Covid-19 is a highly virulent and deadly coronavirus that propagated rapidly in the euro area in its first wave from late February through to mid May 2020. Left to spread without government intervention, the pandemic would have overwhelmed health systems, resulting in even more people in need of medical attention.

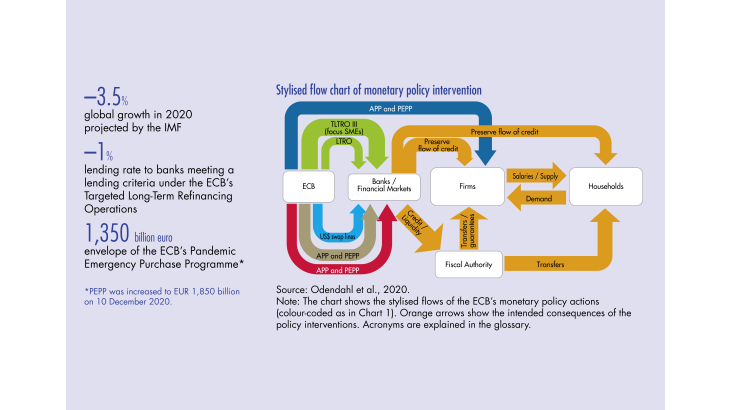

The medical imperative to impose a partial or general lockdown of the population significantly reduced economic activity, increased the risk of business failures and led to a sharp rise in unemployment. In such circumstances, providing additional and temporary liquidity to businesses and households was essential. In parallel, an increase in volatility in financial markets caused by investors looking for liquidity required other targeted monetary policy interventions. Chart 1 presents a timeline of the actions taken by the four main G7 central banks: the European Central Bank (ECB), the Bank of Japan (BoJ), the US Federal Reserve (Fed), and the Bank of England (BoE). With the exception of the BoJ, which introduced a single package, the major central banks applied additional measures as estimates of the economic outlook worsened.

1 The unfolding economic crisis was different from the 2008 financial crisis…

The recession caused by Covid-19 will significantly exceed the one that followed the collapse of Lehman Brothers in 2008. The ultimate cost is still unclear but the global economy is forecasted to have contracted by –3.5 percent in 2020 by the IMF (IMF, 2021).

A key difference from the financial crisis of 2008 is that banks and other financial institutions were healthier when the emergency occurred and not the origin of the shock. Although there were initially very large falls in stock markets and increases in risk spreads, the financial system continued to function smoothly.

Instead, the primary focus of this crisis was and is on firms and households, particularly in countries where welfare safety nets and short time working schemes are less developed. The lockdown measures taken globally suspended economic activity in all service industries requiring physical proximity, severely constrained production and supply chains elsewhere and disrupted labour supply everywhere. The resulting loss of income and spending power by households and firms amplified the recession (Guerrieri et al., 2020; Gourinchas, 2020; ILO, 2020).

It is natural for firms and households under strain to start hoarding cash. Firms demand payment from creditors but delay making payments to suppliers. However, this harms the liquidity position of the supplier and so on down the line. (…)

[to read more, please download the article]