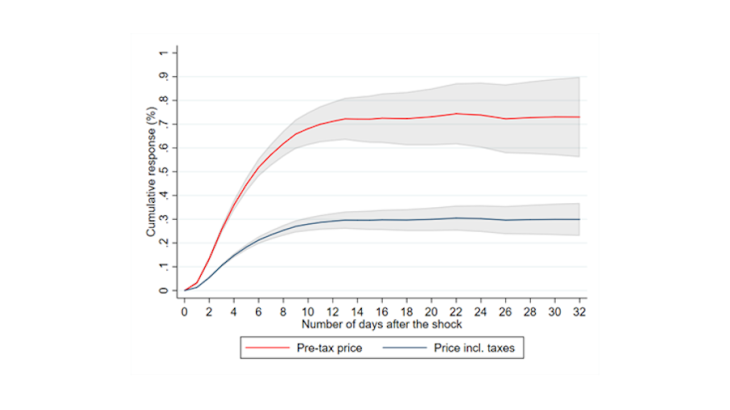

Post n°233. A 1% increase in the price of imported refined diesel ultimately translates into a 0.75% increase in the pre-tax price and a 0.3% increase in the pump price of diesel including taxes in France. The adjustment does not occur immediately but is rapid: after one week, the increase in the pre-tax price is 0.45%, i.e. more than 50% of the final pass-through. Prices respond in the same way to an upward or downward shock.

Sources: Ministry for the Ecological and Solidarity Transition, Reuters. Authors' calculations.

Note: Fourteen working days after a 1% shock to the price of refined diesel on the Rotterdam market, the price of diesel at French service stations rose by 0.72%. In red, estimate of the average impact on pre-tax prices; in blue, estimate of the average impact on the price including taxes based on the share of the pre-tax price in the price including taxes (41%); shaded areas: 95% confidence intervals of the estimate.

For several months now, as a result of the rise in oil prices, fuel prices at the pump have been on the rise (20.2% over one year for diesel in September 2021) after having fallen sharply at the beginning of 2020. Although the weight of fuel at the pump in the average household consumption basket is relatively low (around 4% in the Harmonised Index of Consumer Prices basket), the high volatility of its price contributes significantly to fluctuations in inflation in France Kalantzis and Ouvrard, 2018). Lastly, the relatively high frequency of fuel purchases and the way prices are publicly displayed mean that their price is particularly closely watched by households, which affects their perception of inflation or purchasing power (Coibion and Gorodnichenko 2015). This post describes how fuel prices are set in France, and how changes in the price of refined oil affect them.

The relationship between changes in commodity costs and changes in fuel prices

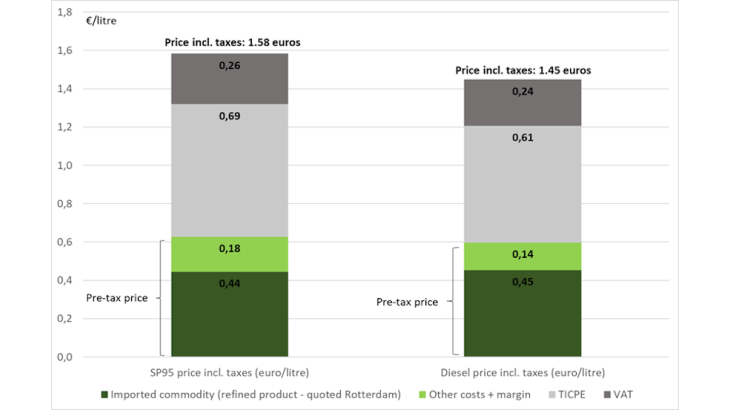

The pump price (including all taxes) can be broken down into two distinct parts: taxes (a fixed amount per litre, the domestic consumption tax on energy products (TICPE) - and VAT, which is proportional to the price including the TICPE), which account for about 60% of the price including taxes, and the pre-tax price (Chart 2).

Sources: Ministry for the Ecological and Solidarity Transition, Bloomberg, Authors' calculations.

Note: Price including taxes in euro per litre - average September 2021: EUR 1.58 for SP95 petrol and EUR 1.45 for diesel. Of the EUR 1.45 average price of diesel, the TICPE represents EUR 0.61, the VAT EUR 0.24, and the pre-tax price EUR 0.60 (of which EUR 0.45 is the commodity cost, and EUR 0.14 the margin or other costs). The pre-tax price represents 41% of the price including taxes.

It is this latter component that can vary on a daily basis. The pre-tax price includes in particular the commodity purchase cost (refined fuel imported or produced in refineries in France), distribution costs (labour, transport, etc.) and lastly the distributors’ margin. Commodity prices fluctuate on a daily basis, closely following the price of crude oil (Brent), and also depend on refining costs. The euro price of refined fuels sold wholesale for import and traded on the European market (quoted on the Rotterdam market in particular) can be used to monitor the daily variations in the commodity cost that service stations have to pay. For example, when the commodity price rises, the cost of buying this commodity increases for the station and its margin decreases or even disappears if it does not immediately pass on this cost variation. To describe how stations pass on these cost variations to consumers, we use the granular and comprehensive fuel price data published by the Ministry of Economy and Finance website since 2007 (https://www.prix-carburants.gouv.fr/) and collected for all French stations on a daily basis (i.e. approximately 10,000 stations and 30 million individual prices).

On average, stations change their prices only once a week

While fuel prices change frequently, they do not change every day, whereas commodity prices do. On average, fuel prices remain fixed for about five days. When they change, pre-tax prices are adjusted on average by 2% either upwards or downwards, which corresponds to changes of about EUR 1 cent on the price including taxes. Small changes of less than 1% are very rare. This price stickiness can be partly explained by the fact that fuel prices often end with a price point of 0, 5 or 9, implying less frequent and larger changes (Levy et al. 2011).

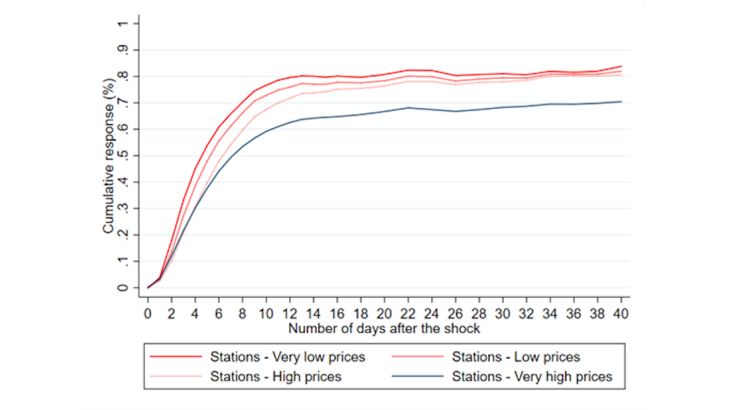

There are significant differences in price-setting behaviour between stations, particularly between stations with lower than average prices and those with higher prices. Stations with lower prices change their prices more frequently than others: the length of time a price remains fixed is about three days, whereas it is six to seven working days for stations with higher-than-average prices.

A change in the commodity cost is fully reflected in the fuel prices after four weeks

Following a change in the commodity cost, fuel prices are gradually adjusted. On average, after 11 working days, 90% of the cost change is passed on to prices and the full pass-through to fuel prices takes about 20 working days. However, over half of the pass-through to the prices is already observed after one week.

For a 1% shock to the price of refined diesel, the price of pre-tax diesel increases by 0.75% in the long term (Chart 1). This would result in an increase in the price including taxes of 0.3%, taking into account the fixed amount per litre of the TICPE. These long-term elasticities are consistent with the share of refined diesel in the total cost of producing the service (Chart 2), which includes other distribution costs (transport, labour, etc.): in the long term, stations pass on the entire increase in the commodity cost in proportion to its share in total costs. If we reason in price level terms, a 1% increase in the price of imported diesel (for an initial price of EUR 0.45 in September 2021) is equivalent to EUR 0.45 cent and results in an identical increase over time for the diesel price including taxes (i.e. 0.3% of the initial price of diesel, equal to EUR 1.45 in September 2021)

As the price of the refined product depends on changes in the price of crude oil (Brent), the response of pre-tax fuel prices to changes in the price of Brent is very similar to that obtained with the refined product. In the long run, the magnitude of the response of the pre-tax price is slightly smaller (0.70%) and the difference between the long-term effects reflects the share of the cost of oil in the cost of producing the refined product (around 90%).

Sources: Ministry for the Ecological and Solidarity Transition, Reuters. Authors' calculations.

Note: “Very low prices”, resp. “very high prices”, refers to stations with a price below the 1st quartile, resp. with a price above the 3rd quartile. “Low prices”, resp. “high”, refers to stations with a price between the 1st quartile and the median, resp. between the median and the 3rd quartile.

There are also differences between stations in the pass-through of cost changes. Those with lower-than-average prices pass on slightly more of the cost changes (Chart 3). This higher pass-through in the long term reflects a higher share of the commodity in the total cost for these stations. Ultimately, however, in terms of price level, a EUR 0.45 cent increase in the price of imported diesel results in an identical increase in cent terms for all stations. The differences in price adjustment times between the stations are however very small and more than 90% of the shock is priced in by all stations in around ten working days.

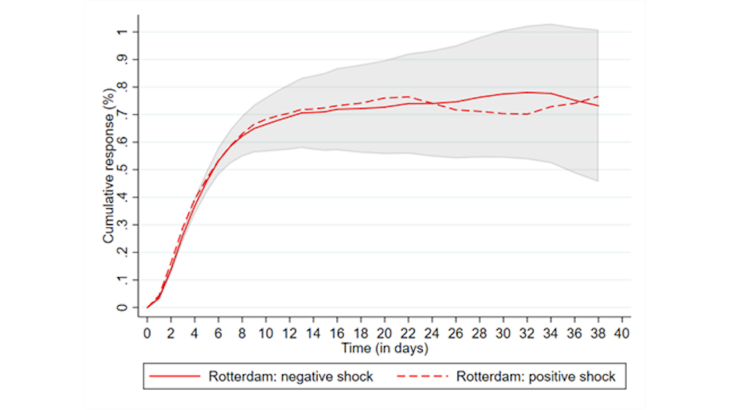

Lastly, households are often concerned by the asymmetry of responses. In the case under review, the response of stations to a fall in the commodity purchase cost is similar to the response to a rise in this cost (Chart 4): fuel prices adjust at the same speed and the magnitude of the long-run adjustment is identical. This result is frequently highlighted in the academic literature on this subject, although the findings are not always consistent. (Deltas and Polemis, 2020).

Sources: Ministry for the Ecological and Solidarity Transition, Reuters. Authors' calculations.

Note: Fourteen working days after a 1% upward shock to the price of refined diesel on the Rotterdam market, the pre-tax diesel price rose by 0.7% (solid line). After a downward shock of 1%, the price fell by 0.7% after 14 days (dotted line, in absolute value). Shaded area: 95% confidence interval of the estimate.

Updated on the 25th of July 2024