- Home

- Publications et statistiques

- Publications

- Monthly business survey – Start of March...

La Banque de France publie des enquêtes de conjoncture : un diagnostic sur l’économie française, sous la forme d’indicateurs de climat des affaires et de prévisions à court terme. L’enquête mensuelle de conjoncture, chaque début de mois, décrit la situation conjoncturelle du mois précédent et prévoit le PIB trimestriel, grâce aux réponses de 8 500 dirigeants d’entreprise.

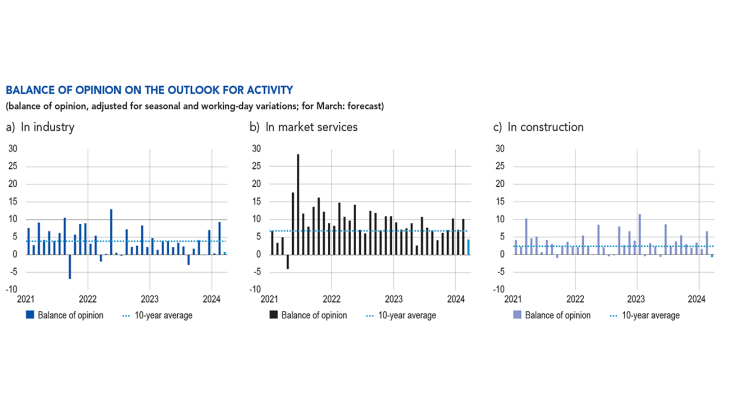

According to the business leaders surveyed (approximately 8,500 companies and establishments between 27 February and 5 March), activity rose in industry, market services and construction in February (after neutralising the calendar effect linked to 29 February), more than what companies

had forecast the previous month. According to expectations for March, business activity is expected to grow in services, show little change in industry and in finishing works, and deteriorate in structural works. Order books are still deemed weak in virtually all industrial sectors (with the notable

exception of aeronautics).

Selling prices continued to moderate. According to business leaders in industry, raw material prices decreased further. In industry and construction, the share of businesses that raised their prices over the past month (11% and 10% respectively) was close to pre‑Covid levels, while the share of businesses

that lowered their prices (7% and 10% respectively) rose compared to the pre‑Covid period. In market services, the share of businesses reporting price increases (15%) has not yet completely normalised.

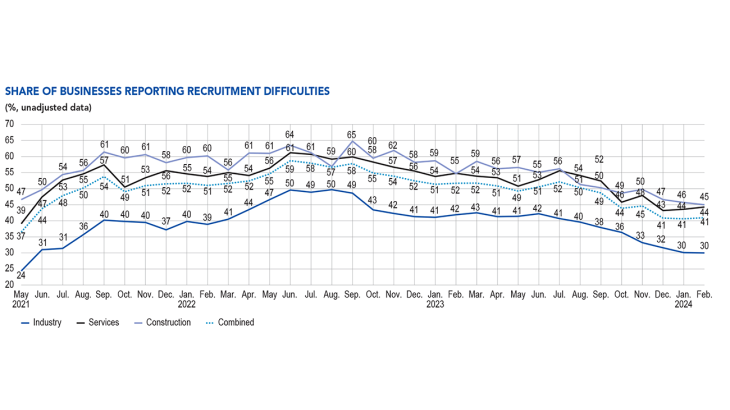

Recruitment difficulties remained stable and still affected 41% of companies in February.

The uncertainty indicator has eased somewhat compared with the previous month.

Based on the survey results, together with other indicators, we estimate that GDP should grow by around 0.2% in the first quarter of 2024, following a slight increase in the fourth quarter of 2023.

1. In February, activity was up in industry,

market services and construction

In February, industrial activity increased, at a higher rate than business leaders had expected last month. The agri‑food and the manufacturing of transport equipment (aeronautics) sectors recorded a rise in activity. Among capital goods, computer, electronic and optical products were also up,

boosted by demand from the automotive sector. However, the machinery and equipment and electrical equipment sectors were less buoyant: while demand from the aeronautics and defence sectors continued to support these sectors, telecoms infrastructure, housing and the agricultural sector

(in particular the manufacture of generators) had a negative impact on them. The other industrial sectors also showed strong growth, in particular rubber and plastic products (with a recovery in foreign orders), and to a lesser extent the chemicals industry.

the past month) was +9 percentage points for February in industry. For March (light blue bar), business leaders in industry expect activity to be virtually stable in industry (+1 percentage point).

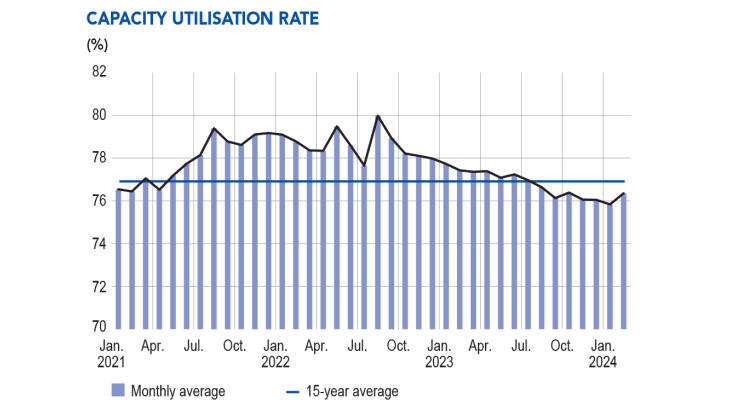

The capacity utilisation rate (CUR) for industry as a whole inched up to stand at 76.4% (after 75.8% in January), close to its 15‑year average (77%). The indicator improved particularly in the other industrial sectors (rubber and plastic products were up 3 percentage points).

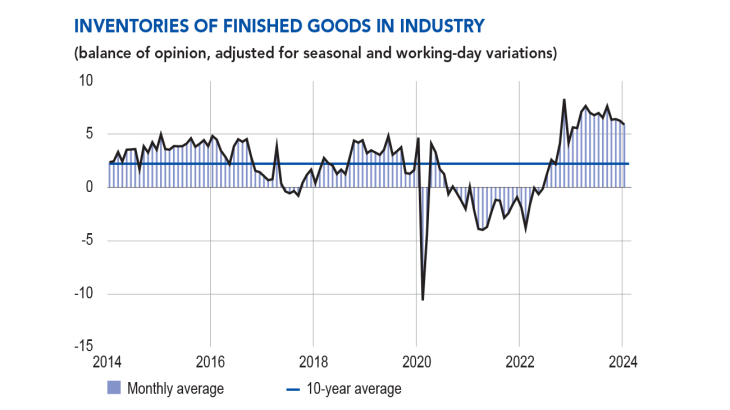

Inventories of finished goods subsided a little in February. They dropped in rubber and plastic products, computer, electronic and optical products, aeronautics and other industrial goods. They rose slightly in the automotive sector, due to supply difficulties (linked in particular to tensions in the Red Sea), which contributed to raising inventories of semi‑finished goods, and in some cases to logistical difficulties. However, they were still deemed to be high, and above their long‑term average in most sectors, with the exception of aeronautics and computer, electronic and optical products.

In market services, activity continued to grow, at a higher rate than what had been expected by business leaders last month, in most sectors. This increase concerned personal services

(accommodation, rental, leisure activities), and certain business services (management consultancy, engineering activities, publishing). Finally, temporary employment recorded a slight rise, in particular in industry and logistics.

In the construction sector, activity held up well in February, in both structural and finishing works. However, business leaders pointed out that this slight rebound followed a particularly sluggish January, but did not reflect a reversal in the trend.

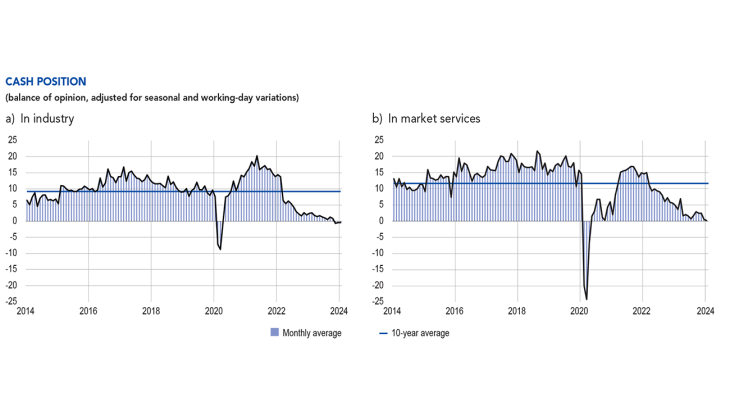

The balance of opinion on the cash position was stable in industry. The cash position was deemed satisfactory in aeronautics and the pharmaceutical industry, but particularly low in the wood‑paper‑printing, wearing apparel‑textiles‑footwear and automotive sectors. It was well below its long‑term average in electrical equipment and machinery and equipment. In our sample, business leaders of SMEs reported worse cash positions than those in larger companies.

In market services, the cash position was still unsatisfactory, below its long‑term average. It fell in particular in management consultancy, publishing and food services, androse in accommodation, car repairs, engineering activities and advertising.

2. In March, business leaders expect activity to

rise in market services, remain stable in industry

and contract in construction

According to business leaders, activity is expected to show little change in industry in March, albeit with a degree of heterogeneity across sectors. The agri‑food and aeronautics sectors, for example, are expected to see an increase. Conversely, in the other industrial sectors (notably rubber and plastic products, wood‑paper‑printing and metal and metal products manufacturing), activity is expected to decline slightly.

In the services sector, activity is expected to continue to grow, albeit more moderately. Business leaders expect activity to be buoyant in the management consultancy, publishing, food services, engineering and rental sectors.

Lastly, in construction, activity is expected to show little change in the finishing works sector, and to contract more markedly in the structural works sector.

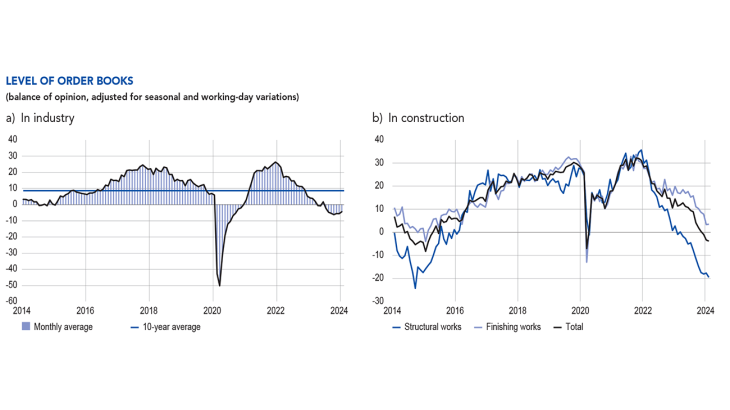

The balance of opinion on order books in industry remained unfavourable in February. It improved in rubber and plastic products, chemicals and wood‑paper‑printing. Conversely, it was down in computer, electronic and optical products, and in wearing apparel, textiles and footwear; in this sector, business leaders pointed out that the deterioration in order books was partly due to shorter order times. The level of order books was deemed to be below its long‑term average in all sectors,

with the exception of aeronautics (notably military orders). In particular, when compared with the highs of January 2022 (just before the invasion of Ukraine), aeronautics is the only sector to see a strengthening of its order books.

In construction, the level of order books is deemed to show little change in the finishing works sector, and remain well below its average in the structural works sector.

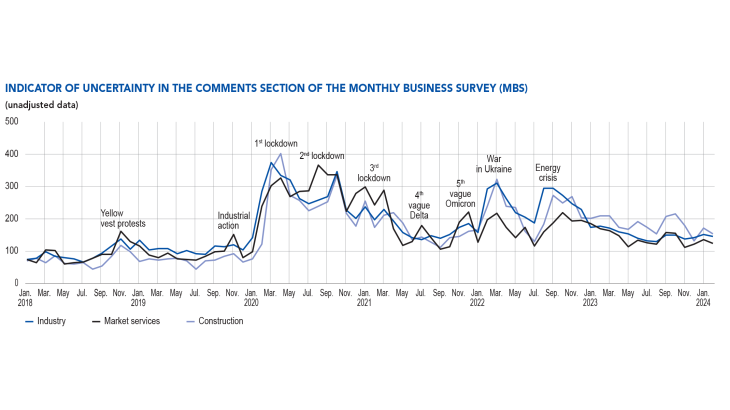

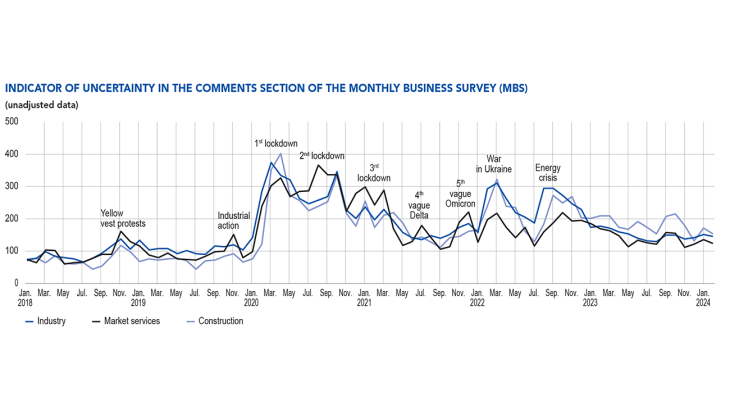

Our monthly uncertainty indicator, constructed from a textual analysis of the comments made by the companies surveyed, eased somewhat in the three main sectors compared with January.

3. Selling prices continued to moderate,

excluding the usual effect of price revisions

at the start of the year

In February, supply difficulties eased further in industry (12% of businesses cited such difficulties, after 14% in January). However, some sectors, such as the automotive industry, reported an increase in their difficulties, linked to the shipping disruptions in the Red Sea. Supply difficulties declined further in the construction sector, where they are in the process of disappearing (6%, after 8% in January).

In industry, business leaders reported a slight fall in raw material prices, while finished goods prices showed little change.

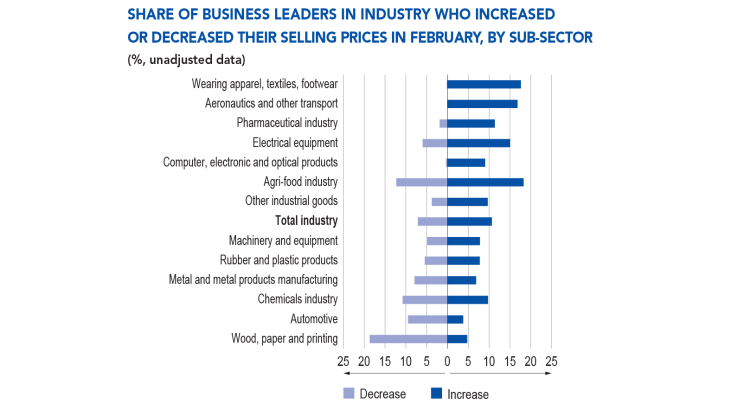

More specifically, 11% of business leaders in industry reported that they had raised their selling prices in February 2024, a proportion close to those recorded in February during the pre‑Covid period, and well below those in February 2022 and 2023. In addition, 7% of business leaders in industry repor ted lowering their selling prices in February.

Decreases in finished goods prices were widespread in the wood‑paper‑printing (19%), chemicals (11%) and automotive (9%) sectors; in all of these sectors, the share of companies that lowered their prices was higher than the share that raised their prices. In the agri‑food sector, 18% of business leaders reported that they had raised their prices in February, and 12% reported that they had lowered their selling prices, following the trade negotiations at the start of the year.

In construction, 10% of business leaders reported raising quote prices, a proportion similar to those recorded during the pre‑Covid period. Conversely, 10% of business leaders reported that they had lowered their prices in February, the highest share for more than five years. The balance of opinion

on quote prices, calculated as the difference between the proportions of increases and decreases, modulated by the intensity of the reported variation, was once again negative, for the first time since mid‑2020. Business leaders mentioned competition as a factor limiting the rise in quote prices.

In services, price dynamics have not yet completely normalised. The share of businesses reporting a rise in prices was 15%, while the share of businesses reporting a fall- remained low at 4%. Price increases were mainly recorded in programming, consultancy and information services; prices

also rose sharply in cleaning, as in January (the increase in the minimum wage having been passed on to prices of cleaning services).

for example, 15% of electrical equipment manufacturers reported having raised their prices

in February whereas 6% of industrial firms in this sector reported having lowered their prices

over the past month.

Business leaders’ expectations for March indicate that 9% of them plan to raise their prices in industry, 12% in market services and 7% in construction.

Business leaders were also asked about their recruitment difficulties, which changed little in February: across all sectors, 41% of companies surveyed reported such difficulties, as in January. Recruitment difficulties rose slightly in services (in particular advertising) but continued to fall in construction, where they nevertheless remained the highest compared with the other two main sectors.

The 20 percentage point drop in recruitment difficulties observed since the summer of 2022 masks a degree of heterogeneity across the sectors concerned. In the most dynamic sectors (management consultancy, engineering, publishing, aeronautics, computer, electronic and optical products), recruitment difficulties eased to a lesser extent, by between 10 and 15 percentage points, over this period. Conversely, in the less dynamic sectors (car rental, transport and storage, rubber and plastic products, chemicals, wood, paper and printing, and structural works), the low level of activity resulted in a less dynamic recruitment drive, and consequently in more pronounced declines in recruitment difficulties (of around 30 percentage points).

4. Our estimates suggest that activity

will rise in the first quarter

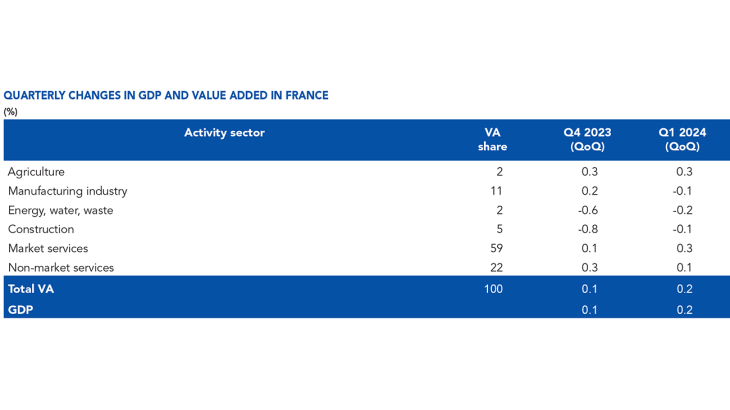

According to the detailed results of the quarterly national accounts published by INSEE at the end of February, GDP growth for the fourth quarter of 2023 was revised upwards to 0.1%, compared with an initial estimate of 0.0%. The decline in activity in the construction and energy sectors was offset

by a rise in value added in industry and market services.

Based on the results of the Banque de France Monthly Business Survey, as well as other available data (INSEE production indices and surveys, high‑frequency data), we estimate that real GDP will increase by around 0.2% in the first quarter.

GDP growth is expected to be buoyed this quarter by market services, thanks in particular to business services, information and communication, transport services and household services, while trade activity should be down. Our estimate of a fall in value added in manufacturing industry over the quarter is mainly linked to the manufacturing production index, which dropped by 1.6% in January, while the Banque de France survey suggests a recovery in activity in February.

Activity in the energy sector is also expected to decrease this quarter.

Lastly, activity in the construction sector is expected to dip slightly (after a sharp decline in the fourth quarter of 2023): the increase in building permits, particularly for multi‑family housing, and in housing starts at the end of 2023, which probably reflects a move to anticipate the tighter controls

on building regulations (contrôle des règles de construction ‑ CRC) that came into force in January 2024, will not offset the deterioration in order books in this sector.

Note: QoQ = quarterly change.

Download the PDF version of the document

Updated on the 25th of July 2024