A large number of commentators have questioned the role of monetary policy tightening in the current decline in inflation, with some arguing that the latter is essentially due to the unwinding of previous supply shocks (Sandbu, 2024). According to this assumption, central banks would not have needed to raise interest rates as much as they did, and more generally, the role of monetary policy would be overestimated.

In order to shed light on this debate, this post assesses the effects of the European Central Bank's (ECB) actions, by examining two counterfactuals that answer the following questions: How would the euro area economy have evolved if:

• the ECB had not reacted to the recent surge in inflation?

• the ECB had pursued a more aggressive policy?

Answering these questions remains difficult, however, as counterfactuals consider “what might have happened”, which is by nature unobservable. There are no empirical data for events that did not occur.

Examining counterfactuals generally requires the use of theoretical and statistical models, which are representations of the economy. Such models make it possible to experiment with alternative policies in order to assess their economic effects. An economic model is like a time machine, which enables us to relive past experiences.

In order to conduct these counterfactual experiments, we need to know the economic effects of a change in monetary policy (via the key interest rate). Within an empirical model, however, estimating these effects comes up against a causality problem, since monetary policy is decided on the basis of the economic situation. This problem is usually solved by identifying the economic effects of an unanticipated change in monetary policy, better known as a “monetary policy shock”. Once all monetary shocks and their effects have been identified, it is then possible to simulate how the economy would behave under an alternative monetary policy, simply by modifying the shocks according to the scenario chosen.

In this post, we use a so-called “vector autoregression” model, estimated on quarterly euro area data over a period from the start of 1990 to the end of 2019. It has the advantage of being estimated on the basis of observed data, without imposing excessive theoretical constraints. The statistical shocks identified are combinations of economically interpretable (so-called “structural”) shocks defined by fairly simple theoretical choices. In particular, monetary policy shocks are identified using “sign restrictions” on the impulse responses of the economic variables. More precisely, all economic shocks that jointly generate a rise in the short-term nominal interest rate and a fall in economic activity and prices are isolated and identified as monetary policy shocks. For an overview of all the variables and restrictions used in the model, the reader is referred to the article by Baumeister et Benati (2013).

What if the ECB hadn't reacted to the recent surge in inflation?

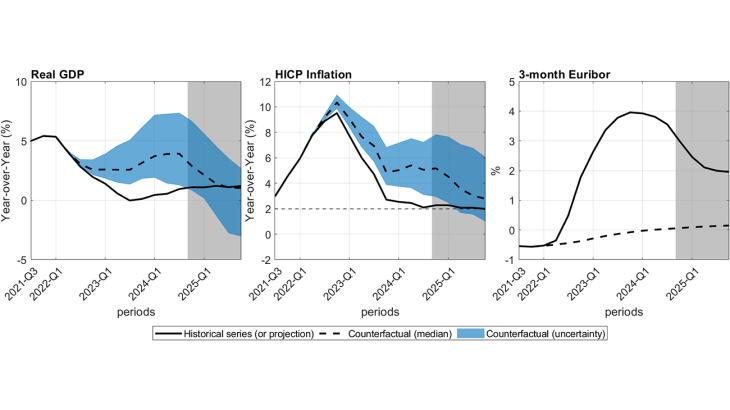

To answer this first question, the simulation starts just before the post-Covid rise in inflation and the invasion of Ukraine: the 3-month nominal interest rate (Euribor) in the model is constrained to follow the path expected by market participants in December 2021 (ECB (B)MPE projections), corresponding to a slight rise in this rate to around 0.15% by the end of 2025 (compared with an initial level of -0.5%). In this counterfactual scenario (Chart 1), the ECB would have completely disregarded the prescriptions of an inflation-fighting framework, such as the Taylor rule.

Initially, the decline in inflation from the end of 2022 would have been close to the historical scenario. Two factors may explain this result: i) during this period, the unwinding of initial energy supply shocks was the main driver of disinflation; ii) the lags in the transmission of monetary policy to the economy are generally quite long. Very short-term effects are therefore modest.

From mid-2023 onwards, the counterfactual inflation path diverges from the path actually achieved. Without monetary tightening, the disinflation process would have stalled. The simulated inflation rate would on average have been 2 percentage points higher than that observed in 2023, and around 2.8 percentage points higher in 2024 (i.e. an inflation rate still above 5%, compared with 2.4% in 2024).

Without monetary policy tightening, aggregate demand would certainly have been more stimulated, leading first to higher real GDP growth. But this would then have been followed by a more severe economic slowdown, when the central bank would have had to tighten policy more sharply to bring inflation back towards its 2% target.

What if the ECB had been more aggressive?

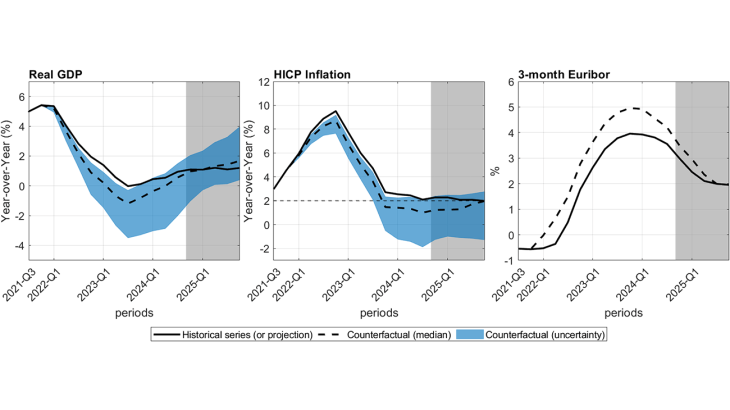

The second counterfactual simulation considers a scenario where monetary policy would have reacted more strongly to inflation deviations from its 2% target. This is achieved through a faster and stronger increase in the nominal interest rate. Specifically, the interest rate begins to rise in the first quarter of 2022, reaching 5% by the end of 2023 (compared with 4% in the historical scenario).

Thanks to this more aggressive monetary policy, inflation declined more rapidly, but at a substantial cost in terms of GDP loss (Chart 2). By adopting such an approach, the ECB would not have been able to achieve a so-called “immaculate disinflation” scenario, in which inflation is reduced without causing a recession. This recession would have lasted one year, from Q2 2023 to Q1 2024, with a maximum fall in real GDP of 1.20% according to the median estimate (or 3.5% according to the uncertainty band).

In addition, in such a counterfactual, most of the model's uncertainty band lies below the 2% inflation target. In other words, with this more aggressive policy, there would have been a significant risk of inflation remaining permanently below 2%.

Chart 2 - Counterfactual #2: the ECB reacts more strongly to inflation