- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Septe...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

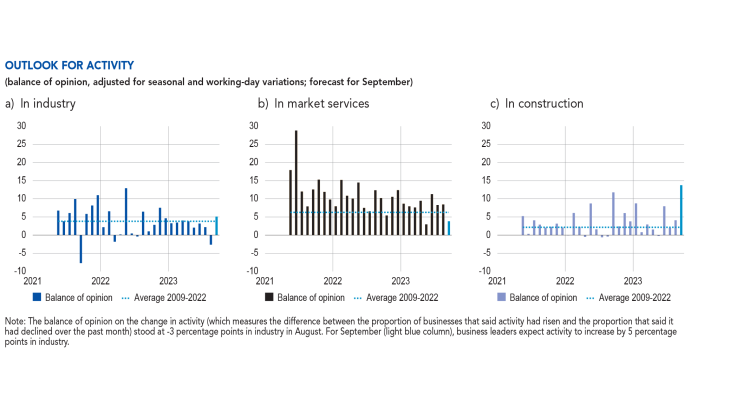

According to the business leaders participating in our survey (around 8,500 companies or establishments interviewed between 29 August and 5 September), activity rose in August in the services and construction sectors, but fell in industry, mainly as a result of prolonged summer closures in certain sectors. For September, business leaders expect an increase in activity in the three main sectors, albeit with a slowdown in services. In industry, September’s recovery should be driven by postponed production from August, particularly in the automotive and aerospace sectors. In addition, order books fell below their long-term averages.

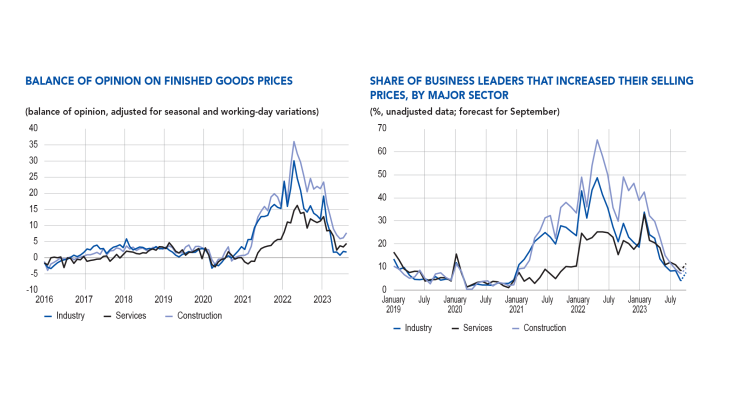

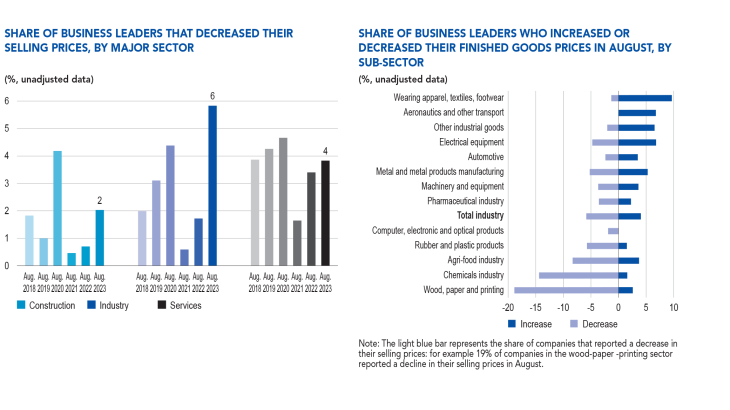

Supply difficulties continued to abate in the construction sector (10% of companies reported such difficulties in August, after 13% in July) and in industry (17%, after 21%). For the fifth month in a row, manufacturers reported a sharp fall in raw materials prices, while finished goods prices stabilised. In all three major sectors, the share of companies that increased their selling prices in the previous month continued to fall, returning to close to their pre-Covid levels.

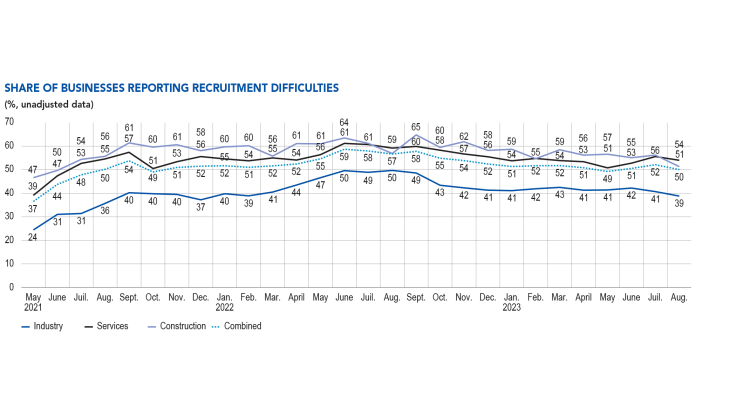

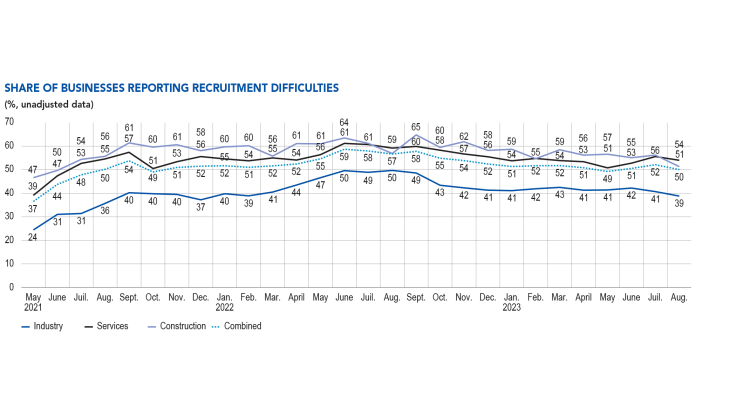

Recruitment difficulties eased somewhat, but still affected half of all companies (50%, down from 52%).

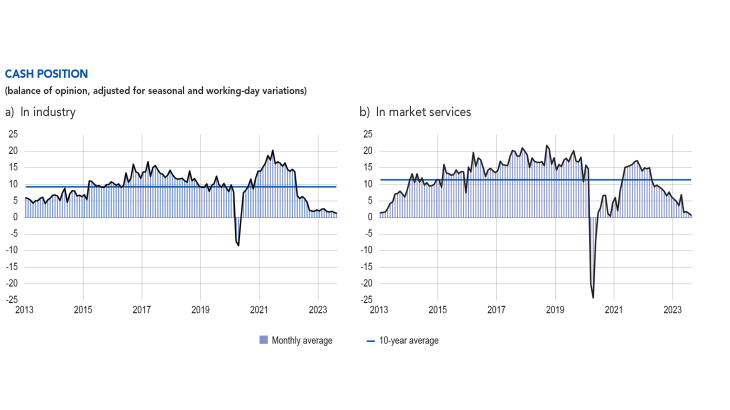

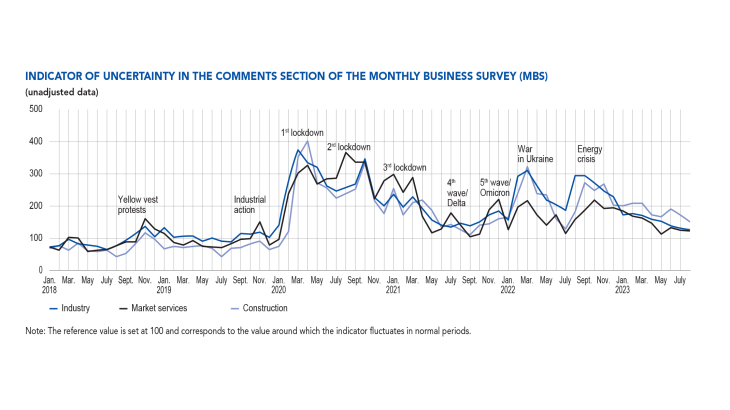

Our uncertainty indicator fell in the construction sector and remained stable in industry and market services. The cash position remained weak in industry and services.

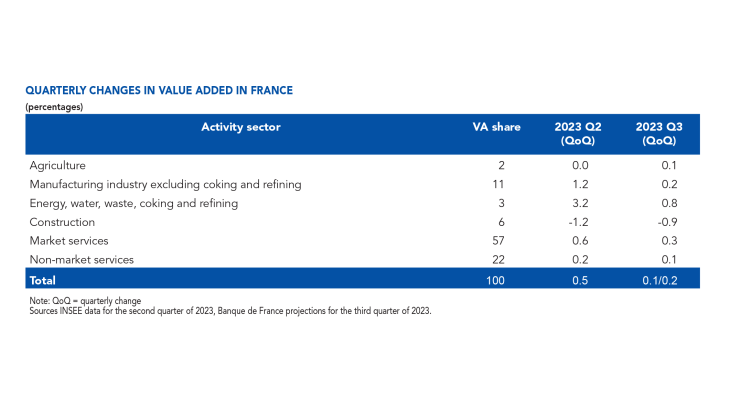

Based on the survey results, supplemented by other indicators, we estimate that GDP will continue to grow in the third quarter of 2023, but at a much more moderate pace (between 0.1% and 0.2% quarter-on-quarter, after 0.5% in the previous quarter).

1. Activity increased in services and construction in August, but declined in industry

In August, industrial activity contracted. This decline was particularly pronounced in certain sectors, for different reasons. In the aeronautical industry, activity fell sharply; the capacity utilisation rate (CUR) was down by 2 percentage points compared with July (from 76% to 74%), due to production being postponed until September as a result of a combination of supply and recruitment difficulties. In the automotive industry, the somewhat sluggish final demand weighed on activity across the sector as a whole, particularly in the rubber-plastics sector. Lastly, in the wood-paper-printing sector, activity was affected by a decline in demand for paper from large retailers and in demand for wood from the construction industry.

Conversely, the pharmaceuticals sector saw an upturn in activity, thanks to precautionary stockpiling and greater visibility over order book developments.

Computer, electronic and optical products enjoyed strong growth, driven by demand for electronic components and the military market.

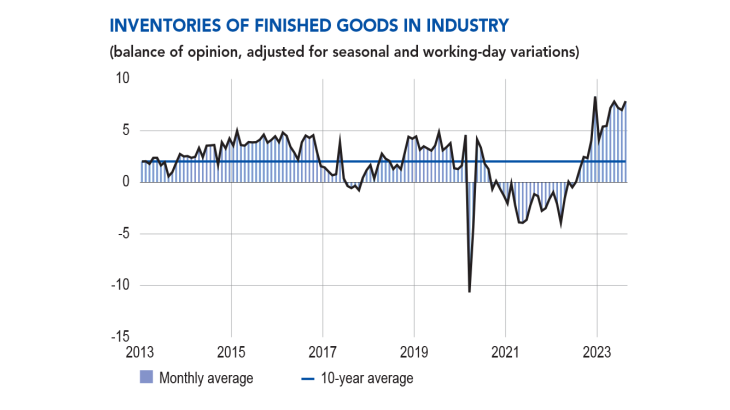

Inventories of finished goods rose slightly in August, with contrasting developments across sectors. In pharmaceuticals, computer, electronic and optical products grew more strongly. Conversely, inventories shrank in the chemicals, plastics, aerospace and automotive sectors.

In market services, activity continued to firm. In business, services, legal and accounting activities, management consultancy and IT services were the most buoyant, while information services performed poorly. In personal services, recreation and personal services recorded strong growth, while the car rental and repair sector and the accommodation and food services sector contracted.

Activity in the construction sector rose slightly, in both structural and finishing works.

The balance of opinion on the cash position was stable overall in industry and remained below its long-term average.

2. In September, business leaders expect to see growth in all three main sectors, although service sector activity is likely to slow.

In September, business leaders expect activity to a rebound in industry. This is likely to be particularly marked in the automotive and aeronautics sectors, and to a lesser extent in machinery and equipment, due to the postponement of production from August. In pharmaceuticals and computer, electronic and optical products, the strong performance seen in August is set to continue into September.

In market services, growth is expected to continue albeit at a slower rate. Some sectors are likely to experience a sharp downturn, notably recreation activities and personal services, while the publishing, IT services, legal and accounting and management consultancy sectors should see a slowdown in activity. Conversely, activity is expected to rebound in the automotive repair and accommodation and food services sectors.

Lastly, in construction, activity is expected to firm in both structural and finishing works.

Our monthly uncertainty indicator, constructed from the text mining of surveyed companies’ comments, declined for the second month in row in construction. It remained stable in industry and market services.

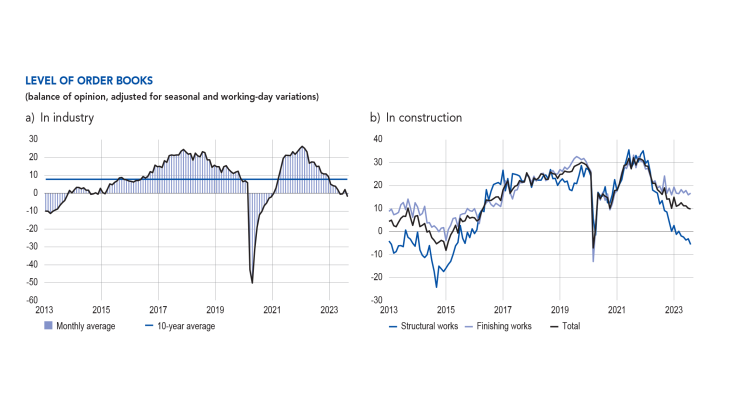

The balance of opinion on order books in industry waned in August. They were particularly low in wood-paperprinting,the chemicals industry, rubber-plastics and the agri-food industry.

In construction, order books stabilised. Since mid-2022, the decline in order books in construction has been mainly attributable to the structural works sector, which has suffered from the sharp drop in new builds. In contrast, order books for the structural works sector have been stable since last autumn, at a level that remains above the long-term average.

3. Supply difficulties are abating; selling prices are rising at a rate close to their pre-Covid level

In August, supply difficulties subsided in industry (affecting 17% of businesses after 21% in July) and in construction (10% after 13%).

In industry, the balance of opinion on raw materials prices suggests a continued fall, for the fifth month in a row, but at a pace that is gradually slowing. The balance of opinion on finished goods prices stabilised.

More specifically, 4% of business leaders reported an increase in their selling prices this month, compared with 9% last month and 21% in August 2022.. Moreover, 6% of business leaders said that they lowered their selling prices in August, in line with the easing of raw material prices; by comparison, this share was around 3% during the pre-Covid period (2017-2019), and had fallen to almost 1% a year ago. Falls in finished goods prices are most widespread in the wood-paper-printing and chemicals sectors.

In construction, 7% of companies increased their selling prices this month (compared with 9% the previous month, and 30% in August 2022), while 2% of companies reported price cuts, compared with less than 1% on average between mid-2021 and the end of 2022.

In services, 8% of companies reported a rise in their selling prices, compared with 11% last month and 15% a year ago.

Business leaders were also asked about their recruitment difficulties. These difficulties eased in August, affecting 50% of the companies surveyed across all sectors, compared with 52% in July; they remain particularly high in the aeronautical sector.

4. Our estimates suggest moderate growth in activity in the third quarter

For the third quarter of 2023 as a whole, we estimate that the volume of GDP will rise slightly, by between 0.1% and 0.2% compared with the previous quarter. After a much stronger-than-expected rise in GDP in the second quarter, driven in particular by the catch-up in energy production, economic activity is expected to have slowed during the summer, but to continue to have grown, driven by the manufacturing, energy and market services sectors.

The manufacturing industry has been particularly bolstered by the transport equipment sector, which is benefiting from a catch-up effect following the end of the disruption to value chains. The energy sector should continue to enjoy the positive impact of power stations reopening, although this effect should gradually fade. Lastly, services proved resilient over the quarter.

Granular survey data, together with other available data (INSEE and high-frequency data), point to an upturn in activity in July, with a slight decline in industry in August (due to the one-off fall in activity in the transport equipment sector), but a recovery in September. Value added in market services should continue to increase, including in August, driven in particular by household services (recreation activities and personal services) and business services. However, the high-frequency data that we monitor alongside the survey data suggest that transport services and retail trade sectors are declining.

Download the paper

Updated on the 25th of July 2024