1 LBOs: complex financing arrangements using debt

LBOs are based on complex financial arrangements

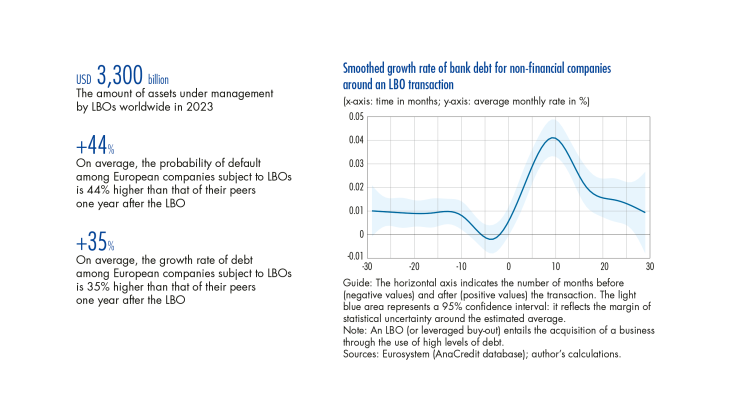

Leveraged buyouts (LBOs) are debt-financed transactions involving the acquisition of businesses. LBOs consist of complex financial arrangements that maximise control for the acquirer while minimising investment. The buyer, often (but not exclusively) a private equity fund, creates a vehicle, or holding company, in which it owns the majority of the capital. This holding company then acquires the target company using bank loans (usually referred to as senior debt), private debt funds, and bond debt (usually referred to as junior debt). The debt contracted by the holding company is relatively risky. LBOs are characterized by intensive use of debt, with loans generally representing between 60% and 90% of the financing of the acquisition (Kaplan and Strömberg, 2009). The financial costs of the debt are repaid by the dividends paid out by the target company (see Diagram 1). LBOs become profitable once dividends exceed the cost of borrowed capital. Leverage is therefore key to ensuring the profitability of the deal from the investor perspective, as they have only committed the equity necessary to create the holding company. The greater the proportion of debt used to finance the buyout, the more the investor benefits from leverage, within the limits of the target’s ability to generate sufficient dividends to service the debt. LBOs also allow investors to benefit from tax leverage: the holding company can deduct the interest on the loan from its corporation tax. At the end of the investment cycle, companies under management are sold either through an initial public offering (14% of exits on average in Europe between 2013 and 2023), a buyout by another company (42%), or a buyout by another private equity (PE) fund (43% – PitchBook, 2023).

LBOs first appeared in the 1970s, when conflicts between shareholders and corporate executives were a hot topic in the United States. Shareholders were concerned about the dilution of their power as a result of the increase in their number, the increased use of executives who sat on boards of directors on their behalf, and conflicts of interest among company executives. …