In 2022, the euro area experienced one of its steepest ever rises in energy prices, comparable in scale to the 1970s oil shock. At its peak in the third quarter of 2022, the composite index of energy prices (oil and gas) was 84% higher than at the end of 2021, which is when prices first began to rise (see Chart 1). To preserve household purchasing power, the French government chose to act directly on energy prices via a “tariff shield”, rather than on income via compensatory transfers (the latter were indeed used, but played a smaller role; see box). In France, therefore, the tariff shield accounted for around three-quarters of total fiscal spending on inflation protection in 2022-23.

To evaluate the macroeconomic impact of the tariff shield, we use two complementary exercises. In the first, we look at the effect of the tariff shield implemented in France and set out in the initial budget law for 2024, and compare it with a counterfactual scenario of the observed rise in wholesale energy prices between 2021 and 2023, but excluding all government compensation measures. Then, using simulations based on a standardised shock, i.e. a 100% shock to energy prices lasting two years, we analyse the tariff shield in greater detail to see how the effects break down across economic agents. In both exercises, the tariff shield is represented as an equivalent, unfunded reduction in indirect taxes on households (similar to a value added tax – VAT – on energy products), which reflects the fact that final energy prices are lower than if they had been allowed to rise freely and that, in exchange, the government transfers public money to energy suppliers. We perform these analyses with a large-scale, semi-structural model developed by the Banque de France, FR–BDF, which is used for medium-term projection exercises and economic policy analysis (for further details on the model, see Appendix 1).

The main results are as follows:

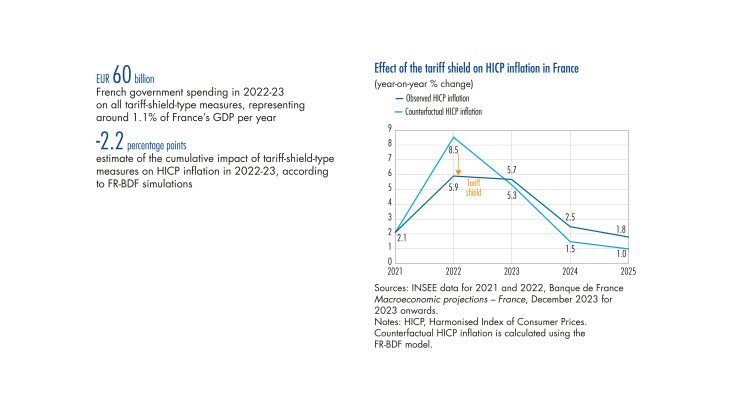

• According to our analyses, the tariff shield deployed as of 2022 represented a cumulative fiscal cost of 2.2% of GDP over 2022-23, and helped to smooth harmonised (HICP) inflation in France, with an impact of -2.6 percentage points in 2022, and then +2.2 percentage points over 2023-25 related to the phasing out of the shield. …