Make-up Strategies with Finite Planning Horizons but Forward-Looking Asset Prices

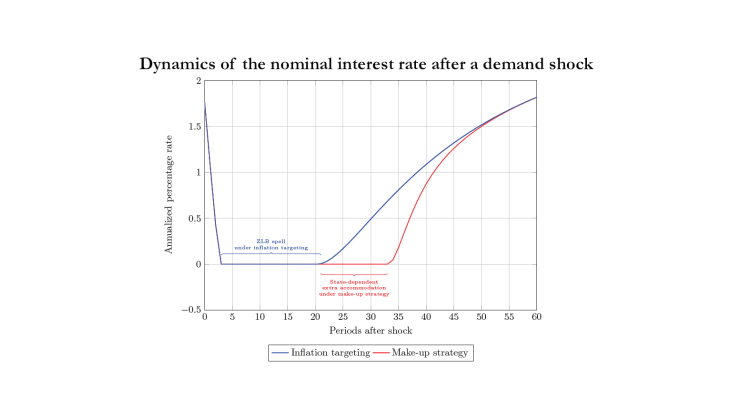

Working Paper Series no. 862. How effective make-up strategies are depends heavily on how forward-looking agents are. Workhorse monetary models, which are much forward-looking, find them so effective that they run into the so-called “forward-guidance puzzle”. Models that discount the future further find them much less effective, but imply that agents discount the very perception of future policy rates. This only evaluates make-up strategies when financial markets do not notice them, or deem them non-credible. We amend one leading solution to the forward-guidance puzzle -namely Woodford's finite planning horizons -to the assumption that financial markets have rational expectations on policy rates, and incorporate them into the long-term nominal interest rates faced by all. Agents still have a limited ability to foresee the consequences of monetary policy on output and inflation, making the model still immune to the forward-guidance puzzle. First, we find that make-up strategies that compensate for a past deficit of accommodation after an ELB episode have sizably better stabilization properties than inflation targeting. Second, we find that make-up strategies that always respond to past economic conditions, such as average inflation targeting, do too but that their stabilization benefits over IT can be reduced by the existence of the ELB.