A cost shock also propagates along the production chain

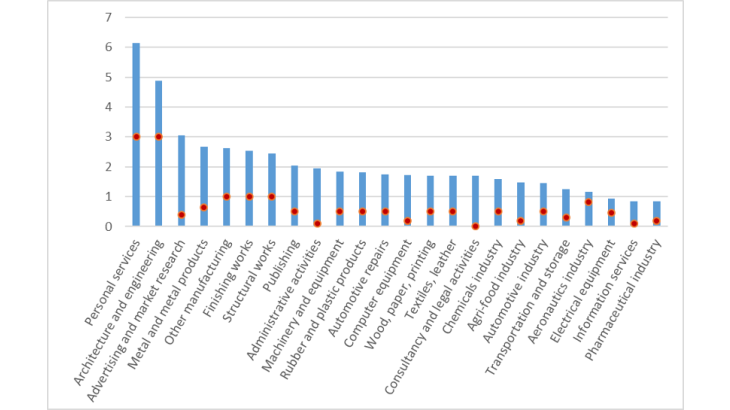

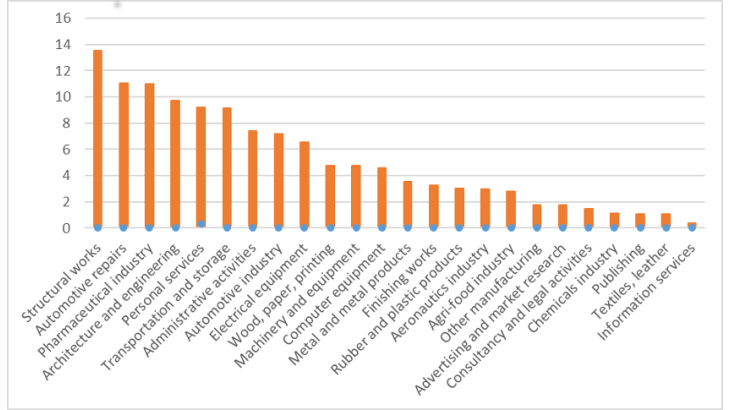

The combination of costs and the pass-through thus results in a direct impact on the price for the company's customer. This can be a final customer (consumer, etc.) but also another company buying inputs. The initial shock will then propagate along the production chain. In order to assess this second channel, we use the symmetrical supply and use tables (SUT) produced by INSEE, which provide the balance between supply (output and imports) and uses (consumption, gross fixed capital formation, changes in inventories, exports) for all the products. These tables therefore make it possible to replicate the sequence of stages in the production process. They also allow us to consider a domestic cost shock, measured in the survey, but also to extend it to the case where our partners experience the same shock and pass it on to import prices.

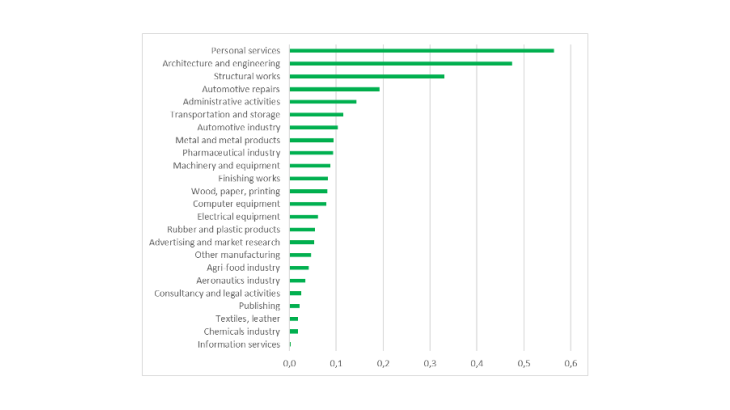

Furthermore, the responses collected do not cover the whole economy. For most of the sectors not covered (non-market services, energy production, finance etc.), it seems reasonable to assume that Covid costs are zero or negligible. As no data is collected for the accommodation and food services sector, we assume an impact identical to that measured for services to households.

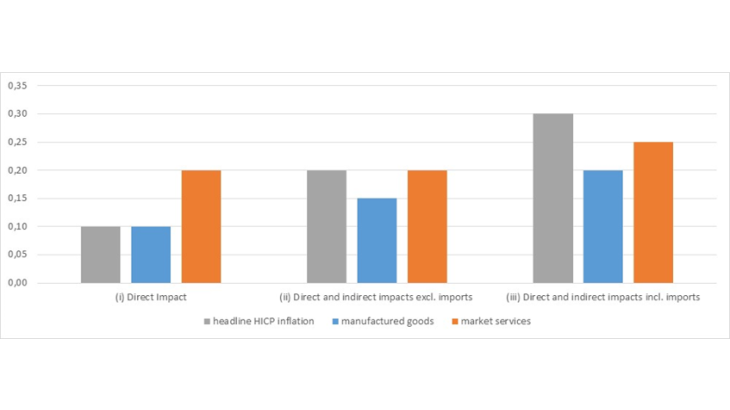

The impact on the general level of consumer prices is estimated to be between 0.1 and 0.3%

Overall, we conduct three assessments (see Chart 4): (i) direct impact; (ii) direct impact plus indirect impact through intermediate consumption; (iii) direct impact plus indirect impact through intermediate consumption and imports.

The direct shock on consumer prices is estimated at around 0.1%. This impact is expected to be concentrated in market services, in line with the raw survey data. Secondly, propagation through intermediate consumption and imports would logically mainly affect goods, thus increasing the potential overall shock to consumer prices to as much as 0.3%.