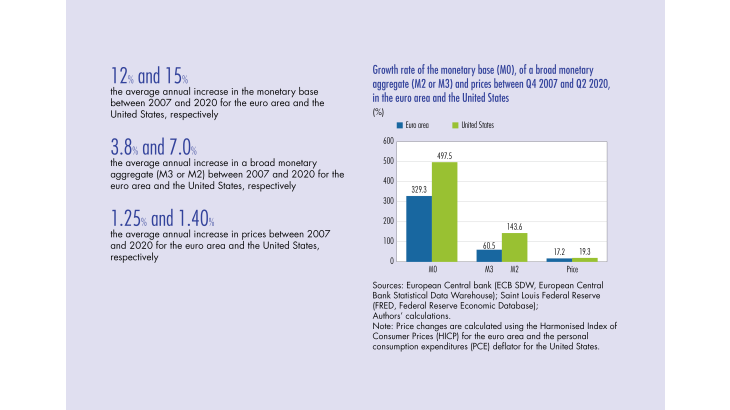

Bulletin n°232, article 8. The unconventional monetary policies implemented by central banks in the wake of the 2008 financial crisis, and subsequently in that of the Covid-19 health crisis, have led to a faster increase in money than in prices, prompting a review of the link between the two. This article recalls in the first two parts the concepts linking money and inflation, i.e. the money multiplier and the velocity of circulation of money, using the cases of the euro area and the United States as examples. Part three shows that while the link between money and inflation is preserved in the long run, consistent with the quantitative theory of money, it has become significantly distorted in the recent period. One reason for this disconnect in the shorter term is that unconventional monetary policies do not act on inflation via the money multiplier and the quantity of money in circulation, but by lowering long-term interest rates and financing conditions for households and businesses. They have thus made it possible to avoid episodes of deflation, and inflation would have been significantly lower without them.

Banque de France - Menu Principal

Appuyez sur Entrée pour lancer la recherche