Following calls for action to financial institutions at the Paris summit in December 2015 (COP21), coalitions for sustainable finance have urged investors to enhance their climate-related disclosure on a voluntary basis. In this paper, we ask instead whether imposing a mandatory disclosure to financial institutions actually leads them to divest from carbon-intensive securities. We study the effects of a recent French law (article 173-6 of the TECV law, for Transition Energétique et Croissance Verte, in english Energy Transition and Green Growth), which pioneered such regulation on climate-related disclosure. Passed in August 2015 in the run-up to the COP21, the law entered into force as soon as January 2016. This new regulation - unique at that time - imposes on institutional investors registered in France a new detailed reporting on both their exposure to climate-related risks and their efforts to mitigate climate change.

We focus on investors' holdings of securities, bonds and stocks, issued by firms in the fossil energy industry, responsible for the bulk of global greenhouse gas (GHG) emissions. In 2019, coal, oil and natural gas accounted for 81% of world primary energy supply according to the IEA, for 75% of global GHG emissions and 90% of carbon dioxide emissions. We first construct an exhaustive dataset of all securities, bonds and stocks, issued by fossil energy companies worldwide and outstanding during the period from 2013 Q4 to 2019 Q3. We select them from two industry classifications: Thomson Reuters' Business Classification (TRBC) and Bloomberg's Industry Classification system (BICS). In a second step, we merge this list of securities with Securities Holdings Statistics (SHS), a unique proprietary dataset of the Eurosystem which covers the entire universe of securities (bonds and stocks) held by investors domiciliated in the euro area.

We first provide new information about the financing of the global fossil energy industry. Euro area investors as a whole held in September 2019 around EUR 600 billion of securities issued by 2,157 fossil energy firms worldwide. Investments into the fossil energy sector by euro area financial institutions have grown (in market value terms) since 2013, from EUR 377 billion to EUR 488 billion at the end of our period.

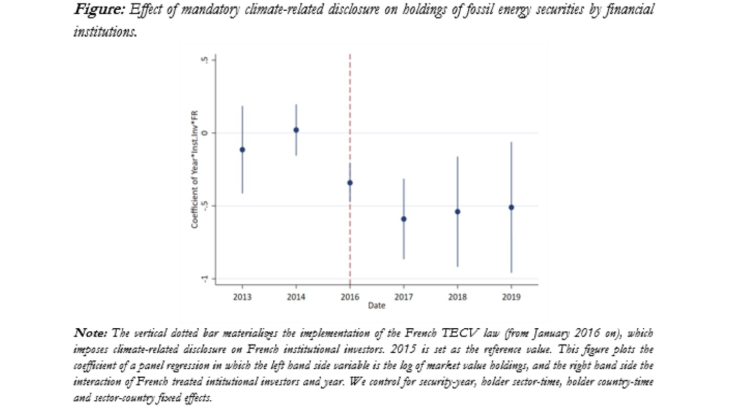

We then exploit this dataset to analyze the consequences of the French TECV law of 2015. The granularity of our data allow us for a proper causal identification of its effects on the amount of funding allocated into the fossil energy industry. The provisions of article 173-6 explicitly target two types of financial institutions: insurance companies and pension funds, and all other asset management firms and mutual investment funds, commonly dubbed “institutional investors”, but not banks. This provides us with neat treated and control groups of holder sectors: we compare, before and after December 2015, the holdings of individual fossil energy securities by institutional investors in France (treated) with those by banks in France and all financial sub-sectors in all other countries (controls).

We find evidence of a sharp relative decrease in holdings of fossil energy securities in the portfolios of treated investors once the TECV law is implemented, as compared to holdings by our control group. The effect of the mandatory climate-related disclosure on investments into these carbon-intensive companies is strongly significant, both statistically and economically. Our results points to a relative reduction in holdings by 39% on average in the portfolios of treated investors. Considering the volume of outstanding investments into fossil energy by French institutional investors at the end of 2015 as a reference point, this suggests EUR 28 billion of fundings have been redirected out of this industry by treated investors (mutatis mutandis).