The monetary policy stance has been traditionally summarized by the (changes in the) short-term policy rate. However, the substantial use of unconventional monetary policy (UMP) tools by major central banks in the wake of the global financial crisis has induced the literature to broaden its perspective and consider a wider range of instruments, especially after short-term policy rates have hit their effective lower bound (ELB). Against this backdrop, this paper focuses on the effects of the euro area monetary policy focusing on exogenous shifts in the euro area yield curve (YC). In doing so, we classify such movements along the type of communication, e.g. conventional vs. unconventional monetary policy announcements, and the type of yield.

We contribute to the existing literature along several dimensions. First, we define a monetary policy shock as a “functional shock”, i.e. a shift in the entire term structure of interest rates in a short window of time around central bank monetary policy announcement dates as measured by simultaneous changes of the yield curve at different maturities. This definition allows us to consider the impact on both short- and longer-term interest rates, which is needed to assess the effect of unconventional monetary policy measures or speeches. We identify monetary policy shocks directly as exogenous shifts in the entire term structure, without requiring any specific model (such as a factor model).

Second, we construct a novel database of surprises based on intra-day quotes of Euro Area OIS forward rates and sovereign yields of France, Germany, Italy and Spain. In our approach, surprise changes in both the risk-free and sovereign yield curves are identified via high-frequency movements of the whole term structure in a tight window of time around monetary policy events. We consider announcements during regular monetary policy meeting days, a few monetary policy announcements outside regular meetings and some important speeches given by the ECB President Mario Draghi.

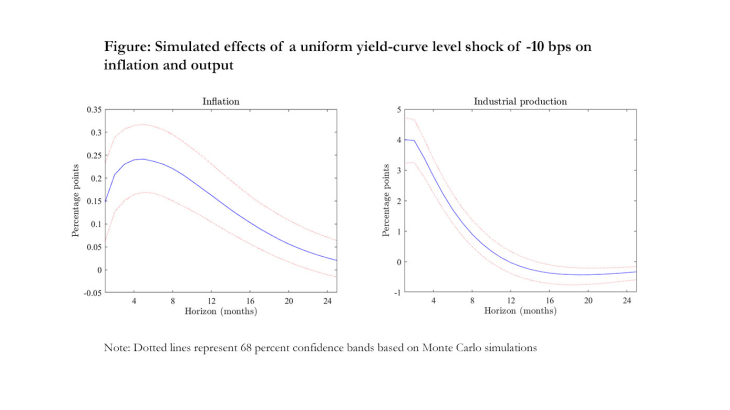

Third, to the best of our knowledge, this is the first paper to systematically document the movements of the risk-free yield curve and of a euro area pseudo-government yield curve for different sets of monetary policy events. Notably, we perform an event study analysis using a narrative approach (tightening vs easing, conventional vs unconventional) to select the monetary policy events. We then provide an assessment of their impact on euro area output and inflation by means of a Functional Vector Autoregressive model with exogenous variables (Functional VARX) estimated over the period 2003:8-2021:3. The identification strategy is a high-frequency approach based on shifts in the short to medium-term portion of the OIS forward rates term structure around key monetary policy events. Overall, we find that the effects on output growth and inflation largely depend on the shape of the monetary policy shocks. We shed further light on this aspect by running some counterfactual exercises assuming shocks to the risk-free YC with comparable size but different shape.