including a package of notes on nature data and supervision in March 2026, the updated guide for supervisors in July, and the phase VI of NGFS long-term scenarios in November.

Fifth, we will work with the ECB Governing Council and European authorities to accelerate the Savings and Investments Union, to better mobilise European savings in support of the energy transition.

The path before us is clear, but it requires political will and collective action. Six years ago, here in Paris for a seminal NGFS Conference, I quoted the political philosopher Thomas Paine who said in The American Crisis (circa 1776): “If there must be trouble, let it be in my day, that my child may have peace.”

I wish you all a productive conference.

Thank you.

i UNEP (2025), Emissions Gap Report 2025

ii IRENA (2025), Renewable Power Generation Costs in 2024

iii IRENA (2025), Renewable Capacity Statistics

iv Copernicus (2025), 2024 is the first year to exceed 1.5°C above pre-industrial level

v IEA (2025), World Energy Investment 2025

vi Frank Elderson, ECB blog post (2024), “Failing to plan is planning to fail’’ – why transition planning is essential for banks.

vii ECB (2025), Press release ECB to adapt collateral framework to address climate-related transition risks

viii Positive Money (2024), The Green Central Banking Scorecard: 2024 Edition

ix NBER (2023), Think Globally, Act Globally: Opportunities to Mitigate Greenhouse Gas Emissions in Low- and Middle-Income Countries

x European Environment Agency (2025), Economic losses from weather- and climate-related extremes in Europe

xi SwissRe, Sigma 1/2025, Natural catastrophes: insured losses on trend to USD 145 billion in 2025

xii https://www.irena.org/News/pressreleases/2025/Jul/91-Percent-of-New-Renewable-Projects-Now-Cheaper-Than-Fossil-Fuels-Alternatives

xiii I4CE (2025), The State of Europe’s Climate Investment

Download the full publication

Updated on the 16th of December 2025