Understanding the causes of inflation between 2021 and 2023: a semi-structural approach

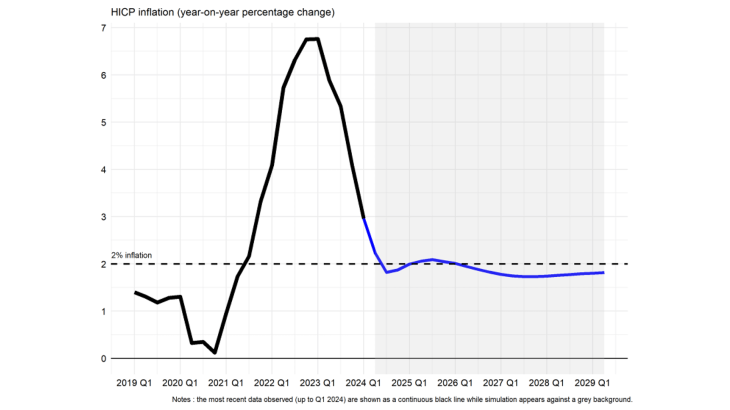

Inflation in France (measured in this post using the Harmonised Index of Consumer Prices, HICP) rose by 2.1% in 2021, before reaching 5.9% in 2022 and 5.7% in 2023. Several factors may have contributed to this increase, including disruptions to global supply chains during the post-pandemic recovery, the increase in energy and food prices following the Russian invasion of Ukraine, and tightness in the labour market.

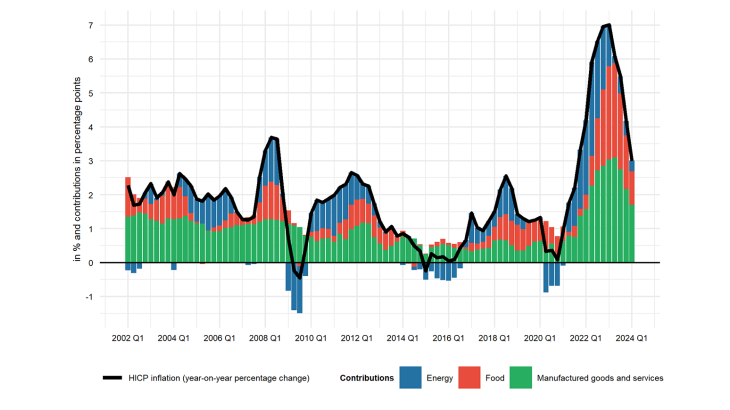

Inflation, a macroeconomic variable, is measured by the change in an index that combines the prices of different products (energy, food, manufactured goods and services). Chart 1 shows the contribution of energy and food to consumer price inflation between 2021 and 2023. However, this “accounting” breakdown does not isolate the causes of past inflation. So, while energy price shocks directly impact the contribution of energy to inflation, they can indirectly impact other components as energy is an input for producing many goods and services. Furthermore, a rise in energy prices can translate into higher wages, triggering a wage-price spiral.

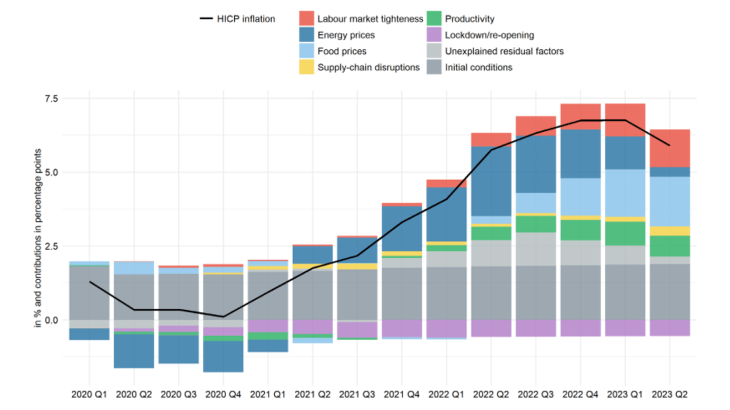

To isolate the factors that underpin inflation, Bernanke and Blanchard (2023) have developed a semi-structural econometric model, initially applied to the US economy. Under this model, the rise in inflation (just like movements in wages and inflation expectations) is attributable to shocks affecting different variables such as the tightness of the labour market (measured by the ratio of job vacancies to the number of unemployed), energy and food prices, supply chain disruptions and trend productivity. According to their analysis, the surge in US inflation from 2021 on (from 1.2% in 2020 to 8% in 2022) was mainly caused by commodity price shocks and supply chain disruptions. The tightening of the labour market was not a decisive factor for inflation until Q1 2023. However, the effects of overheating in the labour market could have materialised subsequently, given the greater persistence of higher wages. These latter considerations had initially led the authors to contend that the ‘last mile’ on the road to achieving the Federal Reserve's 2% inflation target could have been harder than anticipated.

Chart 2: Inflation in France driven primarily by the impact of energy prices, followed by food prices