In the aftermath of the Covid-19 crisis, we have entered in a new monetary policy phase, with most of the major central banks increasing their policy rate. In this context, the question of spillovers from monetary shocks is back to the forefront. Emerging economies have been historically sensitive to changes in Fed’s monetary policy because of their trade and financial links with the US. In this paper, we take a new perspective on this question, studying a financing tool at the crossing between trade and finance, namely trade credit. Trade credit takes the form of a credit made by the supplier to its client by paying for the production of the good and allowing the buyer to pay with some delay after delivery. Using an original proprietary database, we study the effect of US monetary policy shocks on those inter-firm credits, provided by foreign suppliers to buyers in Mexico. We take advantage of granular data to disentangle between the channels of impact. We highlight how trade credit can substitute to other financing tools and act as a partial financial buffer against the negative impact of US monetary policy tightening in emerging economies.

Looking at the relationship between trade credit and other sources of firms’ financing (mainly bank credit), the literature has not reached consensus on the complementarity or the substitutability of the financing sources. Nilsen (2002), Minetti et al. (2019) and more recently Hardy et al. (2022) highlight how firms substitute bank credit with trade credit when the former becomes scarce. However, Love and Zaidi (2010) and Garcia-Appendini and Montoriol-Garriga (2020) show that, in times of crisis, trade credit is likely to dry out as suppliers become more financially constrained. In this paper, we contribute to this debate studying the specific reaction of trade credit in times of tighter global conditions triggered by shocks in US monetary policies.

To do this, we conduct a panel data analysis on trade credit amounts at the firm level, from July 2010 to June 2019. We use an original proprietary database from one of the top three trade credit insurers worldwide, named Coface. It records firm-to-firm insured trade credit from foreign suppliers to buyers in Mexico, on a monthly basis. We control for a trade effect to focus on the financial dimension of trade credit, while accounting for an insurance effect. We avoid potential endogeneity bias by studying the effect of unexpected changes in US monetary policy shocks, following Gürkaynak et al. (2005) and Jarocinski and Karadi (2020).

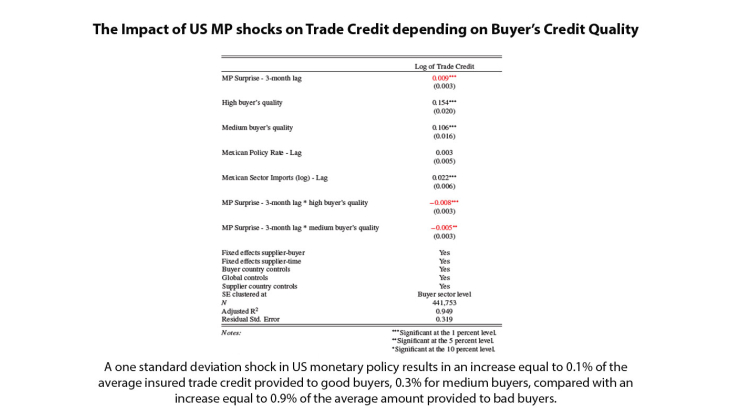

We find a positive and significant impact of an unexpected US monetary policy tightening on the amount of insured trade credit provided by foreign suppliers to buyers in Mexico. We identify a stronger impact for trade credit in US dollars and for trade credit towards sectors with low export orientation. We investigate further this financing role of trade credit and find a positive effect for low credit quality buyers, attesting that more financially constrained firms tend to request additional trade credit to face adverse shocks. When separating across intensive and extensive margins, we find that this positive effect for low credit quality buyers only holds at the intensive margin, namely for pre-existing relationships, a necessary condition for suppliers to accept providing more trade credit to their constrained buyers. Finally, we test for the effects using ECB monetary policy shocks and do not find a similar pattern of results.