- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Novem...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

According to the business leaders surveyed (approximately 8,500 companies or establishments surveyed between 29 October and 5 November), economic activity continued to grow in October, driven by market services, certain industrial sectors, and a rebound in construction. Industrial production increased more than expected, underpinned by aeronautics, chemicals, and capital goods, while the agri-food and automotive sectors recorded a decline. Market services posted clear growth in business services, food services, and temporary work.

In November, activity is expected to continue to grow in industry and services, albeit at a more moderate pace. Order books in industry remain low overall and uncertainty is high, fueled by the political situation.

Cash positions are deemed to be broadly balanced, but are deteriorating in certain industrial sectors.

Supply difficulties in industry remained limited (7% of companies), except in the aeronautics and automotive sectors. Input price increases in certain sectors spread partially, leading to a slight rise in selling prices in industry. Prices remained on a downward trend in construction and posted a very moderate increase in services.

Recruitment difficulties remained stable (17% of companies), with a slight upturn in employment, driven by services and recourse to temporary workers.

Based on the survey results, supplemented by other indicators, we expect GDP to post a slight rise in the fourth quarter.

1. In October, activity increased in the three major sectors

In October, industrial activity grew at a faster pace than business leaders had expected the previous month. This acceleration was mainly attributable to the aeronautics, chemicals, pharmaceuticals, and capital goods sectors. The latter saw in particular marked increases in the electrical equipment and machinery and equipment segments. After declining for several months, the apparel-textiles-footwear sector, driven entirely by the leather and footwear segment, confirmed its recovery that began in September.

Conversely, activity declined in the agri-food and automotive sectors, with results below expectations. In the automotive sector, the fall in activity was accompanied by a significant drop in the production capacity utilisation rate (PCUR), which declined by 3 percentage points over one month.

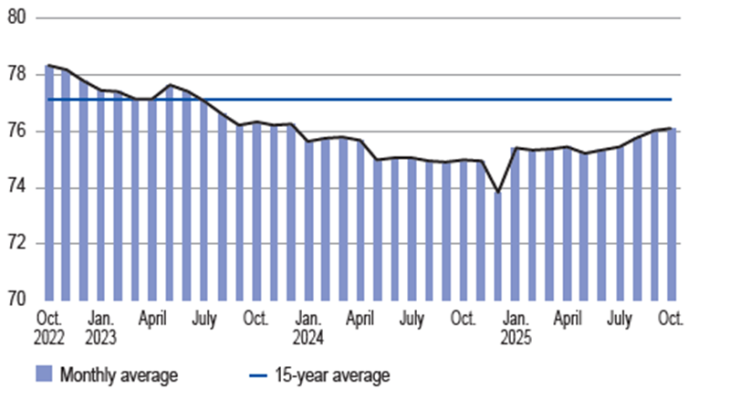

Capacity utilisation rate (%)

This development reflects temporary factory closures in France, as in Europe, in a context of sluggish demand and heightened competition, particularly from China. In the agri-food industry, activity slowed significantly in the meat sector, which was impacted by contagious nodular dermatosis, and in the beverage sector, which suffered from a decline in exports linked to higher tariffs and sluggish demand in Europe and China. For the industry as a whole, the capacity utilisation rate remained unchanged at 76%, below its long-term average (77.1%).

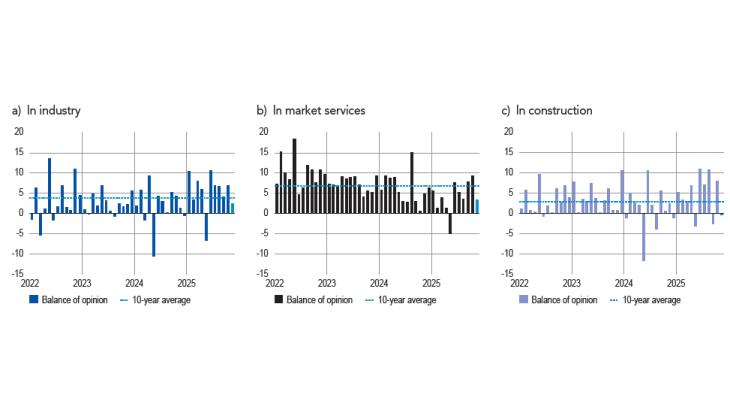

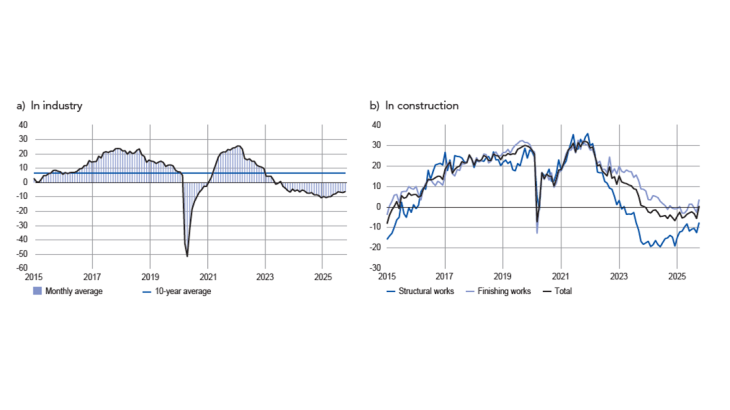

Balance of opinion on the outlook for activity (balance of opinion, adjusted for seasonal and working-day variations; forecast for November)

over the past month) stood at 7 percentage points for October in industry. For November (light blue bar), business leaders in industry expect activity to increase by 2 percentage point.

According to business leaders, inventories of finished goods continued to rise, particularly in the aeronautics sector, where the time lag between production and delivery can be structurally high.

Activity in market services, which was already buoyant in September, strengthened in October. After a fairly quiet summer, the recovery was particularly strong in business services, especially in management consulting, legal and accounting activities, and research services (architecture, engineering, technical analysis, etc.). Food and beverage services also rebounded significantly after several months of sluggish activity. Temporary work grew significantly, in line with a temporary increase in demand for labour in several industrial and service sectors. However, this trend may only be a temporary adjustment, with companies preferring to be flexible in an environment that remains uncertain. Only advertising and market research services declined during the month.

The construction sector picked up sharply in October after the decline observed in September. While finishing works tend to drive the sector, the new housing segment also showed signs of improvement, thanks to a rise in housing starts and building permits. This recovery remains mainly underpinned by the construction of single-family homes, supported by the extension of zero-interest loans and, in October, by more favourable lending conditions. However, regulatory and political uncertainties remained, and signs of improvement were still fragile.

Inventories of finished goods in industry (balance of opinion, adjusted for seasonal and working-day variations)

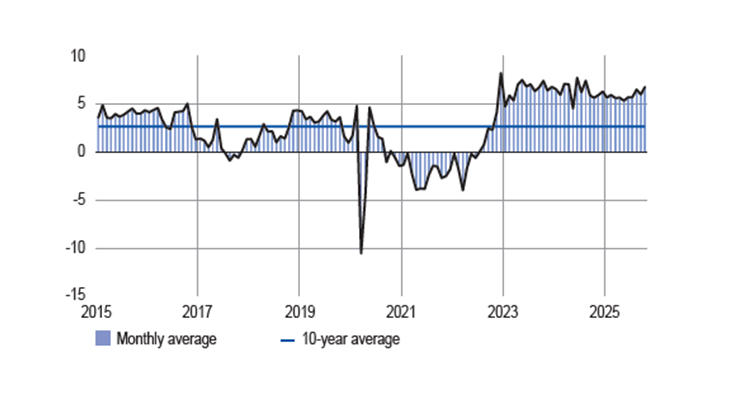

Cash position (balance of opinion, adjusted for seasonal and working-day variations)

The balance of opinion on cash positions improved in October, returning to a level deemed normal in industry. This trend was widely shared across all categories of businesses: large companies, but also, notably, small and medium-sized enterprises, whose liquidity situation is now deemed close to normal.

In market services, the balance of opinion on cash positions remained slightly positive. However, there were still marked differences across sectors. In motor vehicle rental and publishing, cash positions, which were already deemed favourable, continued to improve. Conversely, they deteriorated in programming and advertising services, and, more unexpectedly given the rebound in activity, in food services, where repayments of state guaranteed loans continued to weigh on liquidity.

2. Moderate growth and high uncertainty:

November marked by caution

Business leaders expect industrial activity to continue growing in November, albeit at a more moderate pace than in October.

Activity in the automotive sector is expected to pick up thanks to the reopening of several production sites. It should also recover in the agri-food sector, supported by preparations for the holiday season. Conversely, it is expected to decline in the rubber, plastics, and metal and metal products sectors due to weak demand and difficulties in the sectors that place orders (such as the automotive industry). After the surge in activity linked to winter restocking in October, activity should return to normal in the apparel-textiles-footwear sector, reflecting a slight slowdown in the pace of orders.

In market services, activity is expected to continue to grow in November, but at a slower pace. Expectations remain mixed. Publishing, car rentals, and accommodation are expected to grow, while advertising is expected to remain on a downward trend, reflecting continued caution in corporate marketing budgets. Business services (consulting, technical studies, legal and accounting activities, etc.) are expected to continue to grow, albeit at a more moderate pace after a particularly active month of October.

In the construction sector, expectations remain cautious. After the rebound in October, linked to a catch-up and speeding-up of certain projects ahead of an increase in input costs, a decline is expected in November, mainly in structural works.

At the end of October, order books in industry were still deemed weak, with customers adopting a wait-and-see attitude. However, the situation improved slightly compared with the previous month. Certain segments (shipbuilding, aeronautics, defense, and aerospace) displayed strong order books covering several months or even years. Conversely, the agri-food sector reported a sharp decline in foreign orders, beyond the effect of tariffs. In the construction sector, business leaders reported an improvement, particularly in finishing works, where opinion balances returned to positive territory.

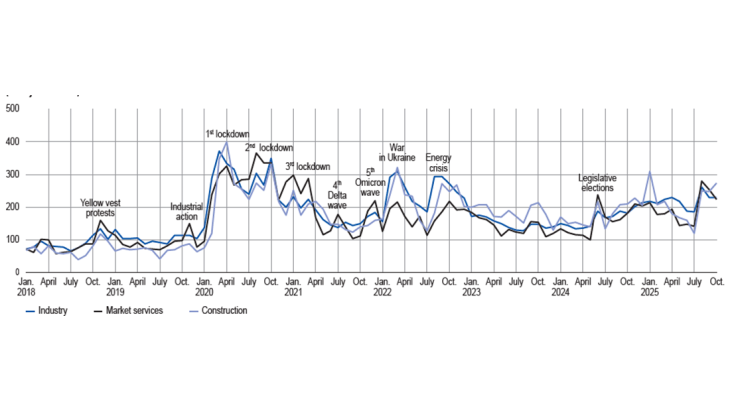

Our sectoral uncertainty indicators remained high. This uncertainty is mainly attributed to the political situation, in particular to its consequences for the budget vote. This uncertainty is holding back large-scale investment projects, while companies are having to contend with the structural challenges of the ecological and digital transition in an uncertain international context, which is fueling a general climate of caution.

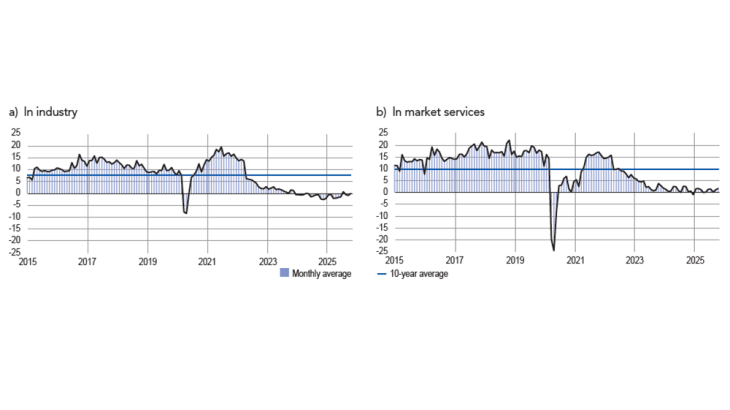

Level of order books (balance of opinion, adjusted for seasonal and working-day variations)

Indicator of uncertainty in the comments section of the monthly business survey (mbs)(unadjusted data)

3. Input price increases were partially passed on in industry

In October, only 7% of companies reported supply difficulties, a very slight decline from September. However, these difficulties remained higher in aeronautics (20%) and were up in the chemicals (8%) and automotive (15%) sectors, due to geopolitical tensions between China and Europe over the supply of electronic components.

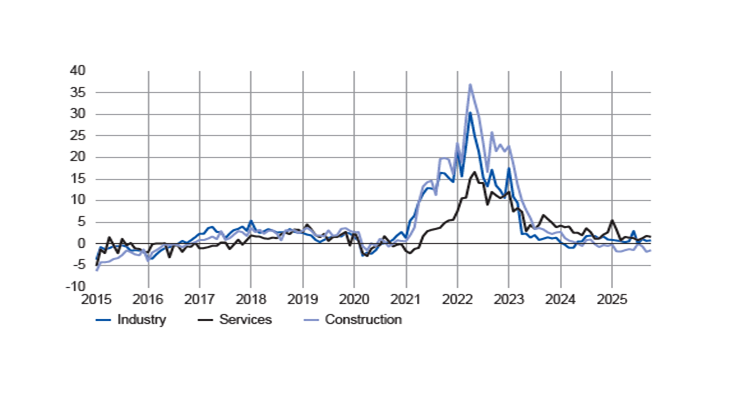

In industry, business leaders reported significant increases in raw material prices in several industrial sectors, particularly agri-food, metal and metal products, and electrical equipment. Conversely, input costs fell again in the chemicals industry, continuing the downward trend that began in the summer.

In the metal and metal products sectors, as in the manufacture of electrical equipment, manufacturers partially passed on the increase in metal costs to their selling prices. In October, 8% of manufacturers in these sectors reported price increases, compared with 5% in industry as a whole. The pharmaceuticals and repair-installation sectors also recorded increases in their selling prices. Conversely, the impact on prices was less widespread in the agri-food sector: 8% of companies raised their prices, while 12% lowered them. Overall, finished goods prices in industry rose slightly, despite the continuing decline in the chemicals sector.

In construction, the balance of opinion on price movements continued to show price decreases in October, in both structural works and finishing works. Thus, 11% of business leaders lowered their prices and only 4% raised them.

In market services, price movements remained very moderate: 4% of companies reported an increase, mainly in accommodation and food services, while 3% reported a decrease.

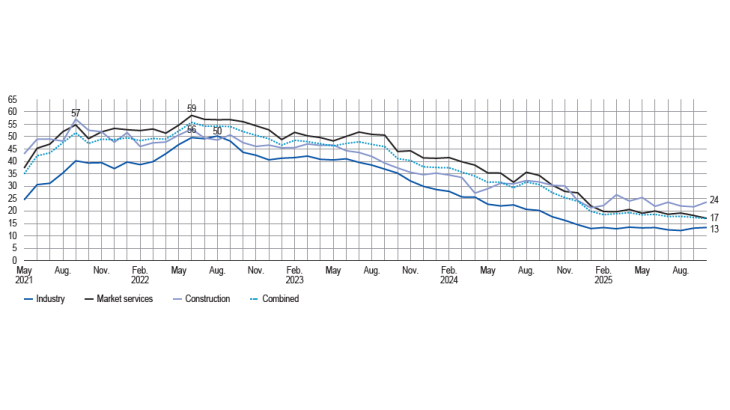

Labour market tensions remained stable in October: 17% of business leaders reported recruitment difficulties, with levels remaining high in construction (24%) and more moderate in industry (13%), where recruitment difficulties have recently begun to rise again. Meanwhile, difficulties in the services sector were close to the overall average (17%). In industry, the workforce (including temporary workers) rose slightly for the first time since June.

Change in selling prices by major sector (balance of opinion, adjusted for seasonal and working-day variations)

Share of businesses reporting recruitment difficulties (%, unadjusted data)

4. Our estimates suggest a slight increase in GDP in the fourth quarter

According to the initial results of the quarterly accounts, published by INSEE at the end of October, GDP grew by 0.5% in the third quarter of 2025, which is higher than we had forecast in our last monthly business survey (+0.3%). Activity was mainly driven by strong value added in industry (particularly aeronautics), market services (especially information and communication), and the energy sector. Value added in construction declined slightly for the eighth consecutive quarter.

Based on the results of the Banque de France monthly business survey, supplemented by other available data (INSEE production indices and surveys and high-frequency data), we expect GDP to increase slightly in the fourth quarter. Activity is expected to be driven by strong value added in the manufacturing industry and market services, as suggested by the monthly business survey for the quarter. Value added should also increase in the energy sector, but could decline slightly in construction in the fourth quarter.

Download the full publication

Updated on the 26th of November 2025